Bitcoin (BTC) could have tapped $37,000 for the primary time in 18 months, however merchants are getting suspicious of BTC worth motion.

BTC worth transfer "does not really feel proper"

After snap overnight gains, Bitcoin is making an attempt to crush resistance on the best way towards the $40,000 mark.

Information from Cointelegraph Markets Pro and TradingView reveals BTC/USD snatching at $37,000 after initially breaking through previous to the Wall Avenue open.

Now up 6.6% in November, the biggest cryptocurrency is shocking some market members with its energy, having already gained almost 30% in October.

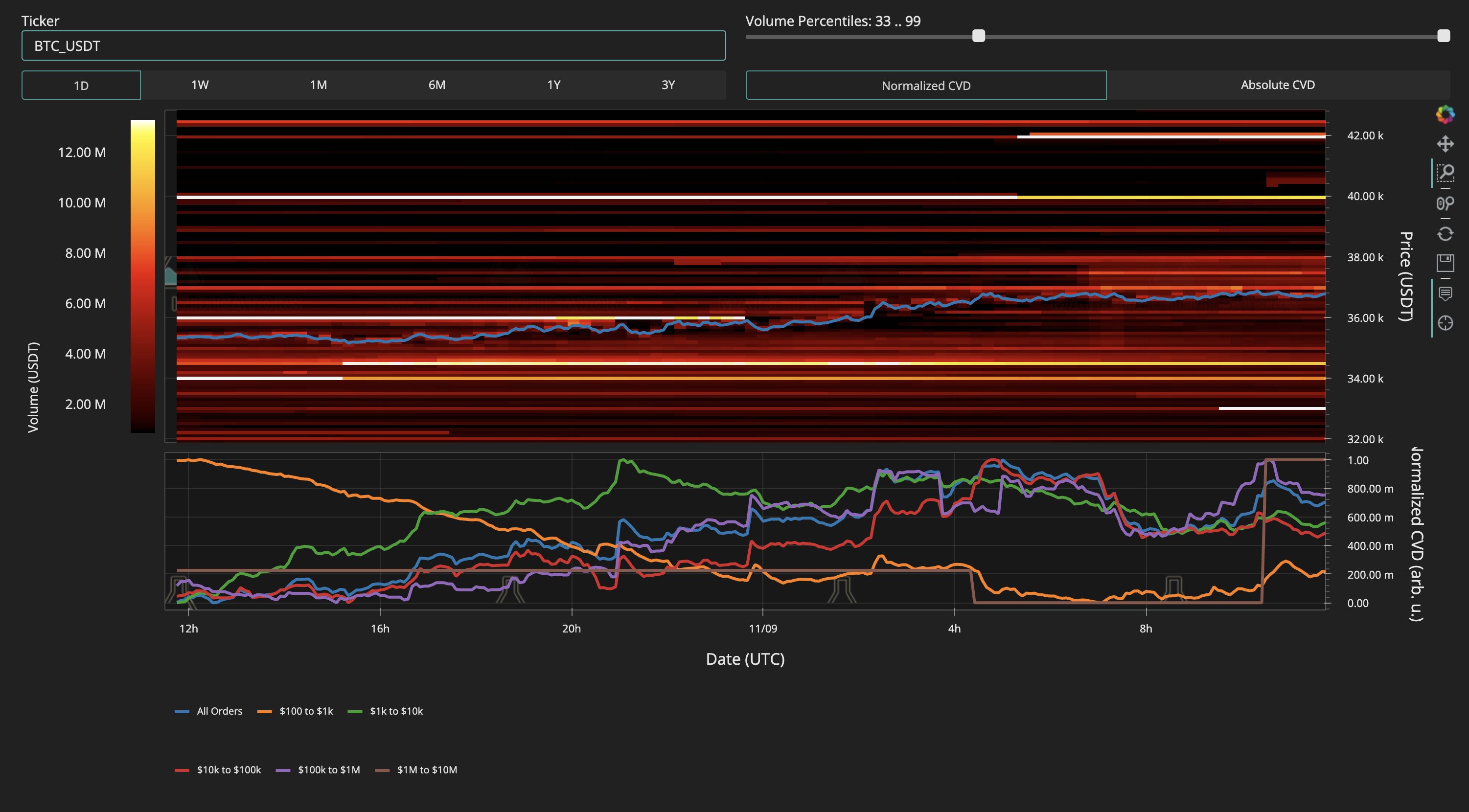

For on-chain monitoring useful resource Materials Indicators, the issue lies in buying and selling quantity. Upside has been brisk, it acknowledged in its latest X post, however help within the type of sturdy quantity is nowhere to be seen at present ranges.

“Help is anchored by new plunge safety at $33k. In the meantime resistance at $40k has moved as much as the $42k vary,” it famous.

An accompanying chart confirmed a print of BTC/USDT order guide liquidity on largest international trade Binance.

“There isn't any denying the truth that worth has been difficult a lot of totally different native prime alerts, however there's additionally no denying that one thing does not appear proper about this transfer,” Materials Indicators continued.

“The obvious purple flag for me is that we're seeing worth recognize on declining quantity. That sometimes does not finish properly, however we're going to have to look at to see if this time is totally different.”

Common dealer Skew in the meantime revealed whale promoting ongoing towards $40,000 — now probably a key psychological stage in its personal proper.

$BTC

bear whale aka gigantic vendor has been promoting into worth for previous few daysthey're dumping once more right here

$38K - $40K might be the place they get carried out of the market

— Skew Δ (@52kskew) November 9, 2023

Open curiosity nears 7-month excessive

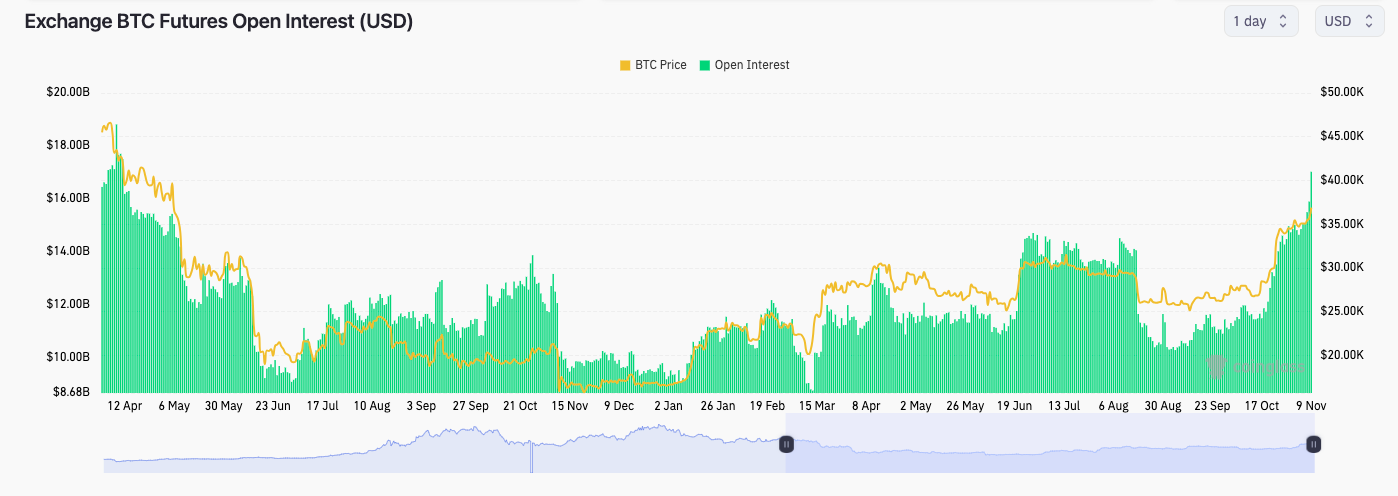

Elsewhere, monetary commentator Tedtalksmacro pointed to rising open curiosity (OI) — one thing which has formed the backbone of snap upside strikes in latest weeks and months.

Associated: Bitcoin ETF launch could be delayed more than a month after SEC approval

Market heating up once more.

~15k BTC in open curiosity added prior to now 10 hours.

That is about $525MM USD price... the vibes are slowly returning. pic.twitter.com/aSMbZxrySO

— tedtalksmacro (@tedtalksmacro) November 9, 2023

Per information from monitoring useful resource CoinGlass, complete Bitcoin futures OI stood at greater than $17 billion on the time of writing — the best worth since mid-April.

“Throughout the bear, the market fades these OI impulses --> a predatory, ranging setting,” Tedtalksmacro wrote in follow-up evaluation.

“We'll know it is full bull time, when the market ignores this and traits larger on larger OI. One thing to look at imo.”

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.