A Bitcoin person paid 83.7 Bitcoin (BTC) price $3.1 million in transaction charges for transferring 139.42 BTC. The transaction payment of $3.1 million is the eighth highest in Bitcoin's 14-year historical past.

The BTC pockets address bc1qn3d…wekrnl tried transferring 139.42 BTC to bc1qyf…km36t4 earlier on Nov. 23, solely to pay greater than half the precise worth within the transition payment. The vacation spot handle acquired solely 55.77 BTC. The mining pool Antpool captured the absurdly excessive mining payment on block 818087.

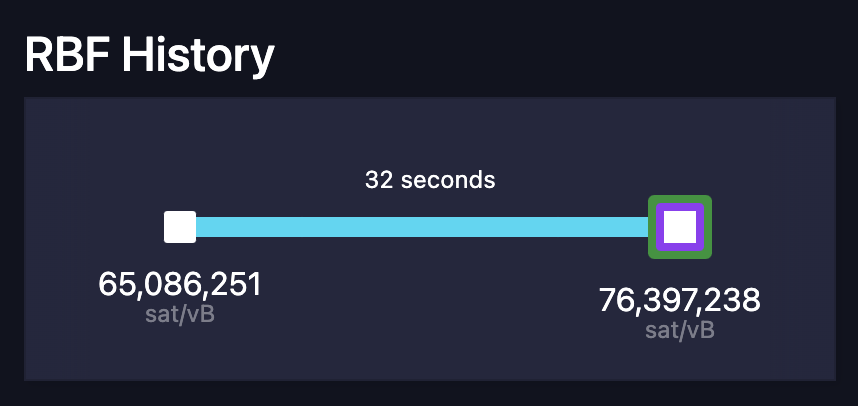

Customers on social media steered that the sender chosen the excessive transaction payment, however Exchange-By-Price (RBF), a node coverage, and the sender's unawareness additionally seem to have performed a component. RBF permits an unconfirmed transaction in a mempool to get replaced with a distinct transaction that pays a better transaction payment, to be able to get it cleared earlier. Mempool is the place all BTC transactions are queued earlier than approval and addition to the Bitcoin blockchain.

A mempool developer who goes by the Twitter title of Mononaut said that the person behind the switch most likely didn’t know RBF orders can't be canceled. The person may need changed the charges a number of instances in hopes of canceling it. The RBF historical past signifies that the final alternative elevated the payment by one other 20%, including 12.54824636 BTC in charges.

This isn't the primary occasion a Bitcoin person by chance despatched an absurdly excessive transaction payment for a single Bitcoin transaction. In September, Bitcoin change platform Paxos accidentally sent $500,000 in transaction fees for $2000 price of BTC switch. Nevertheless, the f2pool miner who verified that transaction returned the $500,000 accidental transaction fee to Paxos.

Associated: Binance’s DOJ settlement offers a glimmer of hope for the crypto industry

Mononaut informed Cointelegraph that though the present occasion of unintentional transition payment is analogous to the Paxos case, the likelihood the funds can be returned by Antpool would depend upon their very own payout insurance policies, ”which could have implications for what obligations they should share transaction charges with their miners.”

Antpool has but to touch upon the problem and hasn't responded to Cointelegraph’s requests for feedback.

Journal: Deposit risk: What do crypto exchanges really do with your money?