Bitcoin (BTC) held nearer to the $40,000 mark on Dec. 3 after weekend good points strengthened a “sturdy” uptrend.

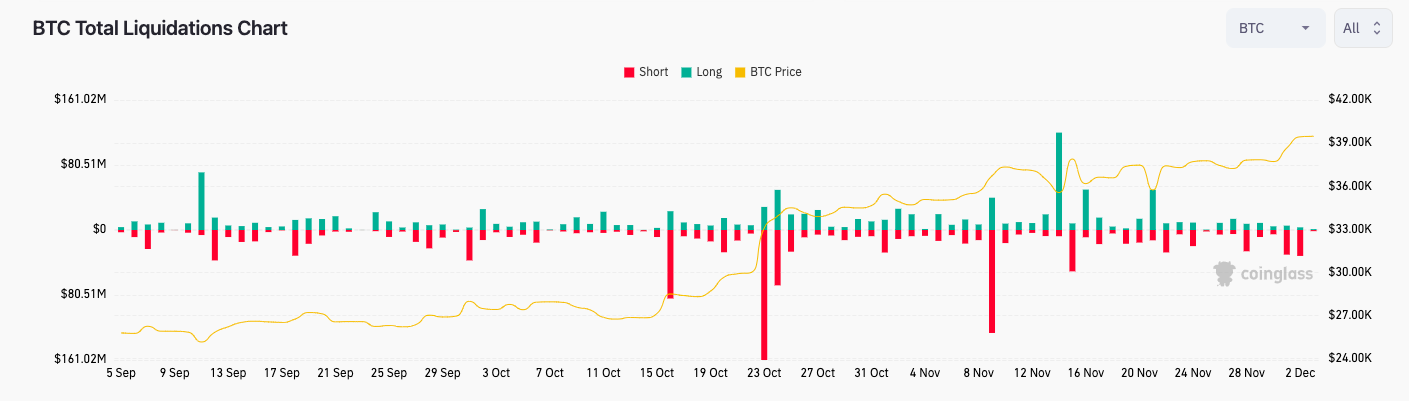

Bitcoin leaves $60 million in shorts hanging

Information from Cointelegraph Markets Pro and TradingView tracked a contemporary BTC worth surge, which took BTC/USD to new 2023 highs of $39,730.

These constructed on upward momentum, which had entered days prior, as Bitcoin hit $39,000 for the first time since mid-2022.

With derivatives main into the top of the Wall Road buying and selling week, commentators had argued that spot consumers wanted to step as much as keep momentum. Occasions finally took an sudden flip, with a snap surge throughout Bitcoin and altcoins wiping earlier resistance.

In a part of protection on X (previously Twitter), widespread dealer Skew suggested that “somebody simply ran all shorts throughout the board seemingly on most pairs.”

This in flip positioned BTC worth conduct across the weekly open in query — CME Bitcoin futures closed the week at $39,225, leaving a niche between there and spot worth, which might usually be “crammed” through a dip.

Analyzing the established order, nevertheless, fellow dealer Daan Crypto Trades predicted that this time can be totally different.

“At any time when $BTC is in a powerful pattern (up or down) and particularly when it is buying and selling at yearly highs or worth discovery. You are likely to have these weekend strikes that get away and depart lots of people behind. Typically creating a niche that by no means will get closed or not till weeks later,” a part of an X post defined.

“Throughout sturdy trending environments, buying and selling the CME worth does not have a really sturdy edge anymore. It is superb throughout sideways chop however not like this.”

Daan Crypto Trades agreed that the realm across the Friday closing worth had supplied a chance to “entice” shorters.

“Because of me pondering it was fairly prone to see a giant transfer happen through the weekend, I didn't share the same old CME chart. Thus far the suspicion was right and other people attempting to quick this transfer would have been rekt,” he wrote.

Information from statistics useful resource CoinGlass confirmed round $30 million in BTC shorts liquidated on each Dec. 1 and Dec. 2.

BTC worth in "all-the-way-UP mode"

With $40,000 in sight, in the meantime, market contributors turned their consideration to bullish alerts on longer timeframes.

Associated: Bitcoin ETF will drive 165% BTC price gain in 2024 — Standard Chartered

For widespread Twitter commentator Alan Tardigrade, BTC/USD was effectively out of a downward channel in place since its November 2021 all-time excessive of $69,000.

“Bitcoin has entered All-the-way-UP mode,” he commented on a chart displaying how current BTC worth motion had decisively exited the pattern.

Fellow commentator BitQuant, identified for his bullish takes on Bitcoin within the present surroundings, eyed a return to the highs earlier than “some correction” might take maintain.

Each views channeled conduct from earlier Bitcoin bull markets.

Sure, all the best way as much as the earlier all-time highs after which some correction for the bears to really feel some hope https://t.co/2ovCs4mvGi

— BitQuant (@BitQua) December 3, 2023

In September, BitQuant made the bold prediction of BTC/USD beating its report highs earlier than the subsequent block subsidy halving in April 2024 — simply 4 months away.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.