Bitcoin (BTC) stays on observe to close $50,000 round subsequent 12 months’s block subsidy halving occasion, longtime analyst Filbfilb says.

In his newest interview with Cointelegraph, the co-founder of buying and selling suite DecenTrader shares his present ideas on BTC value motion.

Filbfilb: Bitcoin has given "robust indicator" of bear market breakout

Bitcoin has effectively and actually cemented its exit from a sub-$30,000 buying and selling vary, which characterised the marketplace for a lot of 2023, Filbfilb believes.

Having overcome a multitude of resistance levels, the query for Bitcoin bulls now could be how value motion will prove into the halving.

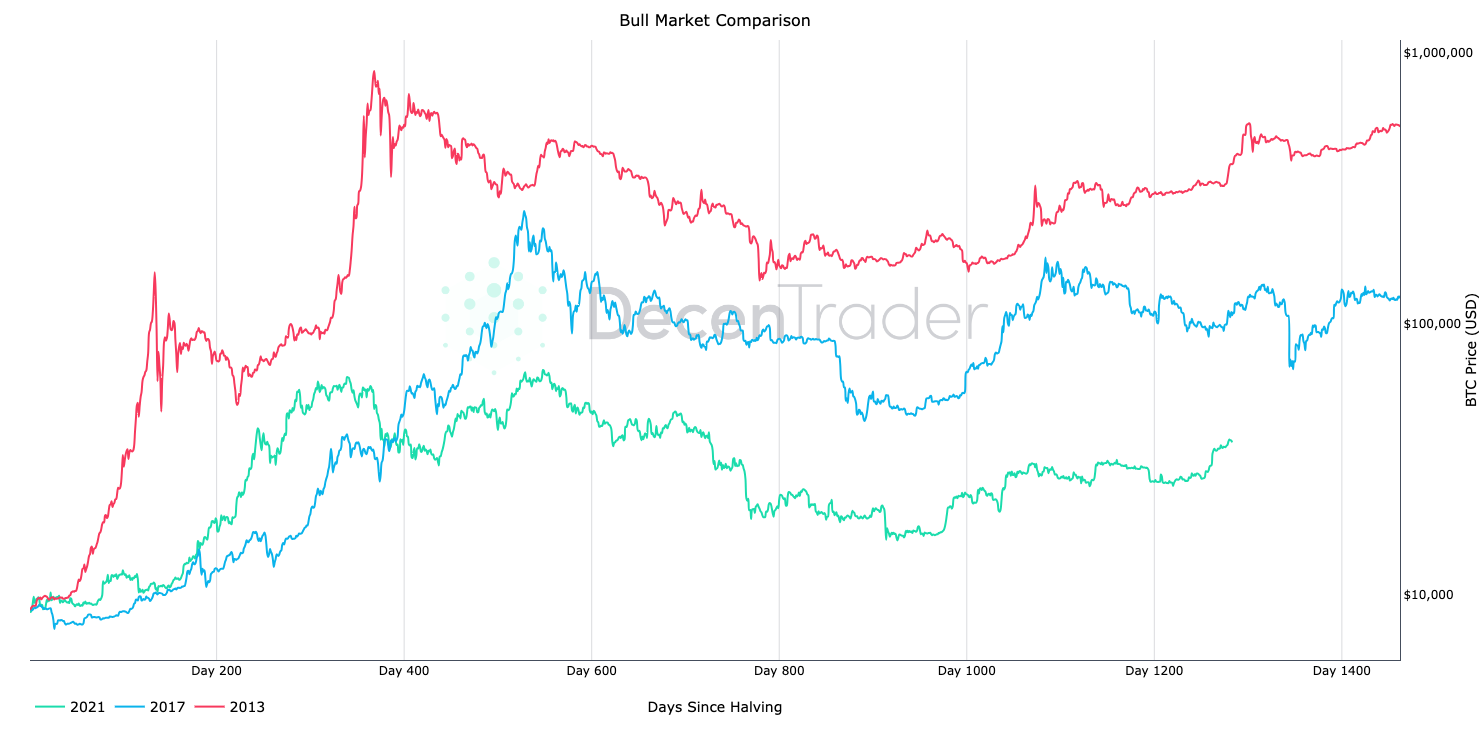

Due in April 2024, lower than 5 months stays till the occasion, and Filbfilb argues {that a} “affordable” bullish goal may lie at slightly below the $50,000 mark. This echoes assumptions from his earlier interview in early September, when BTC/USD traded at just below $26,000.

That mentioned, a drawdown may simply come first, testing the morale of those that would possibly already be used to BTC value upside.

Proceed studying to find what the approaching months may have in retailer for Bitcoin from a technical value perspective.

Cointelegraph (CT): Do you suppose that BTC has definitively damaged out of its earlier vary beneath $30,000? How would you gauge the energy of the assorted shifting averages (MAs) which beforehand acted as resistance?

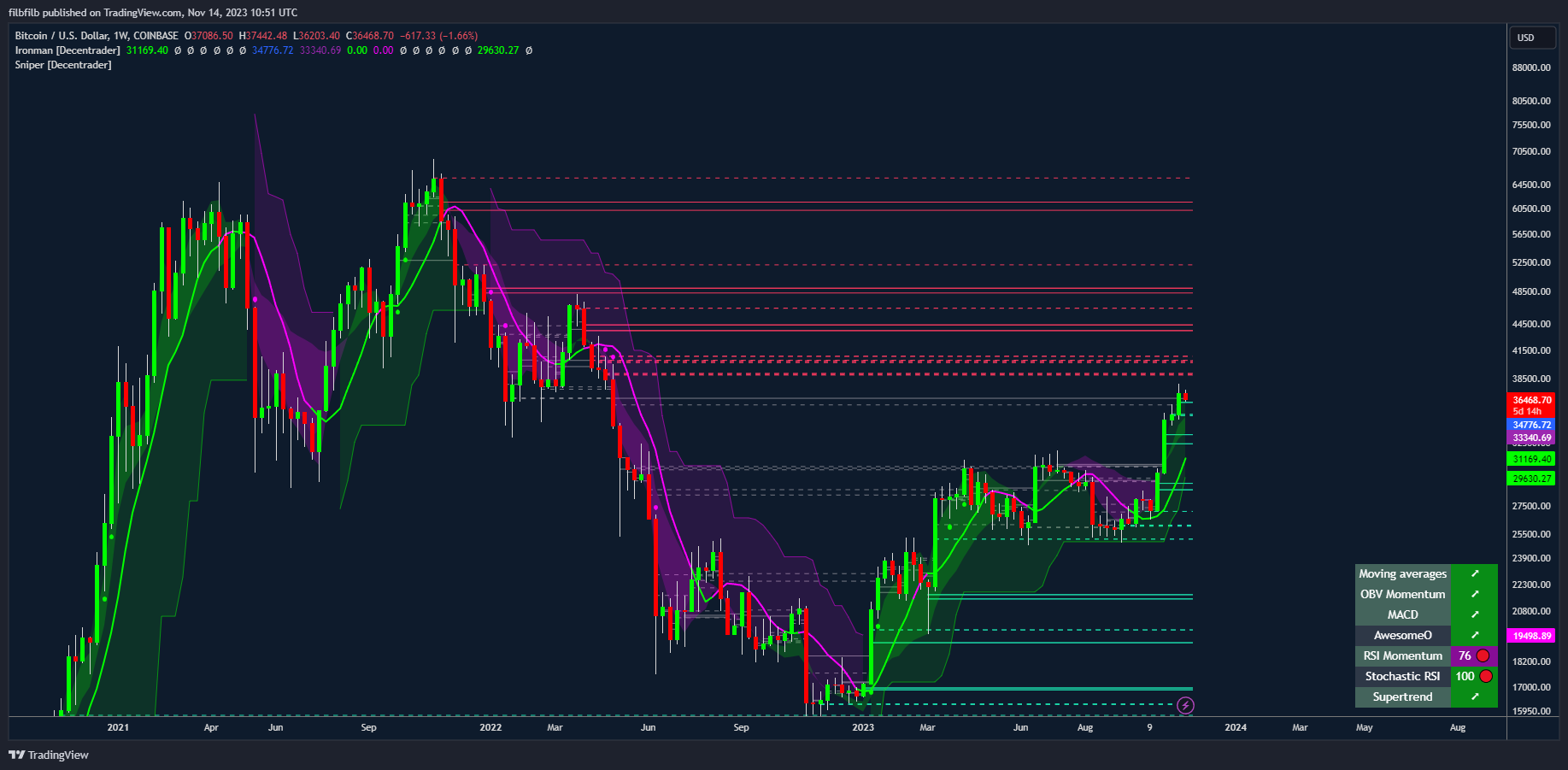

Filbfilb (FF): The 20, 50, 100 and 200-week easy shifting averages are throughout $30,000 in the meanwhile. In addition they lie towards the highest of the buying and selling vary beneath $30,000 and above $25,000, wherein Bitcoin spent 200 days or so.

The 2 mixed would counsel that there will probably be shopping for curiosity beneath and collectively are a powerful indicator of a breakout and pattern change from the two-year bear market.

CT: What’s your timeline for a Bitcoin ETF approval and what do you suppose the occasion would do to cost?

FF: My view on the ETF stays the identical, which is that it's going to proceed to be delayed so long as attainable, however a spot ETF is inevitable. The main gamers usually are not losing their time and so it continues to be a matter of when.

Given their place on market manipulation I would not be stunned to see the approval to deliberately come from left discipline.

CT: The place would you now draw the purpose of management on the BTC value chart? What resistance and assist (R/S) ranges are you watching?

FF: This actually is dependent upon the timeframe. The final couple of years counsel $26,000 is a vital level of management; during the last six months, it might counsel nearer to $27,000.

There's resistance round $38,000-$41,000; a whole lot of quantity was traded there earlier than lots of the implosions we noticed amongst crypto entities. Some folks will exit, others will contemplate redeploying capital below a brand new atmosphere. This can be a clear space of rivalry.

CT: In our final interview you had been eyeing a BTC value enhance as a part of pre-halving motion in This fall. Has that perspective modified a lot since? Some are involved that Q1 2024 might need the other impact.

FF: I believe it's truthful to say that we have now seen that value appreciation in This fall. The cyclical mannequin implies that Q1 2024 may pull again earlier than one other run into the halving.

Associated: Funding rates echo $69K BTC price — 5 things to know in Bitcoin this week

A 61.8% Fibonacci retracement of the bear market — $46,000-$48,000 — could be an affordable technical goal assumption from a bullish perspective in my view.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.

Advertise with Anonymous Ads

Source link Review Overview