Bitcoin (BTC) has skilled a exceptional 15.7% worth surge within the first six days of December. This surge has been closely influenced by the anticipation of an imminent approval of a spot exchange-traded fund (ETF) in the USA. Senior Bloomberg ETF analysts have expressed a 90% probability for approval by the U.S. Securities and Change Fee, which is predicted earlier than Jan. 10.

Nonetheless, Bitcoin’s latest worth surge might not be as easy because it appears. Analysts have failed to think about the a number of rejections at $37,500 and $38,500 in the course of the second half of November. These rejections have left skilled merchants, together with market makers, questioning the market’s energy, notably from the attitude of derivatives metrics.

Bitcoin’s inherent volatility explains professional merchants’ diminished urge for food

Bitcoin’s 7.6% rally to $37,965 on Nov. 15 resulted in disappointment because the motion absolutely retracted the next day. Equally, between Nov. 20 and Nov. 21, Bitcoin's worth declined by 5.3% after the $37,500 resistance proved extra formidable than anticipated.

Whereas corrections are pure even throughout bullish markets, they clarify why whales and market makers are avoiding leveraged lengthy positions in these unstable situations. Surprisingly, regardless of constructive each day candles all through this era, consumers utilizing lengthy leverage had been forcefully liquidated, with losses totaling a staggering $390 million up to now 5 days.

Though the Bitcoin futures premium on the Chicago Mercantile Change (CME) reached its highest level in two years, indicating extreme demand for lengthy positions, this development would not essentially apply to all exchanges and consumer profiles. In some circumstances, high merchants have diminished their long-to-short leverage ratio to the bottom ranges seen in 30 days. This means a profit-taking motion and diminished demand for bullish bets above $40,000.

By consolidating positions throughout perpetual and quarterly futures contracts, a clearer perception could be gained into whether or not skilled merchants are leaning towards a bullish or bearish stance.

Beginning on Dec. 1, OKX's high merchants favored lengthy positions with a powerful 3.8 ratio. Nonetheless, as the value surged above $40,000, these lengthy positions had been closed. Presently, the ratio closely favors shorts by 38%, marking the bottom degree in over 30 days. This shift means that some important gamers have stepped again from the present rally.

Nonetheless, the complete market would not share this sentiment. Binance's high merchants have proven an opposing motion. On Dec. 1, their ratio favored longs by 16%, which has since elevated to a 29% place skewed in direction of the bullish aspect. Nonetheless, the absence of leveraged longs amongst high merchants is a constructive signal, confirming that the rally has primarily been pushed by spot market accumulation.

Associated: Canadian crypto exchanges reach $1B in assets under management

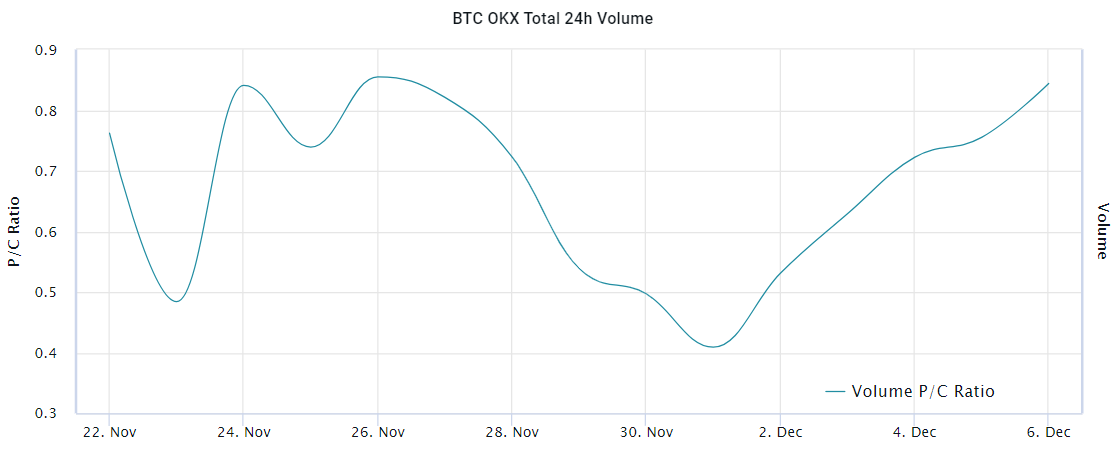

Choices information confirms that some whales will not be shopping for into the rally

To find out whether or not merchants had been caught off-guard and at the moment maintain brief positions underwater, analysts ought to study the steadiness between name (purchase) and put (promote) choices. A rising demand for put choices usually signifies merchants specializing in neutral-to-bearish worth methods.

Knowledge from Bitcoin choices at OKX reveals an rising demand for places relative to calls. This implies that these whales and market makers won't have anticipated the value rally. Nonetheless, merchants weren't betting on a worth decline because the indicator favored the decision choices by way of quantity. An extra demand for put (promote) choices would have moved the metric above 1.0.

Bitcoin's rally towards $44,000 seems wholesome, as no extreme leverage has been deployed. Nonetheless, some important gamers had been taken abruptly, lowering their leverage longs and exhibiting elevated demand for put choices concurrently.

As Bitcoin's worth stays above $42,000 in anticipation of a possible spot ETF approval in early January, the incentives for bulls to stress these whales who selected to not take part within the latest rally develop stronger.

This text is for common data functions and isn't supposed to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don't essentially mirror or signify the views and opinions of Cointelegraph.