Bitcoin miner Riot Platforms is shopping for 66,560 Bitcoin mining rigs from producer MicroBT, in certainly one of its largest orders of hash-rate within the agency’s historical past — forward of the Bitcoin halving scheduled for April 2024.

The extra buy settlement totaled $290.5 million, Riot stated in a Dec. 4 assertion — which means it paid a mean of $4,360 for every machine.

$Riot Workout routines Buy Possibility on 18 EH/s of Newest Technology Immersion Miners from MicroBT, and Secures Extra Buy Choices Offering a Path to Exceed 100 EH/s.

- Riot locations order for 18 EH/s of newest technology MicroBT Bitcoin miners, primarily consisting of the… pic.twitter.com/tEEudV6Z8n

— Riot Platforms, Inc. (@RiotPlatforms) December 4, 2023

The appropriate-to-purchase possibility was included in Riot’s preliminary settlement with MicroBT when it agreed to buy 33,280 machines from MicroBT in June. The 2 companies have now up to date this settlement to supply Riot with choices to buy as much as 265,000 extra miners from MicroBT on the identical phrases as the brand new order.

Riot’s CEO Jason Les mentioned the acquisition order is “the biggest order of hash charge” within the firm’s historical past and hopes the up to date settlement will allow Riot’s mining efficiency to strengthen additional.

Over 48,000 or 72% of the brand new machines might be MicroBT’s newest mannequin, the M66S, which has a hash charge of 250 terahashes per second (TH/s), whereas the remaining machines will encompass the M66 (14,770) and M56S++ (3,720) fashions, Riot famous.

Altogether, the 66,560 miners will add 18 exahashes per second (EH/s) to Riot’s operations.

Riot mentioned the primary 33,280 miners purchased in June will begin to deploy within the first quarter of 2024, whereas the most recent stack of 66,560 miners will deploy within the second half of 2024.

The agency estimates its self-mining hash charge capability to achieve 38 EH/s as soon as the 99,840 rigs are absolutely put in and working, which the primary expects within the second half of 2025.

The agency beforehand cited the upcoming Bitcoin halving event — scheduled for April 2024 — as one of many predominant causes behind its latest shopping for spree.

Riot’s inventory, tickered RIOT, elevated practically 9% on Dec. 4, according to Google Finance. It's now up over 345% so far in 2023.

Bitcoin miners improve manufacturing; Hut 8 Corp begins buying and selling

Bitcoin miner CleanSpark produced 666 BTC in November, up 5.2% from the 633 BTC it produced in October and up 24% from November 2022.

The agency’s CEO Zach Bradford mentioned the agency noticed a “vital improve” in manufacturing from charges, which he mentioned is probably going resulting from rising interest in Ordinals.

“This development means that charges may quickly turn out to be a bigger income as bitcoin’s use instances develop and adoption will increase,” Bradford added.

In November, $CLSK achieved our second-highest month-to-month #bitcoin manufacturing regardless of elevated issue and with out utilizing extra power.

*Month-to-month manufacturing: 666 (24% improve over similar interval final 12 months)

*Whole #BTC holdings: 2,575

*Month-end fleet #efficiency: 26.4 J/TH

*Every day… pic.twitter.com/i65AY2pskk— CleanSpark Inc. (@CleanSpark_Inc) December 1, 2023

In the meantime, NASDAQ-listed TeraWulf said it mined 323 BTC in November, up 3% from its October manufacturing. The agency mentioned a lot of this was pushed by increased community transaction charges however didn’t point out the affect of Ordinals.

Associated: Marathon, Riot among most overvalued Bitcoin mining stocks: Report

Hut 8 accomplished its merger with United States-based mining agency Bitcoin Corp on Nov. 30 to type Hut 8 Corp, which began buying and selling on the NASDAQ and Toronto Inventory Change (ticker: HUT) on Dec. 4.

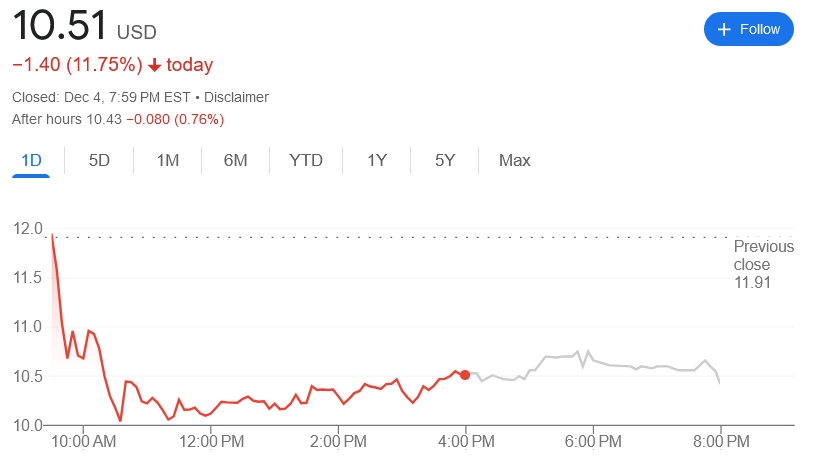

Nevertheless, the merged entity's alternate debut seemingly stumbled, falling 11.75% and seven.44% on the day, according to Google Finance.

Journal: Bitcoin 2023 in Miami comes to grips with ‘shitcoins on Bitcoin’