Bitcoin's (BTC) worth dropped to a brand new yearly low of $78,258 on Feb. 27, main some analysts to counsel that the cryptocurrency is now in an optimum buying zone.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

Bitcoin’s 60-day RCV hints at low-risk accumulation

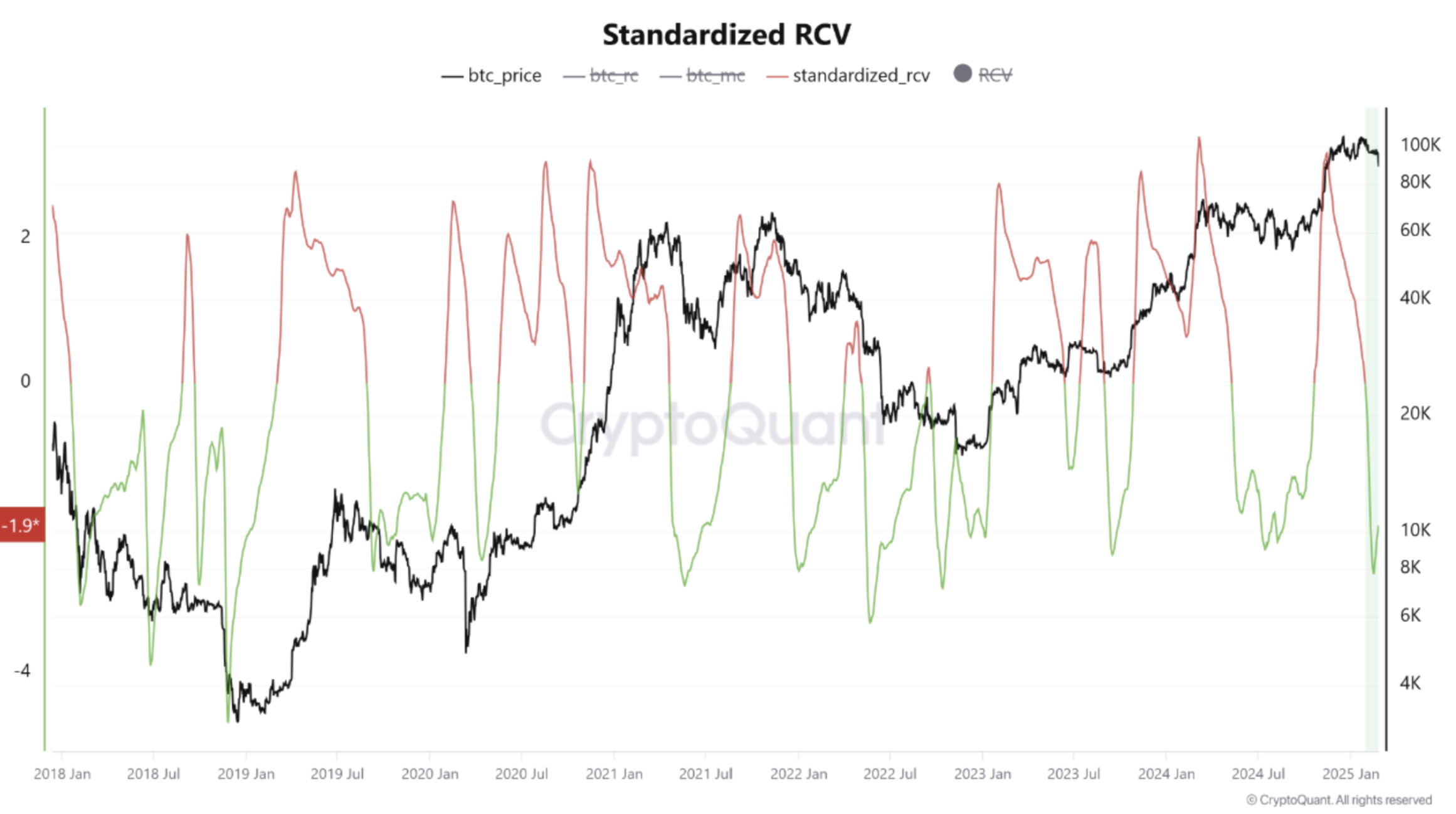

Crazzyblock, a Bitcoin dealer and verified analyst on CryptoQuant said that Bitcoin’s 60-day RCV reached its lowest degree of -1.9 within the chart, signaling an ‘optimum DCA alternative’ for the primary time since July 2024.

Bitcoin 60-day RCV chart. Supply: CryptoQuant

The 60-day realized worth to market capitalization variance (RCV) is a metric that calculates the 60-day rolling common and customary deviation of BTC worth. In line with the metric, each time the RCV worth is beneath 0.30, it signifies a low-risk funding within the asset. A worth between 0.30-0.50 implies a impartial setting, and above 0.5 means a excessive sell-off danger.

The analyst pointed out that the metric has been traditionally correct in figuring out undervaluation and overvaluation traits for BTC, and the present normalized RCV worth presents a positive shopping for alternative based mostly on “historic risk-reward dynamics.” The BTC proponent added,

“Lengthy-term traders ought to think about scaling into BTC positions by way of a DCA technique as risk-adjusted circumstances stay optimum.”

In 2024, the RCV worth flashed a DCA sign between Might and July, the place Bitcoin fluctuated between $70,000 and $50,000. Thus, it's important to notice that the RCV doesn't sign a backside however highlights the low-risk, excessive likelihood of constructing positive factors in the long run.

Crypto analyst Yonsei Dent pointed out that Bitcoin’s short-term holder SOPR (Spent Output Revenue Ratio), which screens realized revenue or losses, had reached a pointy deviation beneath the decrease Bolling Band.

Bitcoin SOPR vary deviation information. Supply: CryptoQuant

Based mostly on such deviations, BTC has registered a short-term rebound between 8%-42%, with recoveries additionally evident throughout the 2022 bear market.

Related: How low can the Bitcoin price go?

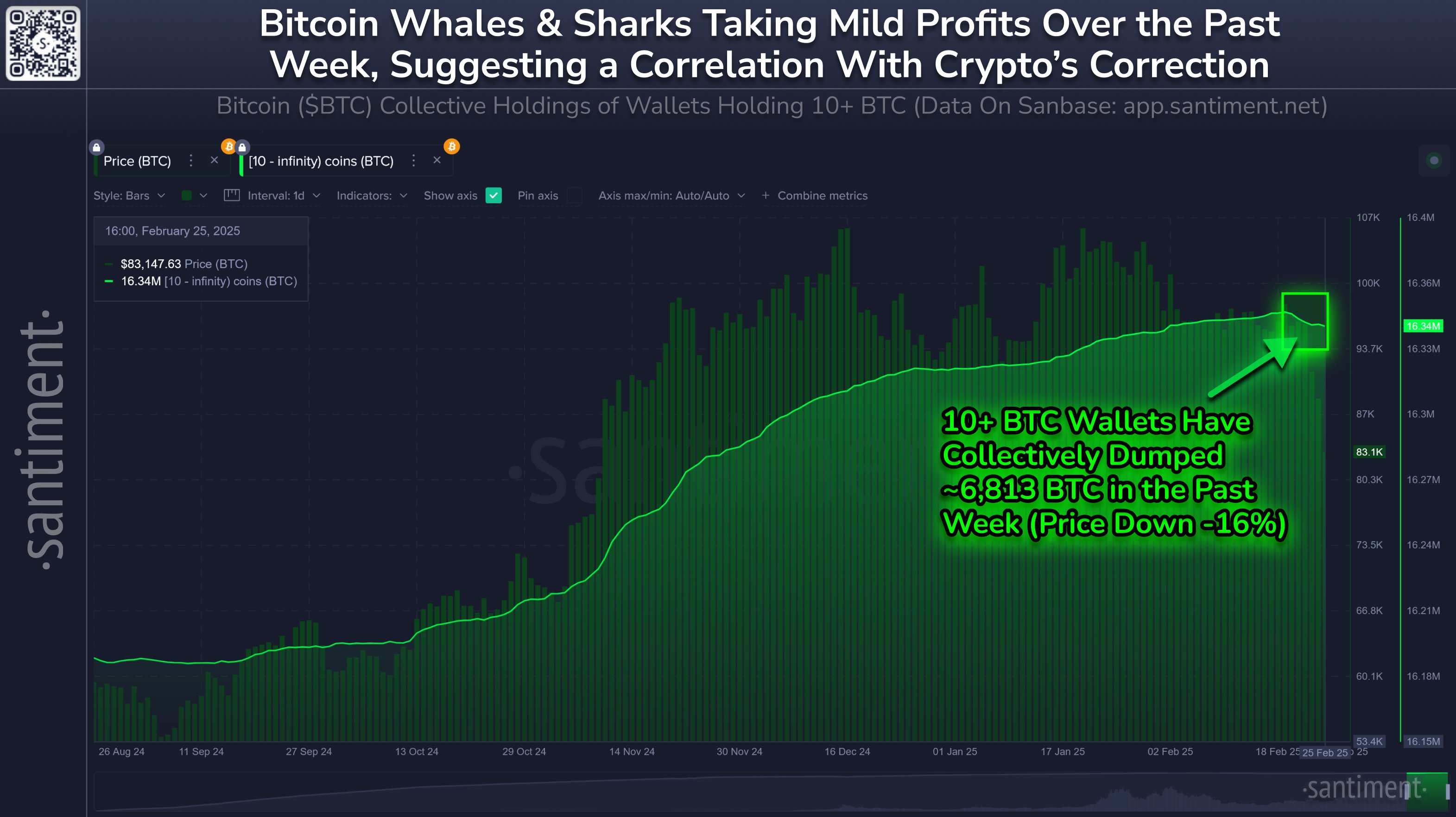

Bitcoin wallets with 10+ BTC dump 6,813 cash

Information from Santiment means that BTC’s worth has been correlated with the buildup and distribution habits of wallets holding 10+ BTC. Each time these addresses accumulate, Bitcoin progressively will increase in worth.

Bitcoin whales and sharks accumulation chart by Santiment. Supply: X.com

Santiment additionally highlighted that the “key stakeholders” have dumped roughly 6,813 BTC over the previous week, its most intensive distribution since July 2024.

Equally, Ki-Younger Ju pointed out that Bitcoin’s spot ETF demand is weak, suggesting {that a} “worth restoration may take a while.”

Related: Is BTC price about to fill a $78K Bitcoin futures gap?

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.