[ad_1]

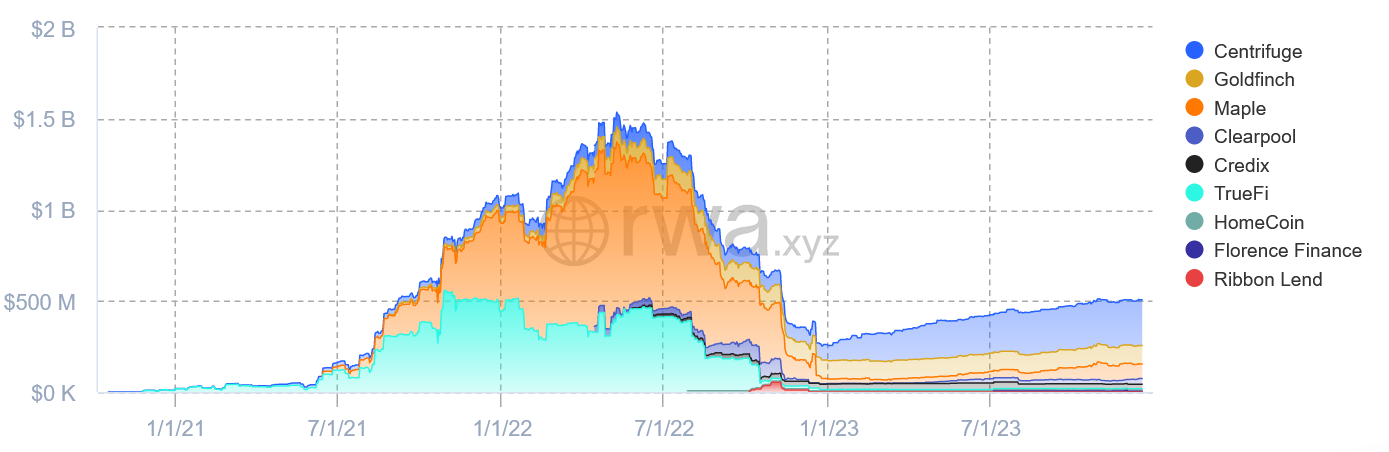

Blockchain-based lending is regaining momentum this 12 months, with the worth of energetic tokenized personal credit score now sitting at $582 million — a staggering 128% improve from a 12 months in the past.

Whereas nonetheless far off from its peak of $1.5 billion in June 2022, according to knowledge from real-world asset mortgage tracker RWA.xyz, the resurgence may sign that loan-seekers are searching for blockchain-based alternatives to conventional financiers amid a current rise in rates of interest.

The present common share charge is 9.64% for blockchain-based credit score protocols, whereas financiers have been providing small enterprise financial institution mortgage rates of interest between 5.75% and 11.91%, according to a Dec. 1 report by NerdWallet.

The loans being taken out aren’t small both. RWA.xyz has tracked $4.5 billion in blockchain-based loans throughout 1,804 offers, which suggests the typical mortgage comes out at about $2.5 million.

Some of the noteworthy loan-seekers of late is United Kingdom-based asset administration agency Fasanara Capital, which took out a $38.3 million mortgage from Clearpool at a sub-7% base APY.

Brazilian financial institution Divibank is one other monetary establishment taking part available in the market.

Ethereum-based Centrifuge owns over 43% of the current active loans market with $255 million, up 203% from $84 million at the beginning of 2023.

Goldfinch and Maple are the second and third largest blockchain credit score protocols, with $143 million and $103 million in energetic loans, respectively.

United States dollar-pegged stablecoins Tether (USDT), USD Coin (USDC) and Dai (DAI) are three of the principle cryptocurrencies used to facilitate these loans.

Associated: Making crypto lending mainstream: How this platform breaks DeFi barriers

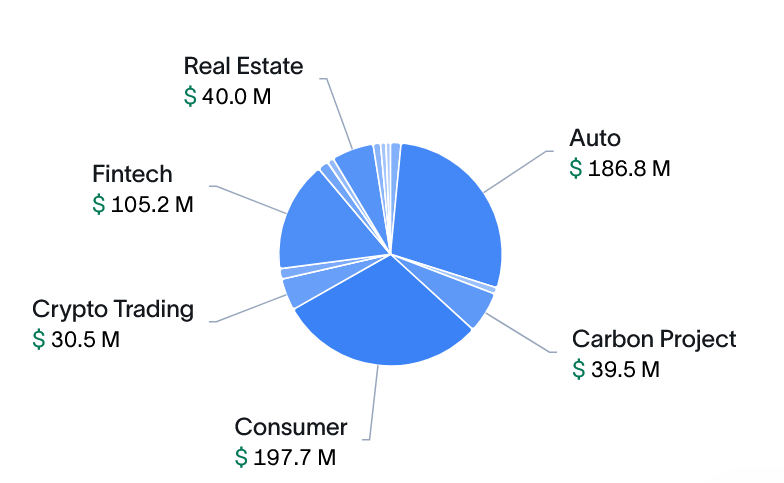

The biggest blockchain-based loan-seekers come from the patron ($197.7 million) and automotive ($186.8 million) sectors, adopted by fintech, actual property, carbon credit score and cryptocurrency buying and selling, the information exhibits.

Regardless of the current rise, the $506 million energetic mortgage market is about 0.3% the scale of the $1.6 trillion conventional personal credit score market.

Acquiring loans from blockchain-based protocols does, nonetheless, include dangers. Mortgage-seekers ought to weigh insolvency, collateralization, sensible contracts and different safety dangers earlier than borrowing.

Journal: Home loans using crypto as collateral: Do the risks outweigh the reward?

[ad_2]

Source link