Bitcoin (BTC) speculators panic bought because the BTC value corrected towards $40,000, the most recent on-chain knowledge suggests.

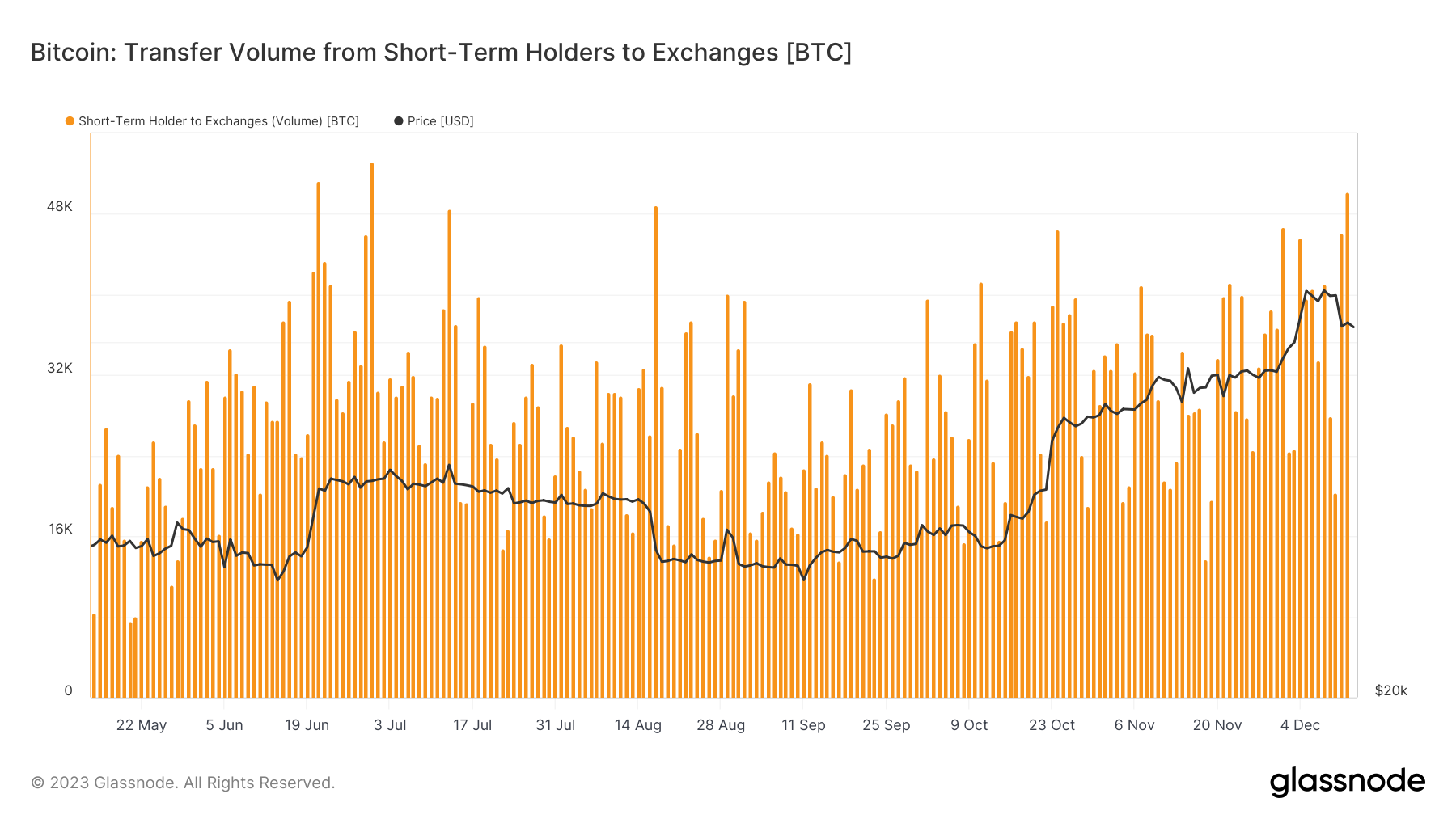

Figures from on-chain analytics agency Glassnode present short-term holders (STHs) offloading greater than $2 billion in BTC on Dec. 12 alone.

Bitcoin short-term holders set 18-month promoting file

Bitcoin noticed its biggest single-day drop of 2023 this week — one which at one level totaled 8.1%, knowledge from Cointelegraph Markets Pro and TradingView confirms.

Reacting, the extra speculative subsection of the Bitcoin investor base adopted in step, decreasing their publicity in what seems to be a bout of chilly toes available on the market outlook.

Glassnode reveals that STHs, which represent entities holding BTC for 155 days or much less, despatched $1.93 billion price of cash to exchanges on Dec. 11, adopted by one other $2.08 billion the day after.

Each days mark long-term highs by way of STH promoting strain, with entities each in revenue and loss becoming a member of the pattern.

The final time single-day promoting handed the $2 billion mark was in June 2022 — a response to the impending collapse of blockchain agency Celsius.

In a post on X (previously Twitter) on Dec. 12, James Van Straten, analysis and knowledge analyst at crypto insights agency CryptoSlate, famous the importance of the week’s STH actions.

“$2B in complete, with $1.1B in loss,” a part of his commentary said.

“That's for anybody who purchased between Dec. 6 and Dec. 13, almost definitely retail, after seeing Bitcoin up 150% YTD.”

In BTC phrases, volumes have been much less sizable, with the Dec. 12 tally marking the most important for the reason that begin of July this 12 months. On the time, BTC/USD was contemporary from a rebound above the $30,000 mark after dipping to $25,000.

Mayer A number of exhibits basic resistance looms

Persevering with, Glassnode flagged a number of on-chain indicators suggesting that STHs might have had their fill of the bull mark in the intervening time.

Associated: ‘Take some rest and GO’ — Bitcoin price copies 2020 bull run fractal

Revenue-taking round this month’s 19-month highs close to $45,000 was “significant,” researchers mentioned, including that “potential saturation of demand (exhaustion) could also be in play.”

“After such a strong 2023 to this point, this rally particularly appears to have met resistance, with on-chain knowledge suggesting STHs are a key driver,” they wrote in a part of a conclusion to the agency’s newest weekly e-newsletter, “The Week On-Chain,” launched Dec. 12.

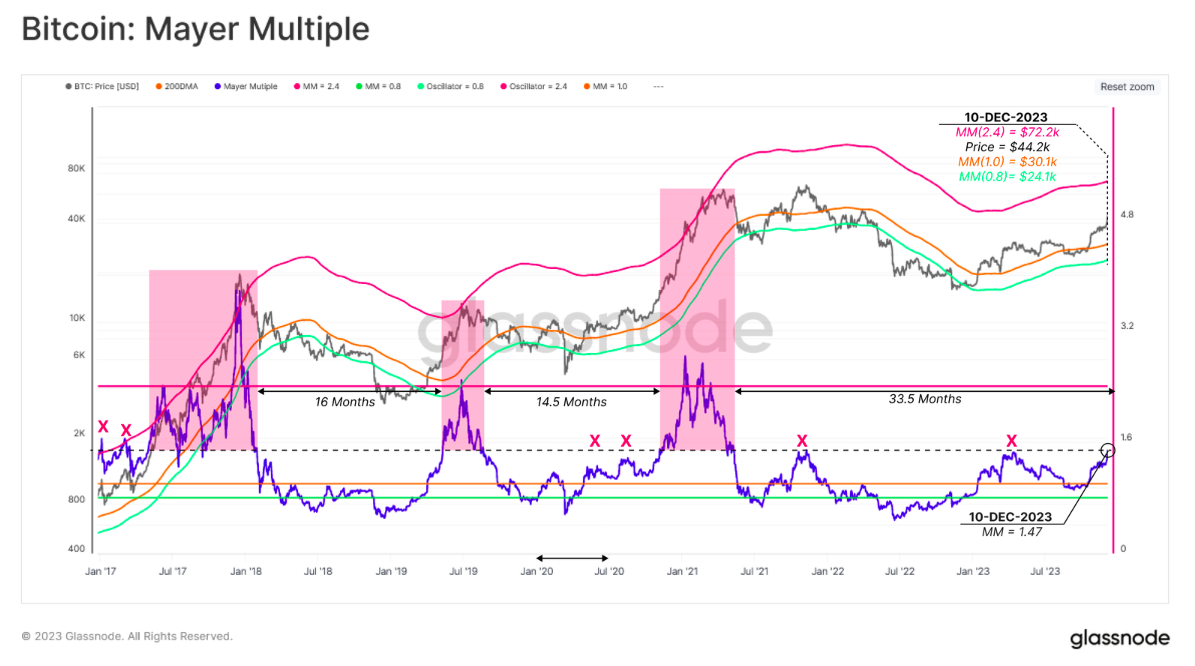

Among the many indicators featured was the Mayer A number of, which describes the connection of present spot value relative to its 200-week shifting common.

The A number of is quick coming as much as 1.5 — an space which, whereas not "overbought," has acted as bull market resistance throughout Bitcoin's historical past.

"The current worth of the Mayer A number of indicator is at 1.47, near the ~1.5 degree which regularly varieties a degree of resistance in prior cycles, together with the Nov 2021 ATH," Glassnode defined.

"Maybe as an indicator for the severity of the 2021-22 bear market, it has been 33.5-months since this degree was breached, the longest interval for the reason that 2013-16 bear."

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.