Bitcoin (BTC) has new short-term BTC value targets as consolidation mixes with bouts of volatility.

After a traditional “brief squeeze” took the biggest cryptocurrency to close $36,000, Bitcoin market individuals are highlighting key ranges to search for from Nov. 8 onward.

Bitcoin purchase liquidity inches right down to $34,000

Bitcoin is dealing with hurdles overcoming resistance at the $36,000 mark, and a number of other makes an attempt to clear it have rapidly pale knowledge from Cointelegraph Markets Pro and TradingView reveals.

Now, sellers have gotten energetic on intraday timeframes, and knowledge from alternate order books reveals the purchase facet getting cautious.

In an X post on the day, on-chain monitoring useful resource Materials Indicators highlighted help liquidity heading decrease — from $34,500 to $34,000.

“The Bitcoin Gameboard is Altering,” it wrote in a part of accompanying commentary.

A snapshot of the BTC/USDT order guide on Binance additionally confirmed $36,000 receiving further promote liquidity after declining throughout the prior day’s faucet of $35,900. $40,000 remained the crunch psychological barrier.

With $34,000 now a possible battleground ought to sell-side stress push the market decrease, common dealer Daan Crypto Trades eyed strains within the sand to the upside.

These got here within the type of $35,000 and $35,000 — the location of liquidity which may serve to copy the brief squeeze ought to bulls achieve the higher hand.

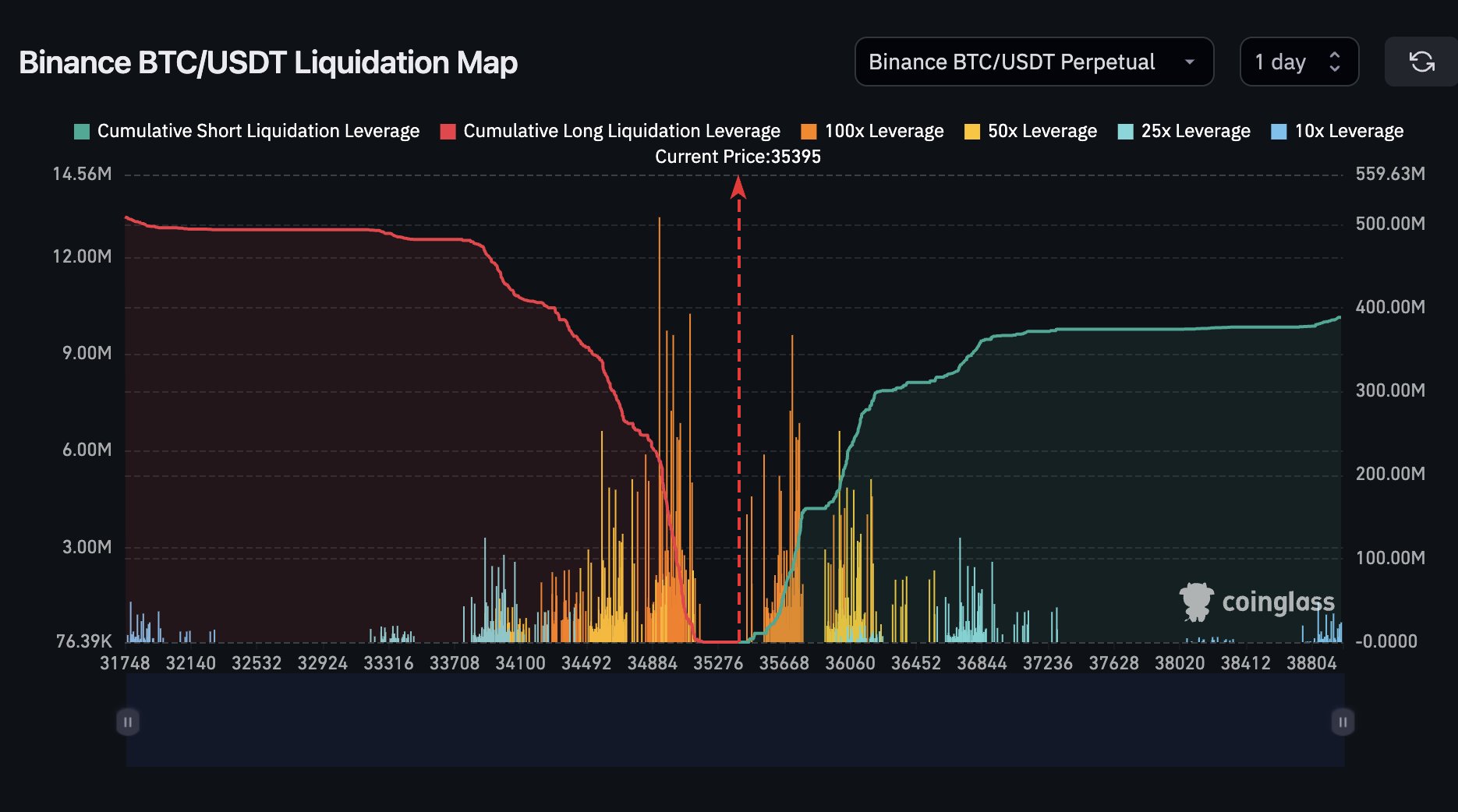

“Clear liquidation clusters positioned round $35K & $35.7K,” he wrote about Binance BTC/USDT perpetual swaps.

“Anticipate a little bit of a squeeze to happen if both of those ranges are tagged.”

Summarizing the spot and perp established order, fellow dealer Skew concluded that spot bidders had been wanted to present the market an opportunity of additional upside.

$BTC Market Information thread

Binance Spot orderbook

Clear quoted vary from liquidity perspective after excessive quantity spot shopping for yesterday

word lack of spot quantity at the moment

Binance Futures orderbook

very thick bid depth & excessive brief float led to the brief squeeze yesterday as… pic.twitter.com/OUzfdRdl9q

— Skew Δ (@52kskew) November 8, 2023

Evaluation: $33,700 "most bearish" BTC value situation

In a characteristically optimistic take, in the meantime, dealer and analyst Credible Crypto acknowledged that Bitcoin returning under $33,700 was unlikely.

Associated: Exchange flow gap hits 10K BTC — 5 things to know in Bitcoin this week

Updating X subscribers on two BTC value situations, he instructed that $34,500 would in actual fact maintain as help.

“In my ‘most bearish’ low timeframe situation, I do not anticipate we see under 33.7k,” he wrote.

“In different words- irrespective of how this performs out within the coming days I believe draw back is extraordinarily restricted.”

Credible Crypto added that hints as to the end result of present circumstances needs to be anticipated inside “the following day or two.”

As Cointelegraph reported, longer-term TBC value views give bulls trigger for celebration. Even year-end targets embrace $45,000 or extra, with the upcoming block subsidy halving a supply of optimism in itself.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.