[ad_1]

Coming each Saturday, Hodler’s Digest will provide help to monitor each single essential information story that occurred this week. The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — per week on Cointelegraph in a single hyperlink.

Prime Tales This Week

US Fed vice chair Michael Barr favors hard line on crypto, OCC acting head no friendlier

World crypto regulation stays a prevalent matter looming over the sector. Latest feedback from United States Federal Reserve Board Vice Chair for Supervision Michael Barr and Performing Comptroller of the Foreign money Michael Hsu favored a lean towards extra authorities overwatch. Barr expressed a want for stablecoin regulation in addition to crypto-related banking rules. Hsu’s feedback included wanting on the business cautiously.

GameStop doubles down on crypto amid a new partnership with FTX US

GameStop is teaming up with crypto change FTX US in a promotional partnership. Up to now, 2022 has seen GameStop pursuing rising involvement within the crypto area, evident in its NFT market launch and its new gaming division dedicated to Web3. GameStop has a long-term imaginative and prescient for crypto involvement, in keeping with CEO Matt Furlong throughout a Q2 fiscal 12 months earnings name.

Binance: No plans to auto-convert Tether, though that ‘may change’

This week, Binance revealed plans to part out three stablecoins on its buying and selling platform: USD Coin (USDC), TrueUSD (TUSD) and USDP Stablecoin (USDP). The three belongings, in addition to related spot buying and selling pairs, will not be tradable on the change. As well as, Binance plans to terminate different providers associated to USDC on its platform, corresponding to staking.

The transition is basically an effort to centralize liquidity into the change’s personal stablecoin, Binance USD (BUSD), based mostly on an evidence tweeted by CEO Changpeng Zhao. The change will convert customers’ remaining holdings of USDC, TUSD and USDP into BUSD over a span of 24 hours, commencing on Sept. 29. A conversion of Tether (USDT) to BUSD, nevertheless, was not included in Binance’s plans, although that would change, in keeping with a Binance spokesperson.

Bank of Russia agrees to legalize crypto for cross-border payments: Report

Russia’s central financial institution is predicted to permit cross-border crypto funds to and from the nation, however digital asset funds inside its borders will stay banned. The nation banned crypto as a cost car by way of earlier laws. In keeping with Russian Deputy Finance Minister Alexey Moiseev, the federal government’s new strategy to crypto is a response to altering circumstances globally following Russia’s invasion of Ukraine earlier this 12 months.

An announcement to media outlet RIA Novosti from the Financial institution of Russia defined: “It is very important emphasize that we’re not speaking concerning the legalization of cryptocurrency as a way of cost on the territory of our nation.” A day later, information got here in relating to Russia reportedly seeking to cooperate with so-called “pleasant” international locations to arrange a stablecoin platform for cross-border funds.

UK economic secretary commits to make country a crypto hub under new PM

Developments in the UK this week appeared constructive for crypto adoption within the nation. Amongst a number of feedback about crypto, Financial Secretary to the Treasury Richard Fuller stated: “We wish to grow to be the nation of alternative for these seeking to create, innovate and construct within the crypto area.” The U.Okay. now has a brand new prime minister in Liz Truss, who expressed in 2018 that crypto’s potential shouldn’t be stifled within the nation.

Winners and Losers

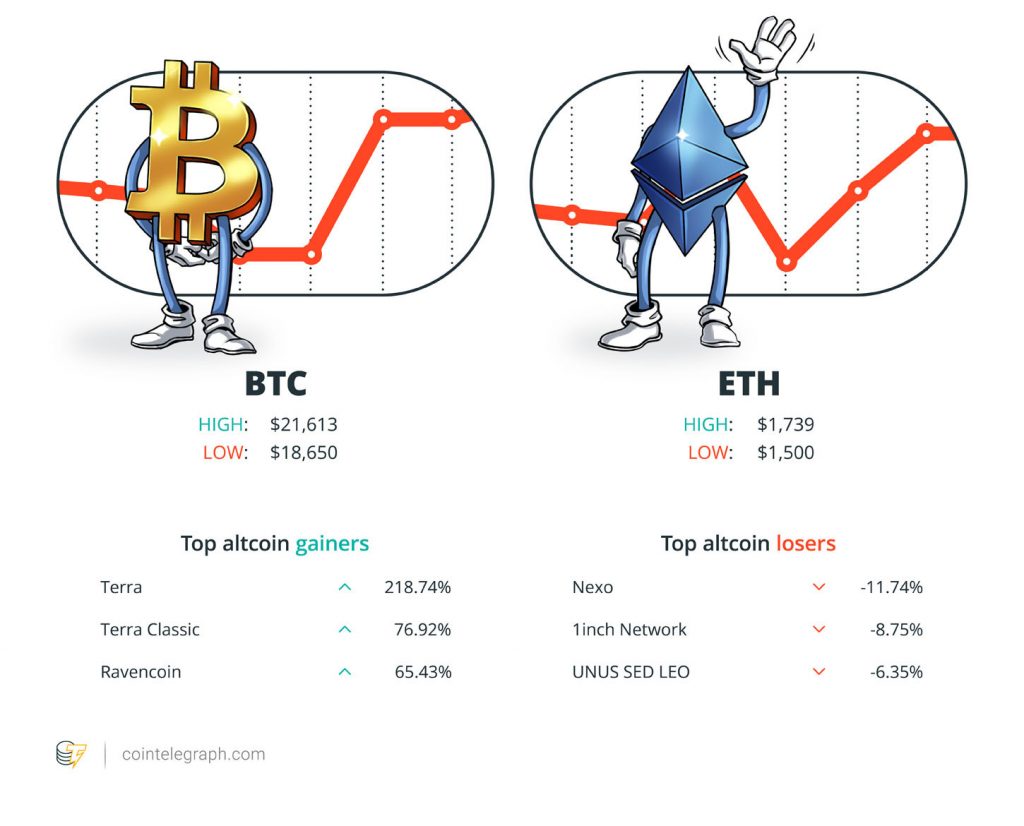

On the finish of the week, Bitcoin (BTC) is at $21,293, Ether (ETH) at $1,715 and XRP at $0.34. The full market cap is at $1.04 trillion, according to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Terra (LUNA) at 218.74%, Terra Traditional (LUNC) at 76.92% and Ravencoin (RVN) at 65.43%.

The highest three altcoin losers of the week are Nexo (NEXO) at -11.74%, 1inch Community (1INCH) at -8.75% and UNUS SED LEO (LEO) at -6.35%.

For more information on crypto costs, ensure to learn Cointelegraph’s market analysis.

Most Memorable Quotations

“Largest purpose I’m bullish on Bitcoin is as a result of the world just isn’t in fine condition proper now and Bitcoin goes to repair that.”

Prince Philip Karageorgevitch, hereditary prince of Serbia and Yugoslavia

“Till they really repair the provision facet of sure issues, like power particularly, however commodities broadly and logistics infrastructure, till that’s improved, it’s onerous to have a extra persistent repair to the inflationary drawback.”

Lyn Alden, impartial macro analyst

“You may’t stroll right into a Starbucks in America and pay with Swiss francs or kilos. But, each of those are actual cash. Context issues.”

Rockwell Shah, co-founder of Invisible School

“There’ll all the time be GPUs mining some GPU optimized chains, however I doubt we’ll return to the degrees of income seen in ETH proof-of-work at its peak ever once more.”

Andy Long, CEO of White Rock

“Ether’s value may decouple from different cryptocurrencies following The Merge, as its staking rewards will make it just like an instrument like a bond or commodity with a carry premium.”

“I wish to ship a transparent, sturdy message to everybody within the crypto world — anybody providing at hand you free cash is mendacity. It merely doesn’t exist.”

FatManTerra, pseudonymous Twitter crypto influencer

Prediction of the Week

Bitcoin analyst who called 2018 bottom warns ‘bad winter’ may see $10K BTC

Pseudonymous crypto market analyst Filbfilb sees Bitcoin presumably dropping all the way down to $10,000 inside 2022. Macro international components and mainstream market correlation may probably influence Bitcoin’s value trajectory, in keeping with feedback made by the analyst throughout an interview. Amongst a slew of insights, Filbfilb famous the present crypto bear market has some similarities to earlier bear markets, but in addition consists of variations. The analyst confirmed notable accuracy in calling Bitcoin’s backside throughout its final bear market in 2018.

FUD of the Week

Bitcoiner sentenced to federal prison warns users involved in OTC trading

Mark Alexander Hopkins, aka Rizzn on Twitter, claims he’s going through a jail sentence of 6-to-15 months. The crime? Allegedly failing to safe correct regulatory licensing for his crypto enterprise of peer-to-peer (P2P) Bitcoin buying and selling. Hopkins’ residence was raided by U.S. authorities in 2019. Hopkins, also called “Physician Bitcoin,” claims to have registered with the U.S. Monetary Crimes Enforcement Community however problems arose as a few of his P2P Bitcoin dealings have been tied to a shopper concerned in cash laundering. Authorities declare Hopkins didn’t conduct due diligence on his prospects, though he asserts in any other case.

Which countries are the worst for crypto taxation? New study lists top five

Crypto taxes range globally. Coincub, a digital asset analytics supplier, not too long ago revealed a examine naming the 5 least favorable areas for paying crypto taxes. Belgium took the cake for the nation with the worst crypto tax legal guidelines, requiring residents to pay as a lot as 50% in some circumstances, with 33% levied on crypto capital positive aspects. Following Belgium on the worst crypto tax jurisdiction record: Iceland, Israel, the Philippines and Japan.

Vermont’s financial regulator alleges Celsius and its CEO made ‘false and misleading claims’

Bankrupt crypto platform Celsius faces allegations from the Vermont Division of Monetary Regulation (DFR). The authority claims Celsius and its CEO Alex Mashinsky knew concerning the venture’s monetary points, however proceeded to mislead the general public into considering the whole lot was high-quality. The allegations additionally cite market manipulation of the venture’s CEL asset. “By rising its Internet Place in CEL by lots of of thousands and thousands of {dollars}, Celsius elevated and propped up the market value of CEL, thereby artificially inflating the corporate’s CEL holdings on its steadiness sheet and monetary statements,” Ethan McLaughlin, assistant normal counsel for the DFR, stated.

Greatest Cointelegraph Options

Powers On… Insider trading with crypto is targeted — Finally! Part 1

“It took a number of years, however authorities crackdowns on ‘insider buying and selling’ involving digital belongings have lastly arrived. It’s about time!”

Insiders’ guide to real-life crypto OGs: Part 1

“Similar to the whole lot else in life, there’s ebb and circulation to our fortunes and life circumstances.”

What will drive crypto’s likely 2024 bull run?

Easing financial insurance policies, the decline of inflation, the change in Bitcoin’s mining problem, and rising confidence in DeFi are components that time to a renewed surge for crypto costs.

The perfect of blockchain, each Tuesday

Subscribe for considerate explorations and leisurely reads from Journal.

By subscribing you conform to our Terms of Service and Privacy Policy

[ad_2]

Source link