[ad_1]

Previously seven days, Bitcoin (BTC) skilled a whopping 14.5% surge, hitting a 20-month excessive at $41,130 by Dec. 4. Merchants and analysts have been abuzz with hypothesis, particularly within the wake of the $100 million liquidation of brief (bearish) Bitcoin futures inside simply 24 hours. Nevertheless, once we dive into BTC derivatives information, a distinct story unfolds—one which locations the highlight on spot market motion.

BTC liquidation map

Sufficient shorts to run it up all the way in which to $45-46k pic.twitter.com/7O2zYD4j8Q

— Nik Algo (@nik_algo) December 4, 2023

The impression of the current liquidations in Bitcoin futures markets

Whereas the Chicago Mercantile Change (CME) trades USD-settled contracts for Bitcoin futures, the place no bodily Bitcoin modifications fingers, these futures markets undoubtedly play an important function in shaping spot costs. The sheer scale of Bitcoin futures, with an combination open curiosity of $20 billion, underscores the eager curiosity {of professional} buyers.

In the identical seven-day interval, a mere $200 million price of BTC futures shorts have been liquidated, representing only one% of the entire excellent contracts. This determine pales compared to the substantial $190 billion in buying and selling quantity throughout the identical timeframe.

Even when focusing solely on the CME, which is understood for potential buying and selling quantity inflation, its each day quantity of $2.67 billion ought to have readily absorbed a $100 million 24-hour liquidation. This has led buyers to ponder whether or not the current Bitcoin rally may be attributed to the focusing on of some whales throughout the futures markets.

$BTC Subsequent Attainable Plan

A Fast Wick to 42k-42.5k To Hunt BSL Of Shorts then A Fast Flushout of the Lengthy’s & We Would possibly see $BTC Pullback right down to 39k-38.5k

Retracement to 39k-38.5k Can be good Shopping for Alternative For the Final Leg upto 45k-47k Earlier than ETF Approval pic.twitter.com/yc7k0hOBpZ

— VeLLa Crypto (@VellaCryptoX) December 4, 2023

One might try and gauge the extent of liquidations at completely different worth ranges utilizing tape studying strategies. Nevertheless, this method fails to contemplate whether or not whales and market makers are adequately hedged or have the capability to deposit extra margin.

Regardless of Bitcoin’s surge to a 20-month excessive, futures and choices markets seem comparatively subdued. In reality, three key items of proof recommend that there isn’t any compelling purpose to anticipate a cascade of brief contract liquidations ought to Bitcoin surpass the $43,500 threshold.

Bitcoin derivatives present no indicators of extreme optimism

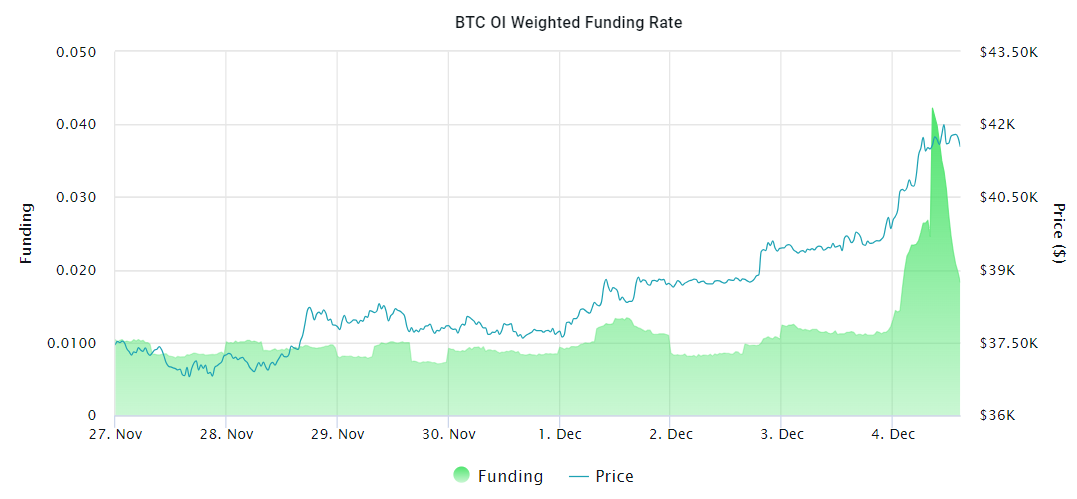

Perpetual contracts, also referred to as inverse swaps, incorporate an embedded price that’s sometimes recalculated each eight hours. A optimistic funding price signifies an elevated demand for leverage amongst lengthy positions, whereas a detrimental price alerts the necessity for added leverage amongst brief positions.

Knowledge reveals a peak of 0.04% per eight hours earlier on Dec. 4, however this stage, equal to 0.9% per week, proved short-lived. The present 0.4% weekly price locations minimal strain on leverage-seeking longs, indicating a scarcity of urgency amongst retail merchants. Conversely, there isn’t any signal of exhaustion amongst bears.

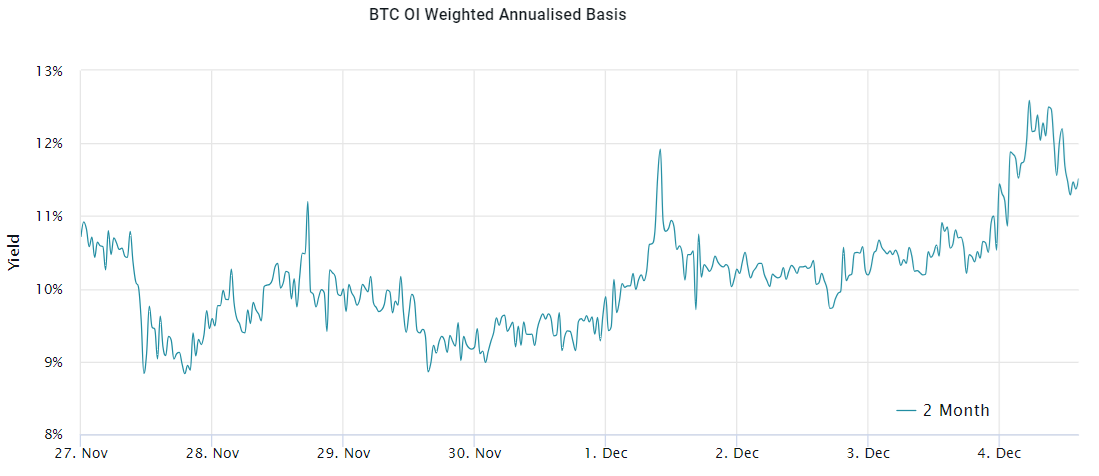

To judge whether or not Bitcoin perpetual swaps signify an anomaly, consideration turns to BTC month-to-month futures contracts, favored by skilled merchants for his or her mounted funding price. Sometimes, these contracts commerce at a premium of 5% to 10% to account for his or her prolonged settlement interval.

Associated: How to prepare for the next crypto bull market – 5 simple steps

BTC fixed-term futures contracts information reveals a peak premium of 12% on Dec. 4, presently resting at 11%. This stage stays affordable, particularly given the prevailing bullish momentum. Historic rallies in 2021 witnessed premiums surging past 30%, additional difficult the notion of a rally predominantly pushed by Bitcoin derivatives.

Finally, with Bitcoin’s worth hovering by 14.5% in simply seven days and solely $200 million price of brief futures contracts liquidated, questions come up concerning whether or not bears employed conservative leverage or diligently elevated margin deposits to safeguard their positions.

When contemplating the funding price and futures foundation price, there isn’t any clear indication that surpassing the $43,000 mark would set off substantial inventory losses.

In essence, the current surge finds assist in spot market accumulation and a decline within the out there provide of cash on exchanges. Over the previous week, exchanges recorded a web outflow of 8,275 BTC, in response to Coinglass.

This text is for common info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.

[ad_2]

Source link