Bitcoin (BTC) bull market “FOMO” has but to look regardless of BTC value being up 120% this yr.

Information from statistics platform Look Into Bitcoin exhibits that on-chain transactions are solely beginning to contain “youthful” bitcoins.

Bitcoin bull market evaluation: "We're nonetheless early"

Bitcoin stays close to 18-month highs and nicely past its bear market buying and selling vary and a number of other key resistance ranges.

Whereas the number of smaller wallets is rising, there has not been a significant return to the community from speculators — these holding BTC for brief intervals of time.

In an X post on Nov. 16, Look Into Bitcoin creator Philip Swift flagged the Realized Cap HODL Waves metric, often known as RHODL Waves, as proof.

RHODL splits the present HODL Waves metric, which divides BTC by age group of the availability, and compares it to the value at which they final moved on-chain.

The result's a spike in cash, which transfer incessantly throughout bull market phases, and the alternative in bear markets, the place buyers are afraid to promote or are within the purple on their holdings.

“Hotter color low timeframe waves are solely simply beginning to improve as cash are transferred on-chain,” Swift commented on the present state of RHODL.

“No FOMO but. We're nonetheless early.”

Bitcoin profitability nears "potential breakeven level"

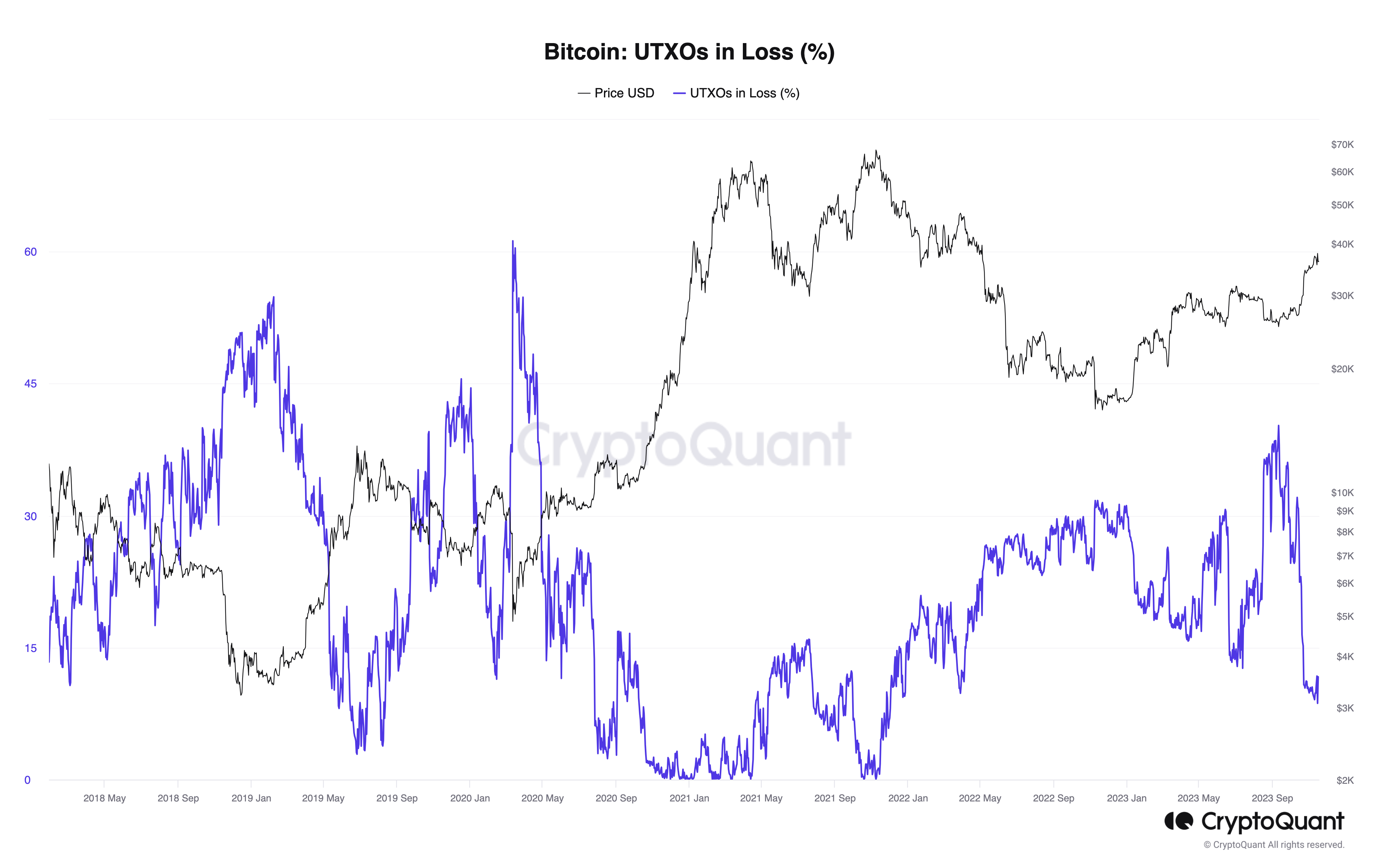

Persevering with the examination of Bitcoin provide “age bands,” Onchained, a contributor to on-chain analytics platform CryptoQuant, pressured that those that elevated BTC publicity within the run-up to the 2021 all-time highs stay underwater.

Associated: Bitcoin institutional inflows top $1B in 2023 amid BTC supply squeeze

He did so utilizing the Internet Unrealized Revenue/Loss (NUPL) indicator, which affords profitability ratios for cohorts of saved cash.

Coming quickly, nevertheless, is a key line within the sand for bull market hodlers.

“Contemplating NUPL throughout totally different age bands gives insights into profitability dynamics. Notably, the depicted graph reveals all UTXO age bands at the moment in a worthwhile state, apart from holders with bitcoins held for 18 months to three years,” Onchained wrote in one in every of CryptoQuant’s Quicktake market updates on Nov. 16.

“This aligns with their entry through the Bitcoin value rally to $67,000. Their NUPL nearing the profitability benchmark of 0 suggests a possible break-even level if Bitcoin continues its rally past $39,000.”

CryptoQuant knowledge exhibits that the general proportion of unspent transaction outputs, or UTXOs, at the moment at a loss is now simply 11.6%.

As Cointelegraph reported, whale entities have been increasing BTC selling at present costs.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.