Bitcoin (BTC) closed final week with features of 9.55%, however began the brand new week on a weak observe, falling close to $40,500. The sharp correction in Bitcoin additionally triggered liquidations in a number of altcoins. In response to CoinGlass information, cross-crypto lengthy liquidations for Dec. 11 have been greater than $300 million.

The sharp fall doesn't change the development in Bitcoin and altcoins, as corrections are an element and parcel of any uptrend. Usually, vertical rallies are adopted by sharp pullbacks, which shake out the weaker palms and permit long-term buyers to purchase extra at decrease ranges.

The corrections are unlikely to stretch longer as a result of a number of bullish catalysts in 2024. Analysts count on a number of Bitcoin exchange-traded funds to obtain regulatory approval in January, which may very well be a sport changer. That will likely be adopted by Bitcoin halving in April, and at last, expectations of a price lower by the US Federal Reserve may enhance dangerous property. Goldman Sachs anticipates the Fed to start cutting rates within the third quarter of 2024.

What are the essential ranges that would arrest the autumn in Bitcoin and altcoins? Let’s analyze the charts to search out out.

S&P 500 Index worth evaluation

The bulls have efficiently held the S&P 500 Index (SPX) above the breakout stage of 4,541 for the previous a number of days. This means that the consumers are attempting to flip the extent into help.

The upsloping 20-day exponential shifting common (4,531) and the relative power index (RSI) close to the overbought zone point out that the trail of least resistance is to the upside. If consumers pierce the overhead resistance at 4,650, the index may choose up momentum and surge to 4,800.

This bullish view will likely be invalidated within the close to time period if the value turns down and plunges under the 20-day EMA. That may point out aggressive promoting at greater ranges. The index might then tumble to the 50-day easy shifting common (4,393).

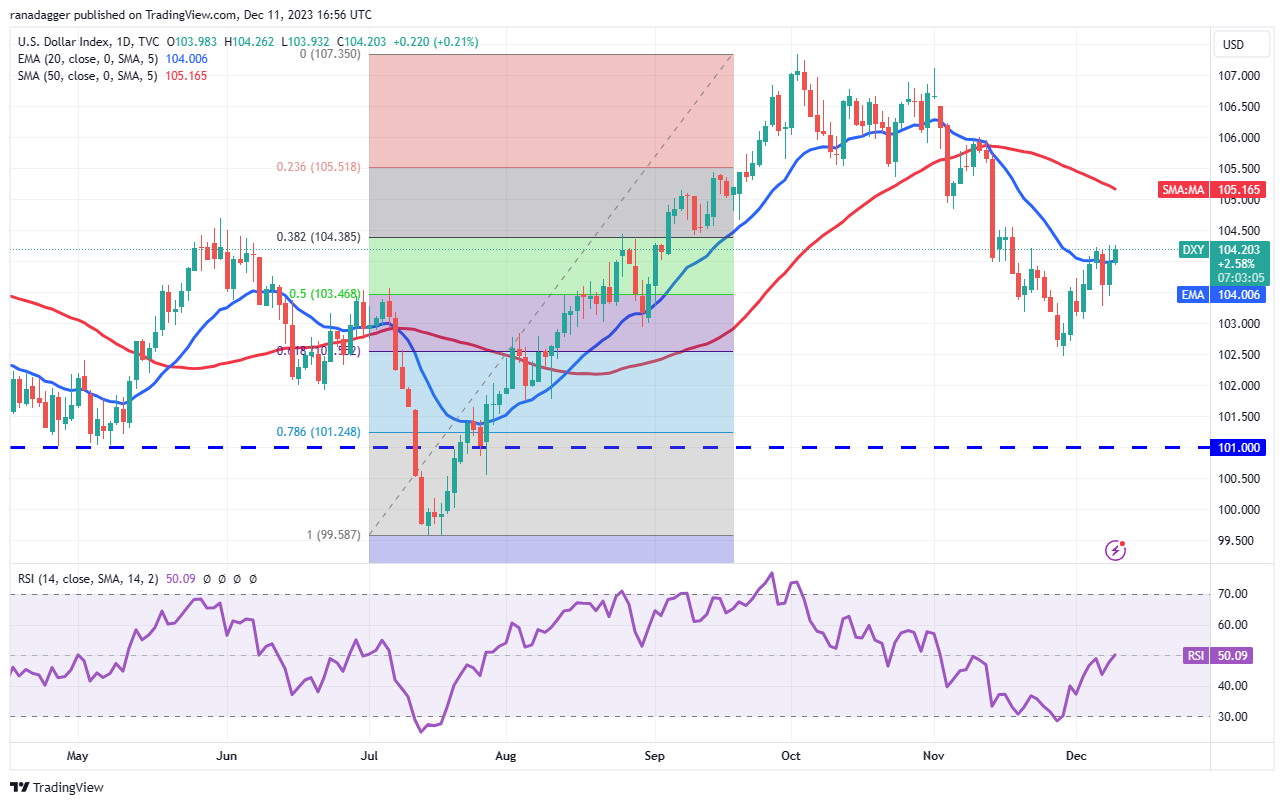

U.S. Greenback Index worth evaluation

The U.S. Greenback Index (DXY) bounced off the 61.8% Fibonacci retracement stage of 102.55 on Nov. 29, indicating shopping for at decrease ranges.

The aid rally has reached the 20-day EMA (104), the place the bears are mounting a stiff protection. A minor constructive in favor of the bulls is that they haven't allowed the value to dip a lot under the 20-day EMA.

There's a minor resistance at 104.50, but when this stage is scaled, the index may rise to the 50-day SMA (105). The flattening 20-day EMA and the RSI close to the midpoint recommend a variety formation within the close to time period. The sturdy help on the draw back is at 102.46.

Bitcoin worth evaluation

Bitcoin’s tight consolidation close to $44,700 resolved to the draw back on Dec. 11. The failure to renew the up-move might have attracted promoting by the merchants.

A minor constructive in favor of the bulls is that the value rebounded off the 20-day EMA ($40,708), as seen from the lengthy tail on the candlestick. Patrons will as soon as once more attempt to shove the BTC/USDT pair above $44,700, however the bears might not hand over simply. The destructive divergence on the RSI cautions that the bullish momentum is slowing down.

If the value skids under the 20-day EMA, the correction may deepen to the breakout stage of $37,980. This stage is more likely to entice strong shopping for by the bulls. On the upside, a break and shut above $44,700 will point out that the bulls are again within the driver’s seat.

Ether worth evaluation

Ether (ETH) turned down from $2,403 on Dec. 9 and plunged under the breakout stage of $2,200 on Dec. 11. This means that the bulls are speeding to the exit.

The worth motion of the previous few days has shaped a destructive divergence on the RSI, indicating that the bullish momentum is weakening. Nonetheless, the bulls are attempting to vigorously defend the 20-day EMA ($2,186).

If the value bounces off the present stage, the bulls will once more attempt to resume the uptrend by pushing the ETH/USDT pair above $2,403. In the event that they try this, the pair may rally to $2,500 and later to $3,000.

This optimistic view will likely be invalidated if the value closes under the 20-day EMA. Which will deepen the correction to the 50-day SMA ($2,012).

BNB worth evaluation

BNB (BNB) witnessed an outside-day candlestick sample on Dec. 11, indicating a troublesome battle between the bulls and the bears.

The lengthy tail on the day’s candlestick reveals aggressive shopping for at decrease ranges. If the value maintains above $239.2, the BNB/USDT pair is more likely to choose up momentum and soar to $265. This stage might show to be a troublesome hurdle to cross, but when the consumers succeed, the pair will full a bullish inverse head-and-shoulders sample.

The development will flip in favor of the bears in the event that they sink and maintain the value under $223. The pair might then stoop to the pivotal help at $203.

XRP worth evaluation

XRP (XRP) rose above the $0.67 resistance on Dec. 8, however the bulls couldn't construct upon this breakout on Dec. 9. This means promoting at greater ranges.

The bulls once more tried to drive the value above $0.67 on Dec. 10, however the bears held their floor. This began a pointy pullback, which dipped under the 50-day SMA ($0.62) on Dec. 11. If the value closes under the 50-day SMA, the XRP/USDT pair may drop to the essential help at $0.56.

If the value rises from the present stage, it'll sign shopping for on dips. The bulls will then once more attempt to overcome the impediment at $0.67. In the event that they try this, the pair might journey to $0.74, the place the bears are anticipated to mount a robust protection.

Solana worth evaluation

Solana (SOL) is dealing with promoting on the overhead hurdle of $78. The failure to scale this stage might have began the pullback on Dec. 11.

The SOL/USDT pair is discovering help on the 20-day EMA ($63), indicating that decrease ranges proceed to draw consumers. If bulls maintain the rebound, the pair may retest the excessive at $78. A break and shut above this stage may open the doorways for a possible rally to the psychological stage of $100.

If bears wish to forestall the rally, they must drag the value under the 20-day EMA. Which will begin a deeper correction towards the essential help at $51.

Associated: Is the Bitcoin price dip toward $40K a bear trap?

Cardano worth evaluation

Patrons pushed Cardano (ADA) above the overhead resistance of $0.60 on Dec. 9 and 10, however they might not keep the upper ranges.

The up-move of the previous few days propelled the RSI deep into the overbought zone, indicating that the rally was overextended within the close to time period. Which will have tempted short-term bulls to ebook out on their positions, which began the pullback on Dec. 11.

The ADA/USDT pair is looking for help on the 50% Fibonacci retracement stage of $0.51. If the extent holds, consumers will once more attempt to push the value to the native excessive at $0.65. Then again, a break under $0.51 may sink the pair to the 20-day EMA ($0.45).

Dogecoin worth evaluation

The bears are posing a robust problem to Dogecoin’s (DOGE) rally at $0.11, as seen from the lengthy wick on the Dec. 11 candlestick.

The worth can pull right down to the 20-day EMA ($0.09), which is a vital stage to be careful for. A powerful bounce off the 20-day EMA will recommend that the sentiment stays constructive and merchants are shopping for the dips. That will increase the potential of a break above $0.11. If that occurs, the DOGE/USDT pair might soar to $0.15.

Quite the opposite, a drop under the 20-day EMA will recommend that merchants are aggressively reserving income. The pair might then lengthen the decline to the 50-day SMA ($0.08).

Avalanche worth evaluation

Avalanche (AVAX) has been in a robust uptrend for the previous a number of days. Patrons simply cleared the barrier at $31 on Dec. 9 and reached $38 on Dec. 10.

The vertical rally pushed the RSI deep into the overbought territory, signaling {that a} correction or consolidation is feasible within the close to time period. The worth pulled again on Dec. 11, indicating that the short-term merchants could also be reserving income.

If consumers don't enable the value to slide under $31, it'll improve the probability of a rally above $38. The AVAX/USDT pair may climb to $46 and later to $50. As a substitute, if the value turns down and plummets under $31, it'll recommend the beginning of a deeper correction to the 20-day EMA ($25.85).

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.