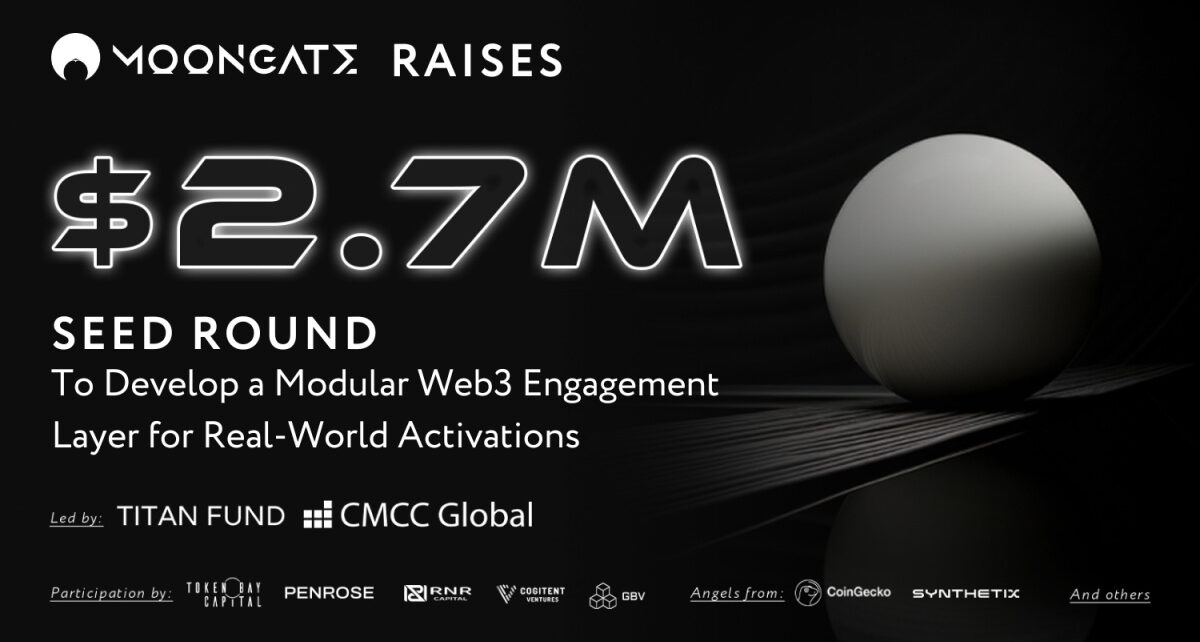

[ad_1] AdvertismentHong Kong, Hong Kong, April 2nd, 2024, Chainwire Moongate broadcasts the closing of a $2.7M Seed spherical to develop a Modular Web3 Engagement Layer for Actual-World Activations. Backed by its success in disrupting the ticketing business, the corporate goals to broaden its attain into different sectors to rework interactive experiences utilizing blockchain and AI. The funding spherical was led by CMCC World’s Titan Fund, with participation from Token Bay

[ad_1] Tether, one of many main stablecoin issuers, has introduced the completion of a System and Organization Controls 2 (SOC 2) audit, marking the best stage of safety compliance achievable for a company. This unbiased audit, developed by the American Institute of Licensed Public Accountants (AICPA), highlights Tether’s dedication to making sure a safe person expertise. Paolo Ardoino, CEO of Tether, emphasised the importance of this compliance measure in assuring

[ad_1] Coinbase and Circle, two outstanding gamers within the cryptocurrency business, are contesting features of a proposal from the Basel Committee on Banking Supervision that goals to introduce stricter standards for the regulatory therapy of stablecoins held by banks. The committee’s session doc, launched in December, outlines necessities for stablecoins to qualify for preferential regulatory therapy underneath a “Group 1b class.” These necessities embrace sustaining low volatility and sufficient liquidity.

[ad_1] Bitkub Capital Group Holdings, the mother or father firm of Thailand’s main cryptocurrency alternate, is ramping up its workforce because it prepares for its anticipated preliminary public providing (IPO) on the Inventory Alternate of Thailand (SET) in 2025. CEO Jirayut Srupsrisopa revealed to Bloomberg on April 1 that Bitkub is actively searching for monetary advisors to help its IPO itemizing, aiming to safe new capital and improve its market

[ad_1] XRP’s worth is witnessing a decline at present, following the broader pattern within the crypto market. At the moment, down by over 5.5% to $0.59, it continues its unstable buying and selling sample seen in latest days. The present dip in XRP’s worth displays a retracement that commenced in March after reaching a peak of $0.74. Since then, it has decreased by roughly 18.5%, with a number of components

[ad_1] Chainage, a decentralized finance (DeFi) hub with roughly $100 million in whole worth locked, is pursuing a $13 million capital increase for protocol enlargement, topic to approval from its tokenholders inside its native decentralized autonomous group (DAO). In a snapshot proposal dated April 1, Chainage outlined plans for the $13 million increase, led by an undisclosed enterprise capital agency. This increase would contain the issuance of fifty million extra

[ad_1] Telegram has rolled out a brand new characteristic permitting customers to purchase channel ads utilizing Toncoin, as introduced over the weekend. This replace is a part of the messaging app’s newest initiative for consumer monetization, whereby 50% of the income generated from advertisements displayed in public Telegram channels will probably be distributed to their respective homeowners. In line with Telegram, customers can now promote their channels by spending as

[ad_1] In line with a be aware from TD Cowen, Home Republicans’ efforts to move an anti-central financial institution digital forex (CBDC) invoice may disrupt bipartisan backing for a stablecoin invoice. The CBDC Anti-Surveillance State Act, launched by Home Majority Whip Tom Emmer, goals to forestall the Federal Reserve from straight issuing a CBDC to people. Regardless of the invoice’s development from the Home Monetary Companies Committee in September, it

[ad_1] After experiencing record outflows of almost $1 billion only a week prior, crypto-based funding merchandise made a big turnaround, with roughly $900 million in internet inflows reported, in line with information from CoinShares. CoinShares analyst James Butterfill disclosed that crypto-based funding automobiles collectively noticed a outstanding rebound final week, accumulating $862 million in internet inflows. This resurgence follows a difficult interval when funds managed by distinguished asset managers like

[ad_1] Binance Holdings Ltd. has not too long ago shaped a board of administrators, a big transfer amidst a interval marked by modifications and challenges, as reported by Bloomberg Information. The board includes seven members, together with CEO Richard Teng and three different firm executives: Heina Chen, Jinkai He, and Lilai Wang. Moreover, three exterior members be part of the board: Gabriel Abed, Arnaud Ventura, and Xin Wang, in accordance