The Bitcoin sell-off, which dominated a majority of the weak, seems to be easing off, with BTC value making a restoration again within the $80,000 vary to achieve an intra-day excessive at $85,120.

Some merchants imagine that Bitcoin (BTC) was overdue for a bounce, given how deeply oversold a few of its technical indicators had turn into. These holding that perception warn that after bids are crammed close to the latest lows, if new consumers fail to maintain the momentum or negative macroeconomic newsflow resumes, BTC is more likely to revisit its latest lows.

HighStrike head of choices and crypto buying and selling JJ took a distinct view, noting that “Coinbase spot bids” had been “crammed,” representing the “first flip of bids outweighing asks now for the reason that September backside at $52,000.”

Bitcoin bids at Coinbase crammed. Supply: JJ the Janitor

Whatever the short-term value motion from Bitcoin, many analysts proceed to say that historic information highlights the latest drawdown as a main buying alternative.

On X, Wintermute dealer Jake O said,

“For anybody with long-term conviction within the house, the present disconnect between positioning/sentiment vs fundamentals has by no means regarded higher. The setup feels much like August 2024 as spot dipped beneath $50K on mass liquidations and I do suppose we’ll see massive topside buying and selling over the subsequent few periods.”

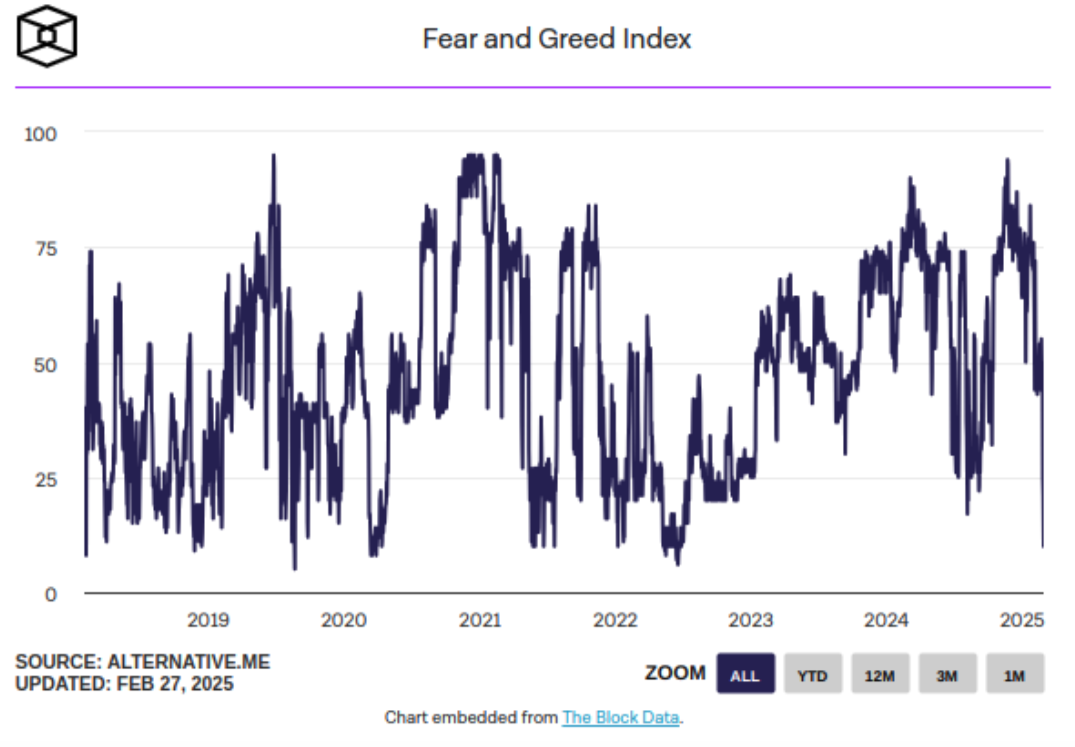

Crypto Worry & Greed Index. Supply: Jake O / X

Associated: Bitcoin rebounds to $84K — Analysts say BTC crash was ultimate buy signal

From a technical perspective, chartered market analyst Aksel Kibar described Bitcoin’s sweep of the $78,000 stage as a “sharp retest” however declined to say whether or not a value backside had been achieved.

Bitcoin 1-day chart. Supply: A

Momentum and technical merchants ought to notice that Bitcoin day by day RSI stays in deeply oversold territory, and regardless of the energy of as we speak’s rebound, the day by day candlestick sample of decrease highs and decrease lows. Failure to determine a day by day shut candlestick that generates the next excessive may very well be an early signal that the downtrend will not be but full.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.