Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981.

The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development.

Nevertheless, the green in the market is a welcome sight after the rough start to 2022.

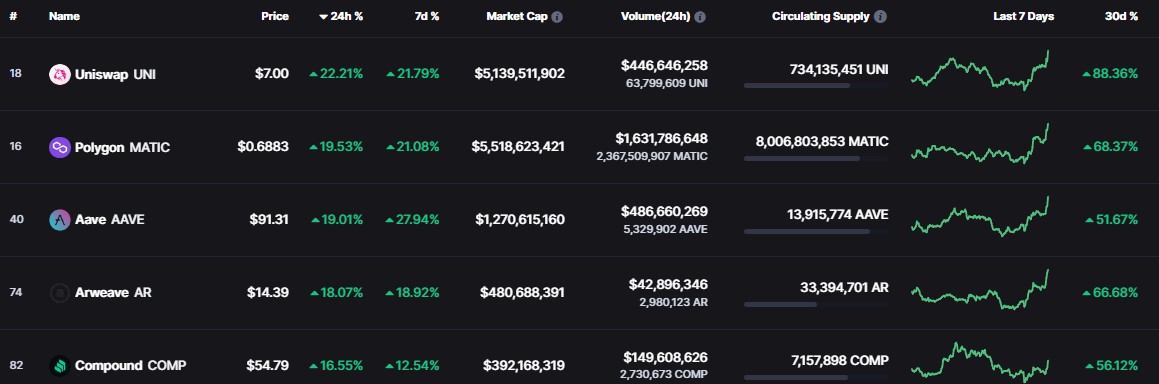

According to data from Cointelegraph Markets Pro and TradingView, the biggest gainers over the past 24-hours were Uniswap (UNI), Polygon (MATIC) and Aave (AAVE).

Robinhood lists UNI

Uniswap, the top decentralized exchange by volume, saw its token price head higher on July 13 after hitting a low of $5.23. The token has since climbed 36% to hit a daily high of $7.11 on July 14 amid a 104% spike in its 24-hour trading volume to $449 million.

The sharp turnaround in UNI price and trading volume comes as the popular brokerage firm Robinhood announced that the UNI token is now available to trade on the platform, exposing the asset to a large cohort of new buyers who don’t have accounts on other cryptocurrency exchanges.

Disney news provides a boost for MATIC

Polygon is one of the top layer-two scaling solutions for the Ethereum network that offers a faster, lower-fee transaction experience for users and protocols.

Data from Cointelegraph Markets Pro and TradingView shows that after briefly dipping to a low of $0.52 on July 13, the price of MATIC spiked 36% to hit a daily high at $0.707 on July 14 on the back of a 120% spike in its 24-hour trading volume.

MATIC’s price increase follows an announcement that the protocol was the only blockchain selected by Disney to be part of its 2022 Accelerator Program.

Interrupting the #GreenBlockchainSummit for some breaking news!

We're excited to be the only blockchain chosen to be a part of the Disney Accelerator program. https://t.co/LaGU4bhidi

— Polygon - MATIC (@0xPolygon) July 13, 2022

Related: Bitcoin analysts weigh sub-$17.5K dip after 'weak' BTC price bounce

Aave rallies on stablecoin developments

Aave, a populardecentralized finance platform, is a lending and borrowing protocol that currently holds $5.63 billion in total value locked (TVL), making it the second-ranked DeFi platform by TVL behind MakerDAO.

Data from Cointelegraph Markets Pro and TradingView shows that over the past 24-hours, the price of AAVE has rallied 38.5% from a low of $67.10 to hit a daily high of $93 in the afternoon hours on July 14.

Aave sparked excitement within its community on July 7 when it revealed plans to release its own GHO stablecoin, which will be a collateral-backed stablecoin that is native to the AAVE ecosystem.

1/ Calling all GHOsts

We have created an ARC for a new decentralized, collateral-backed stablecoin, native to the Aave ecosystem, known as GHO.

Read more below and discuss your thoughts for the snapshot (coming soon)!https://t.co/P7tHl9LbBe

— Aave (@AaveAave) July 7, 2022

The overall cryptocurrency market cap now stands at $927 billion and Bitcoin’s dominance rate is 42.6%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.