Ethereum’s native token, Ether (ETH), posted a brand new yearly low at $2,070, which can be the bottom since Jan. 1, 2024. The second-biggest cryptocurrency dropped 7.40% on Feb. 28, leading to over $200 million in liquidations over the previous 24 hours.

Ethereum1-day chart. Supply: Cointelegraph/TradingView

With ETH value now testing two-year lows, 0xLouisT, a crypto funding supervisor, says that Ether’s social sentiment is “at its lowest prior to now 12 months”.

Ethereum’s weekly shut nears 2-year lows

Ether value is down 24.50% prior to now seven days, its worst weekly turnover since 2022. A weekly shut under $2,300 will mark its lowest since November 2023, a two-year low.

Ethereum weekly chart. Supply: Cointelegraph/TradingView

As illustrated within the chart, the highest altcoin can be set to shut under its 200-weekly exponential transferring common (EMA). The 200-weekly EMA indicator has intently tracked Ethereum’s backside vary.

Since 2020, ETH/USD has closed underneath the 200-weekly EMA degree for less than 39 weeks out of a potential 268, solely 14.55% of the time.

Related: Why is the crypto market down today?

Thus, primarily based on historic tendencies, Ethereum may reclaim a place above the EMA degree inside a number of weeks.

Nevertheless, a double-top sample threatens the bulls. The 7-day chart additionally exhibits a double-top sample taking form over the previous 12 months. A detailed underneath $2,100 will validate the neckline, and any correction underneath $2,000 will increase the prospect of one other 28% to the following help at $1,500.

Ethereum 1-weekly chart. Supply: Cointelegraph/TradingView

Jason Pizzino, a crypto investor, additionally mentions that Ethereum might be “in additional hassle” if it closes underneath $2,000-$2,1000. Thus, ETH should stay above $2,000 to invalidate this double-top sample on the charts.

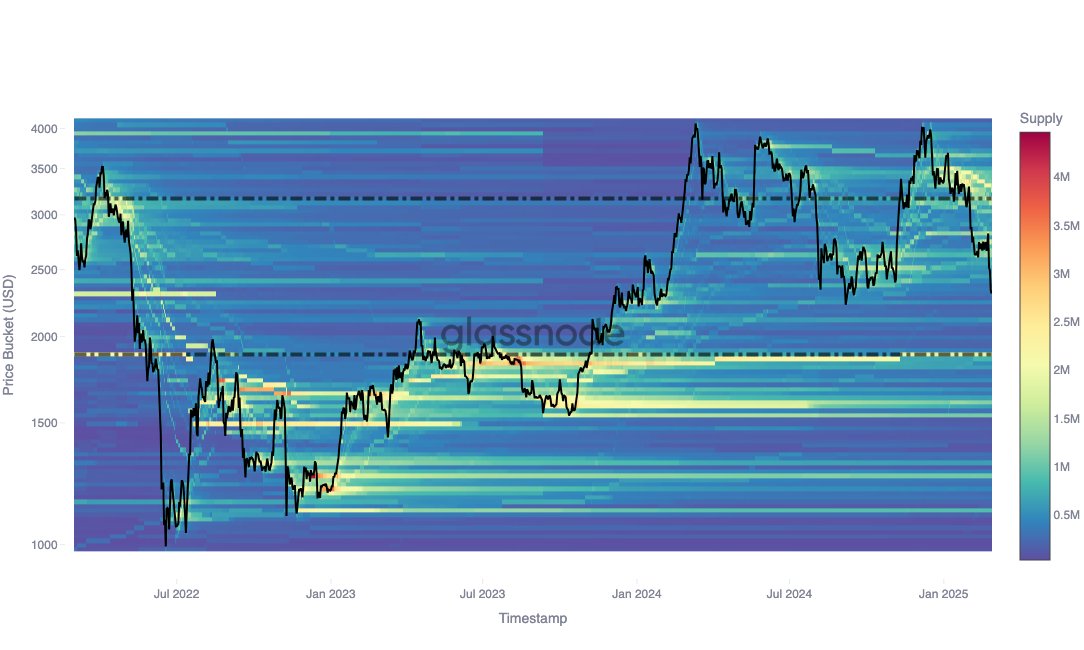

Ethereum cost-basis distribution value at $1.9K

Though Ether should keep above $2,000 to stop additional decline, Glassnode information indicates that the cost-basis distribution value is decrease at $1,890.

Ethereum cost-basis distribution value. Supply: X.com

The associated fee foundation distribution (CBD) value of an asset isn’t a single mounted quantity however a spread of costs reflecting when the ETH final moved onchain. A $1,890 CBD value signifies that Ether might retest this worth if value weak spot persists.

Related: Brutal 20% Ethereum price sell-off is not over, but is there a silver lining for ETH?

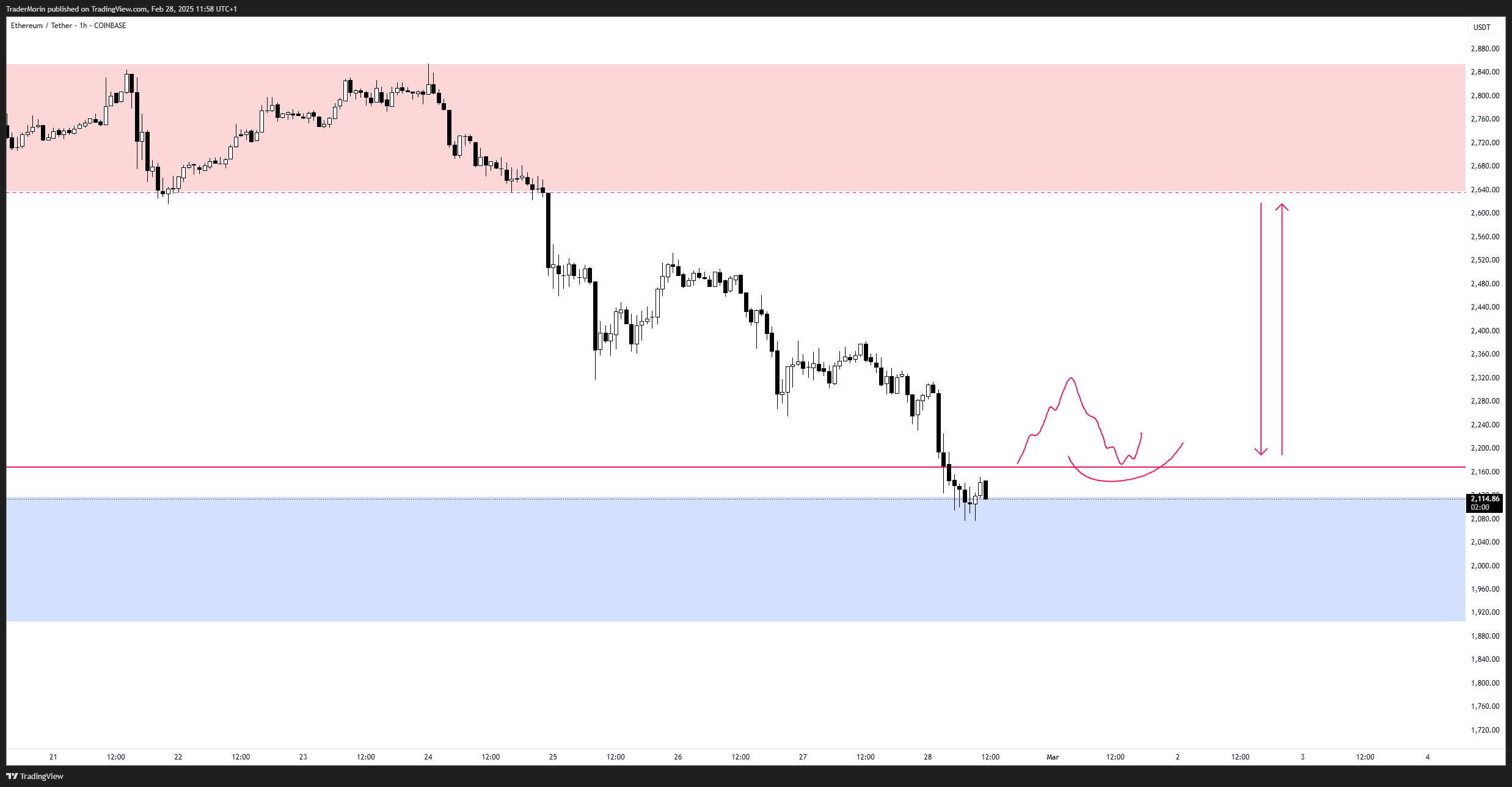

Morin, a crypto dealer, additionally underlined {that a} demand zone for ETH lies round $2,100 to $1,900. The dealer anticipated the altcoin’s drawdown to be contained inside this vary as soon as the bearish strain subsides.

Ethereum 1-hour chart evaluation Morin. Supply: X.com

Conversely, Leon Waidmann, head of analysis at OnchainHq, suggested that ETH change balances proceed to drop alongside value. The researcher means that traders doubtlessly stay assured with ETH, accumulating at key demand zones as the worth corrects.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.