Bitcoin (BTC) faces sharp volatility as the brand new week begins with BTC worth motion specializing in $42,000 — can it endure?

The biggest cryptocurrency, recent from weekend positive factors which topped 10%, continues to be protecting merchants guessing over its subsequent transfer.

Whereas a visit to $40,000 was effectively anticipated, the query now's whether or not or not the most recent transfer represents the start of a brand new pattern or, conversely, a new bull trap.

Value determinations presently differ extensively, with bullish and bearish views battling for vindication.

Cointelegraph takes a have a look at crucial help and resistance ranges now in play after latest BTC worth efficiency reshapes the market panorama.

BTC/USD is presently buying and selling at round $41,600, per information from Cointelegraph Markets Pro and TradingView, having hit 19-month highs of $42,160 earlier on the day.

Bitcoin whales hit “promote” at $42,000

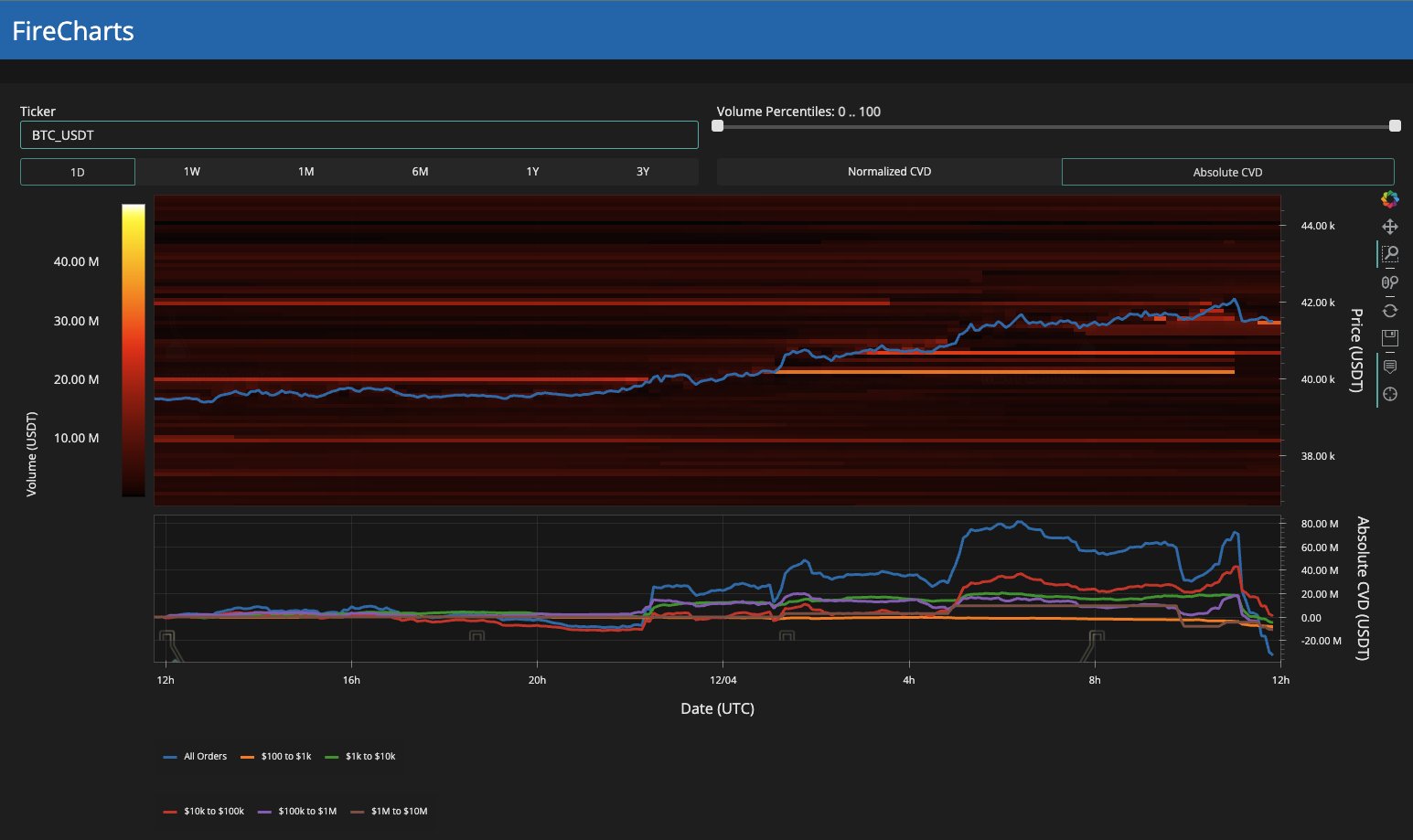

A cursory have a look at order guide liquidity offers a direct snapshot of the place purchaser help and vendor curiosity lie.

Uploading the info to X (previously Twitter) on Dec. 4, buying and selling useful resource Materials Indicators confirmed the strongest focus of bids at $41,500 and $40,700 on the time of writing.

Little by the use of vital promote stress lay in wait instantly above spot worth, with large-volume merchants already promoting into the rally. This, Materials Indicators suggests, isn't any coincidence.

“As I have been saying all week, I believed Bitcoin would proceed to climb so long as whales might maintain attracting bid liquidity to the vary, or they lured sufficient to distribute into,” it defined in accompanying commentary.

“They succeeded in attracting over $120M to the energetic buying and selling vary so wasn't stunned to get up to BTC taking out $42k, earlier than the promoting started.”

The evaluation added that promoting cooled as soon as purchase partitions had disappeared, with $86 million nonetheless offered off in simply half-hour.

“Undecided the occasion is over simply but. A brand new $30M block of bid liquidity simply confirmed as much as doubtlessly proceed the sport,” it famous.

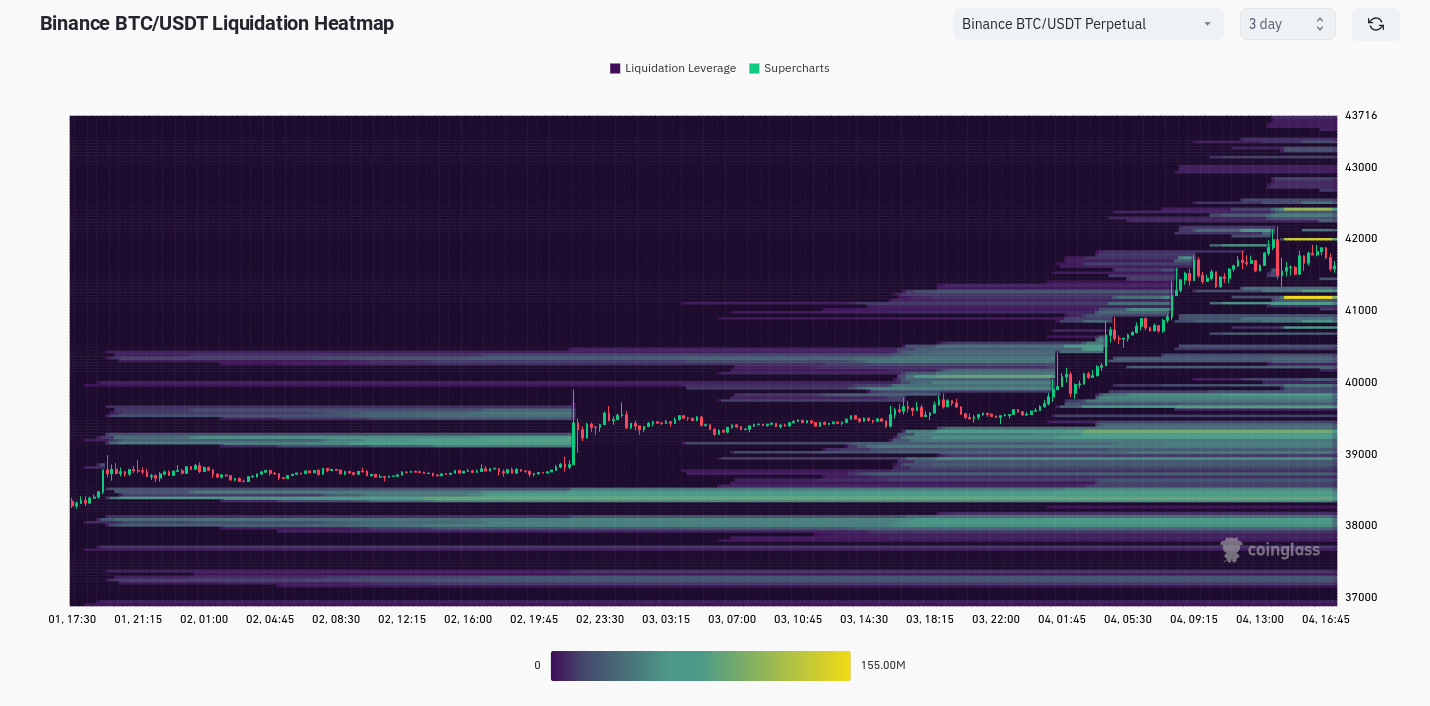

Liquidity information from statistics useful resource CoinGlass in the meantime confirmed $42,420 as a close-by space of curiosity for derivatives on largest international change Binance after the Dec. 4 Wall Avenue open.

Lengthy-term BTC worth ranges stay as legitimate as ever

Zooming out, there isn't any denying the psychological gravitas of historic BTC worth ranges.

Associated: Breakout or $40K bull trap? 5 things to know in Bitcoin this week

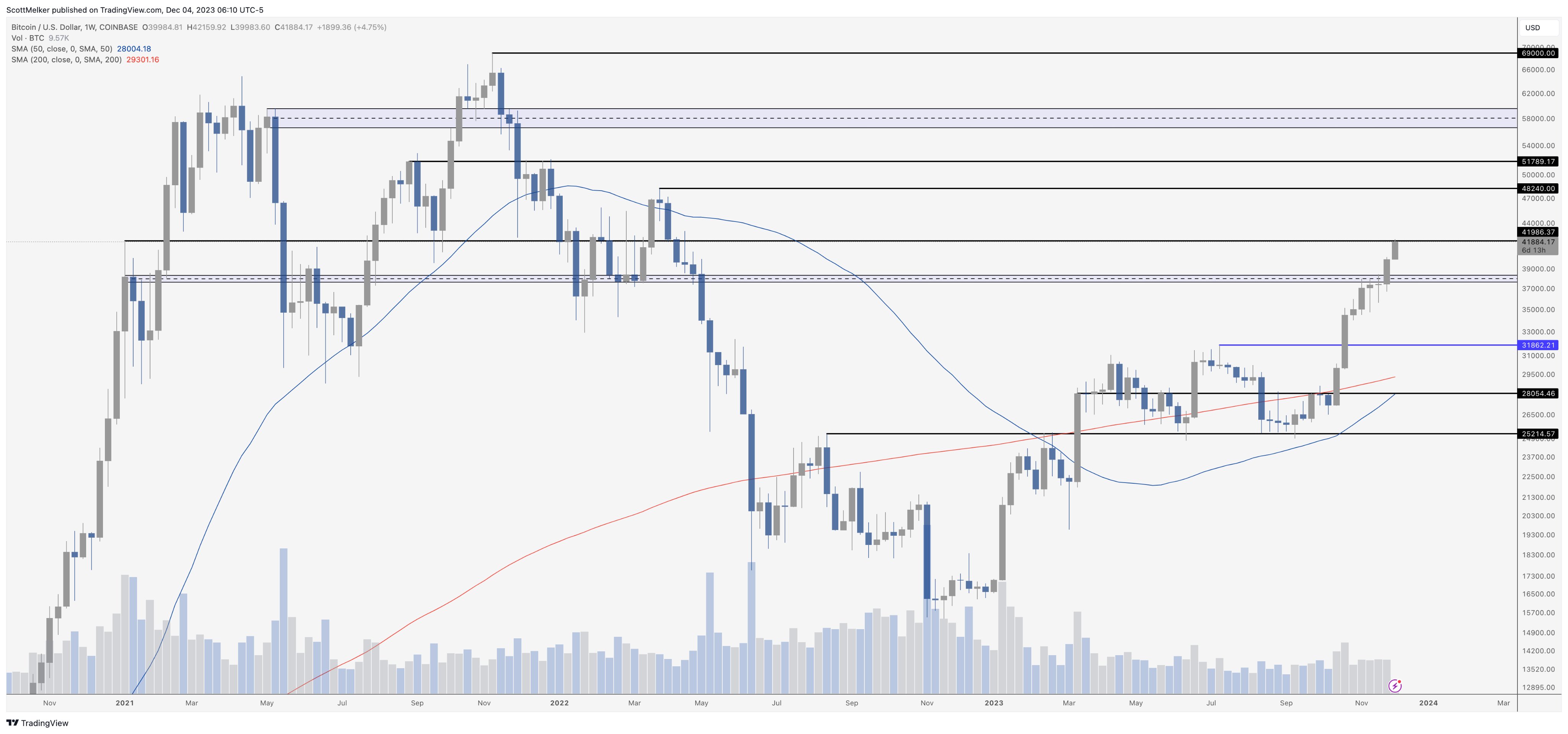

For Scott Melker, the dealer, analyst and podcast host who himself has witnessed the emergence of many such strains within the sand, these are as vital as ever.

“$42K is traditionally one of the crucial vital ranges for Bitcoin,” he told X subscribers on Dec. 4.

An accompanying chart mapped out the important thing worth factors to concentrate to, these variously appearing as magnets since their creation — some over two years in the past.

For example, $42,000 represents the preliminary rejection worth from early 2021, when BTC/USD rose sharply on information that electrical automobile producer Tesla had added Bitcoin to its steadiness sheet.

“It was the useless prime of the ‘Tesla’ pump in January of 2021, and acted as each help and resistance numerous occasions after,” Melker defined.

Elsewhere on the chart lie $31,860, $28,050 and $25,200 — all vital help and resistance ranges since their preliminary creation from 2021 onward.

To the upside, $48,240, $51,790 and, naturally, the all-time excessive of $69,000 function as psychologically pertinent resistance ranges for market sentiment.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.