Bitcoin (BTC) begins a brand new week nonetheless driving excessive close to $37,000 as macroeconomic knowledge returns to the fore.

The most important cryptocurrency continues to circle its highest ranges in 18 months, with pleasure over a potential exchange-traded fund (ETF) approval in the USA driving sentiment.

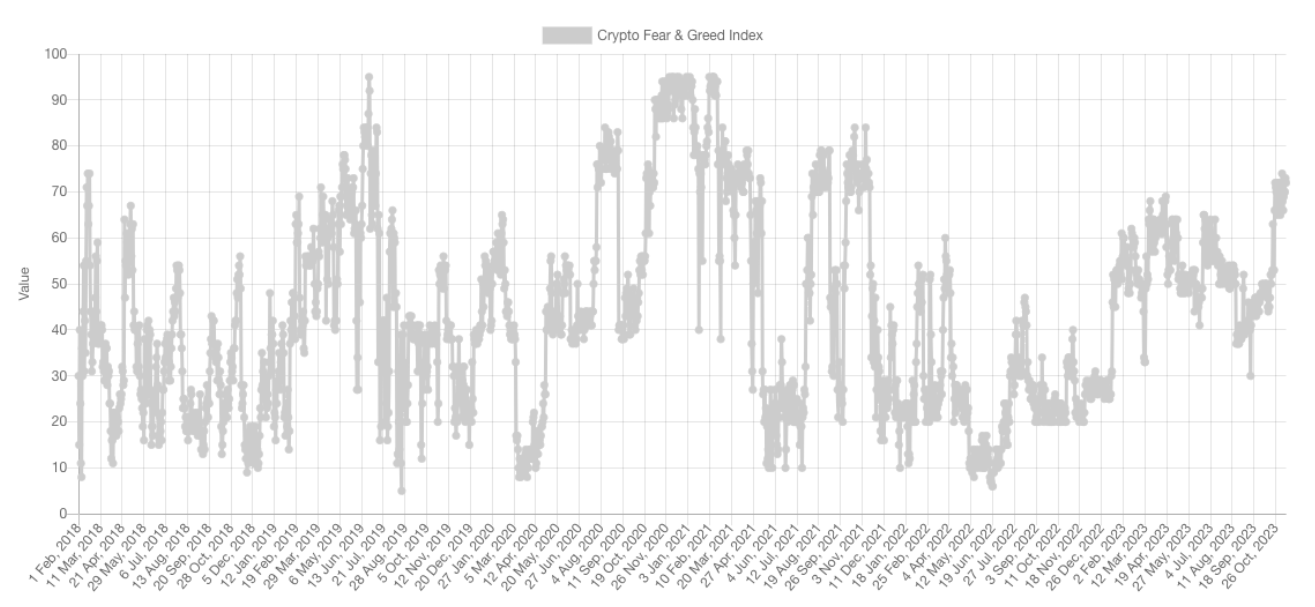

That's getting more and more grasping, nevertheless, as in accordance with the Crypto Concern & Greed Index, situations match these seen as BTC worth motion hit its present all-time highs in late 2021.

What may shake up the established order to supply volatility within the coming days?

The percentages of an exterior set off are extra vital this week. A raft of U.S. macro knowledge, together with the Client Value Index (CPI), has the potential to disrupt any sideways buying and selling exercise throughout danger property.

A number of officers from the Federal Reserve are additionally resulting from communicate, whereas the precarious geopolitical scenario within the Center East grinds on within the background.

On the institutional aspect, in the meantime, the longer term seems firmly bullish for Bitcoin — forward of the possible ETF approval, the Grayscale Bitcoin Belief (GBTC) is closing in on parity with internet asset worth.

Can Bitcoin markets keep the course and keep away from a big retracement? Cointelegraph takes a take a look at situations within the weekly rundown of BTC worth volatility catalysts ready within the wings.

Funding charges flash warning with BTC worth caught at $37,000

Bitcoin’s weekly shut set a brand new 18-month excessive on Nov. 12, however what adopted was not the features seen after other recent closes.

Through the Asia buying and selling session, BTC/USD as a substitute fell under $37,000, sticking firmly to the buying and selling vary in place all through the weekend, per knowledge from Cointelegraph Markets Pro and TradingView.

Monitoring the scenario, well-liked dealer and analyst Credible Crypto steered that this may quickly change. The explanation, he mentioned, was open curiosity (OI), now at multi-day highs and apt to spark volatility.

“OI has ramped proper again up off the lows which implies extra positions to squeeze out,” a part of an X put up read.

Credible Crypto gave a goal of $36,600 for a possible native low, with one other put up including that Bitcoin was “very shut” to additional upside.

Countering the optimism over short-term market motion was funding charges. These weren't solely constructive, however at their highest since Bitcoin’s November 2021 all-time highs, indicating an total drawback of being lengthy BTC at present ranges.

Bitcoin’s funding charges are on the highest stage since final ATH. pic.twitter.com/mMlnJleQ5u

— Thomas Kralow (@TKralow) November 12, 2023

“Fairly elevated ranges of funding charges throughout the board,” fellow dealer Daan Crypto Trades commented alongside knowledge from monitoring useful resource CoinGlass.

“Though this is not all the time a right away cause for a flush, ideally this goes again to regular after some extra ranging. Good to notice that in sturdy up traits, this will keep this fashion for weeks and even months.”

Additionally noting the conspicuous state of play on funding, well-liked analyst Caue Oliveira informed merchants to train warning.

“This worth means that optimism is prevailing out there, driving a excessive variety of futures contracts to guess on a rise in worth,” he wrote in an Quicktake market update for on-chain analytics platform CryptoQuant on Nov. 10.

“Nevertheless, this setup is harmful as it may well reveal excessively bullish sentiment and a worth contraction may set off a cascade of liquidations.”

CPI comes amid contemporary U.S. gov't shutdown turmoil

A basic macro setup marks the third week of November — CPI leads a deluge of knowledge prints which have sparked danger asset volatility prior to now.

Due on Nov. 14 for the month of October, the CPI print is keenly watched by inflation displays, with the Producer Value Index (PPI) following a day later.

Varied Fed officers may even take to the stage in talking engagements each throughout and after the info releases, offering insights into the Fed’s perspective on inflationary forces in actual time.

“Necessary week for inflation and the Fed,” monetary commentary useful resource The Kobeissi Letter summarized whereas importing vital macro diary dates to X.

Key Occasions This Week:

1. October CPI Inflation knowledge - Tuesday

2. October PPI Inflation knowledge - Wednesday

3. Retail Gross sales knowledge - Wednesday

4. Philly Fed Manufacturing knowledge - Thursday

5. Constructing Permits knowledge - Friday

6. Complete of 14 Fed speaker occasions

Necessary week for…

— The Kobeissi Letter (@KobeissiLetter) November 12, 2023

Widespread dealer Skew in the meantime famous expectations pointing to receding inflation, this regardless of some unwelcome surprises in October’s knowledge prints.

This could notionally present a tailwind for crypto markets, however as Cointelegraph reported, Bitcoin’s response to even bigger goal misses has grow to be muted this 12 months.

CPI & PPI this coming week

CPI - Tuesday 14th Nov

PPI - Wednesday fifteenth NovExpectations are for a substantial decline of entrenched inflation ~ much less inflation anticipated pic.twitter.com/PrQ0Rsf1Ab

— Skew Δ (@52kskew) November 12, 2023

Including to the combo is one other acquainted wildcard — a partial U.S. authorities shutdown within the making. Whereas up to now prevented this 12 months, the necessity to attain a deal on spending in Congress is as soon as once more turning into tangible forward of the Nov. 17 deadline.

Ought to it happen, the shutdown would solely be the fourth within the U.S. prior to now ten years.

Altcoins in focus as crypto capital inflows return

With a possible ETF approval firmly on the radar for crypto market contributors, capital inflows into the trade are being keenly monitored.

Purchaser curiosity varieties a key merchandise on the record for a bull market comeback, and the about flip in inflows is already attracting mainstream consideration.

“For the primary time in years, crypto markets are starting to see tons of latest liquidity,” Kobeissi wrote in a dedicated X post.

It famous that the mixed crypto market cap has elevated $600 billion since November 2022, within the aftermath of the FTX meltdown and Bitcoin’s cycle lows of $15,600.

“That is a +75% bounce in a single 12 months whereas Bitcoin is up +120% over the past 12 months,” it added.

“This comes after years of constant outflows from crypto markets. One factor we've got seen a number of occasions prior to now? A return of liquidity all the time causes historic strikes in crypto.”

It's not simply Bitcoin exhibiting potential — altcoin markets are waking up, merchants and analysts say.

#Altcoins are flying. Will probably be epic. pic.twitter.com/bSAw0nKKL0

— Stockmoney Lizards (@StockmoneyL) November 9, 2023

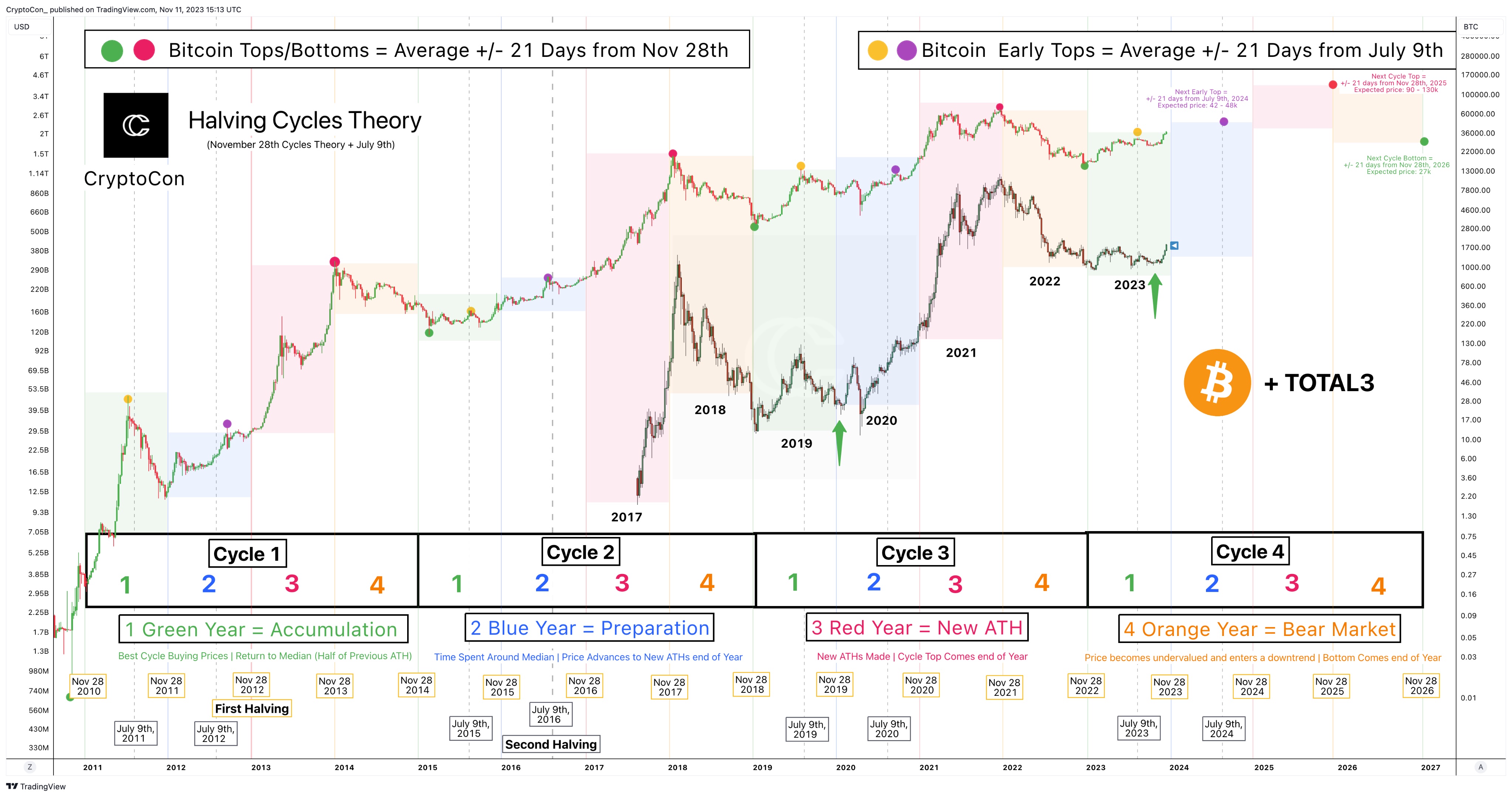

Regardless of Bitcoin’s dominance of the general crypto market cap nonetheless being sturdy, analyst CryptoCon steered to not take this as an indication of comparative altcoin weak spot.

“Some folks have informed you to fully ignore Altcoins as a result of Bitcoin dominance goes up. And as you may need seen, this can be a vital mistake,” he told X subscribers on the weekend.

An accompanying chart confirmed BTC worth conduct in annually of its halving cycle, with altcoins likewise exhibiting particular reactions.

With Bitcoin due an “early” cycle prime in mid-2024, per CryptoCon, altcoins are unlikely to underdeliver.

“I believe it's now very possible that Altcoins have already bottomed for the cycle, and people who did nothing should purchase increased,” he continued.

“Think about being informed, ‘Ignore Altcoins at their bottoms and solely purchase Bitcoin which is already up.’ That is occurred this 12 months. 2024 is coming, Altcoins are able to get even stronger!”

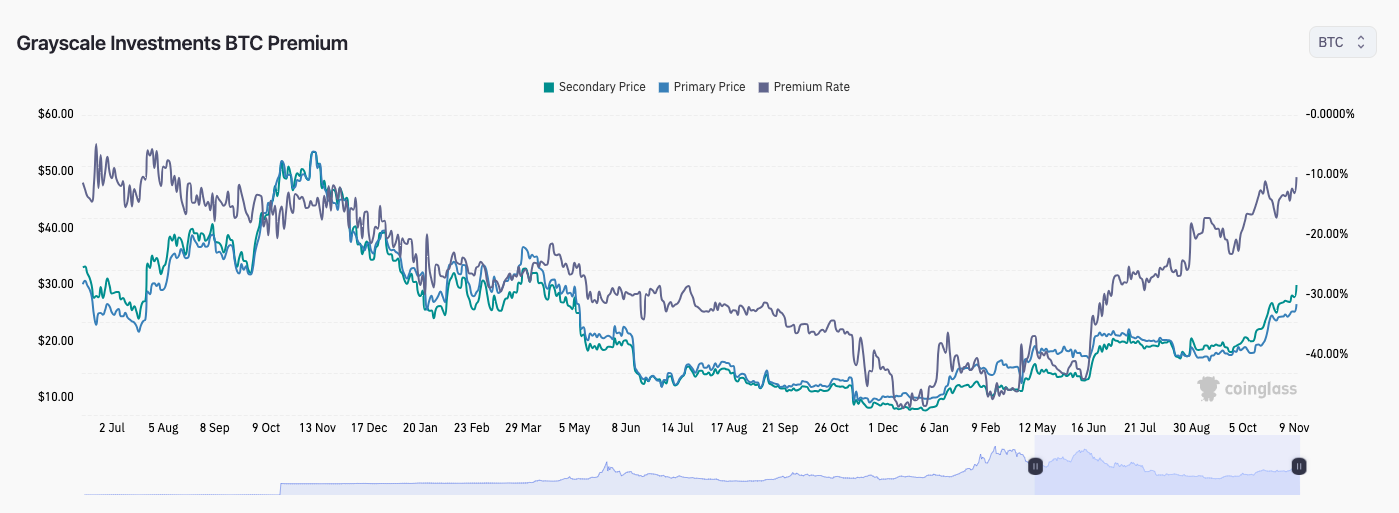

GBTC low cost passes two-year lows

A yardstick for the return of Bitcoin to the mainstream highlight — regardless of the absence of retail curiosity — is its largest institutional funding automobile.

The Grayscale Bitcoin Belief (GBTC) is quick approaching parity to internet asset worth (NAV), the Bitcoin spot worth.

GBTC traded with an implied share worth increased than BTC/USD prior to now, however the previous two years has seen the premium grow to be a reduction which at one level neared 50%.

Now, the low cost to NAV is simply 10.35% — its smallest since August 2021.

Commenting on the phenomenon, William Clemente, co-founder of market analysis agency Reflexivity, tied GBTC’s reversal of fortune to a potential ETF go-ahead.

“Appears to be like just like the market is pricing in very excessive chance of BTC ETF approval at this level,” he wrote final week.

Grayscale continues to petition to achieve the right to convert GBTC to a Bitcoin spot ETF.

Crypto buyers keep grasping

There is no such thing as a ignoring the need to squeeze income after a report lengthy crypto bear market.

Associated: Pre-ETF BTC price 'crash' or $150K in 2025? Bitcoin forecasts diverge

This continues to be aptly displayed by the Crypto Fear & Greed Index, the basic market sentiment gauge now at ranges final seen in November 2021.

Whereas not at its excessive ranges but, the Index unequivocally reveals that the common crypto investor is nearing a state of irrational exuberance.

Concern & Greed stood at 72/100 on Nov. 13, having hit 74/100 on Nov. 6.

Commenting on market psychology firstly of the month, well-liked dealer Pentoshi reminded X readers that excessive ranges of each worry and greed can provide the “finest alternatives” for these capable of time and exploit market volatility at excessive sentiment ranges.

Usually, when the Index is both under 10/100 or above 90/100, crypto markets are in line for a snap development reversal.

Now is an efficient time to share this once more

Concern and greed

Markets drive participation, they drive you to behave https://t.co/f1nJOyGaLS

— Pentoshi euroPeng (@Pentosh1) November 12, 2023

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.