Bitcoin may even see a short correction to the $72,000 help as an imminent market restoration stays restricted by a scarcity of crypto investor sentiment, which has dropped to lows not seen since 2022.

Bitcoin (BTC) value hit an over three-month low of $78,197 on Feb. 28, falling over 28% from its report excessive of over $109,000 reached on Jan. 20.

Bitcoin could expertise a deeper retracement towards the “low $70,000’s vary because the market repositions,” based on Iliya Kalchev, dispatch analyst at digital asset funding platform Nexo.

BTC/USD, 1-day chart. Supply: TradingView/Cointelegraph

But, a “vital drop under $75,000 appears much less seemingly,” the analyst informed Cointelegraph, including:

“Whereas there is perhaps a brief backtrack because the market fills within the gaps left in the course of the fast climb, Bitcoin is extra more likely to set up agency help within the $72,000 to $80,000 vary.”

“This help might present a basis for a extra sustainable restoration, decreasing the chance of a deeper retracement,” he stated.

Associated: Binance is not ‘dumping’ Solana and other token holdings — Spokesperson

Different analysts additionally predicted a Bitcoin backside close to $70,000 in early 2025 earlier than the subsequent stage of the rally.

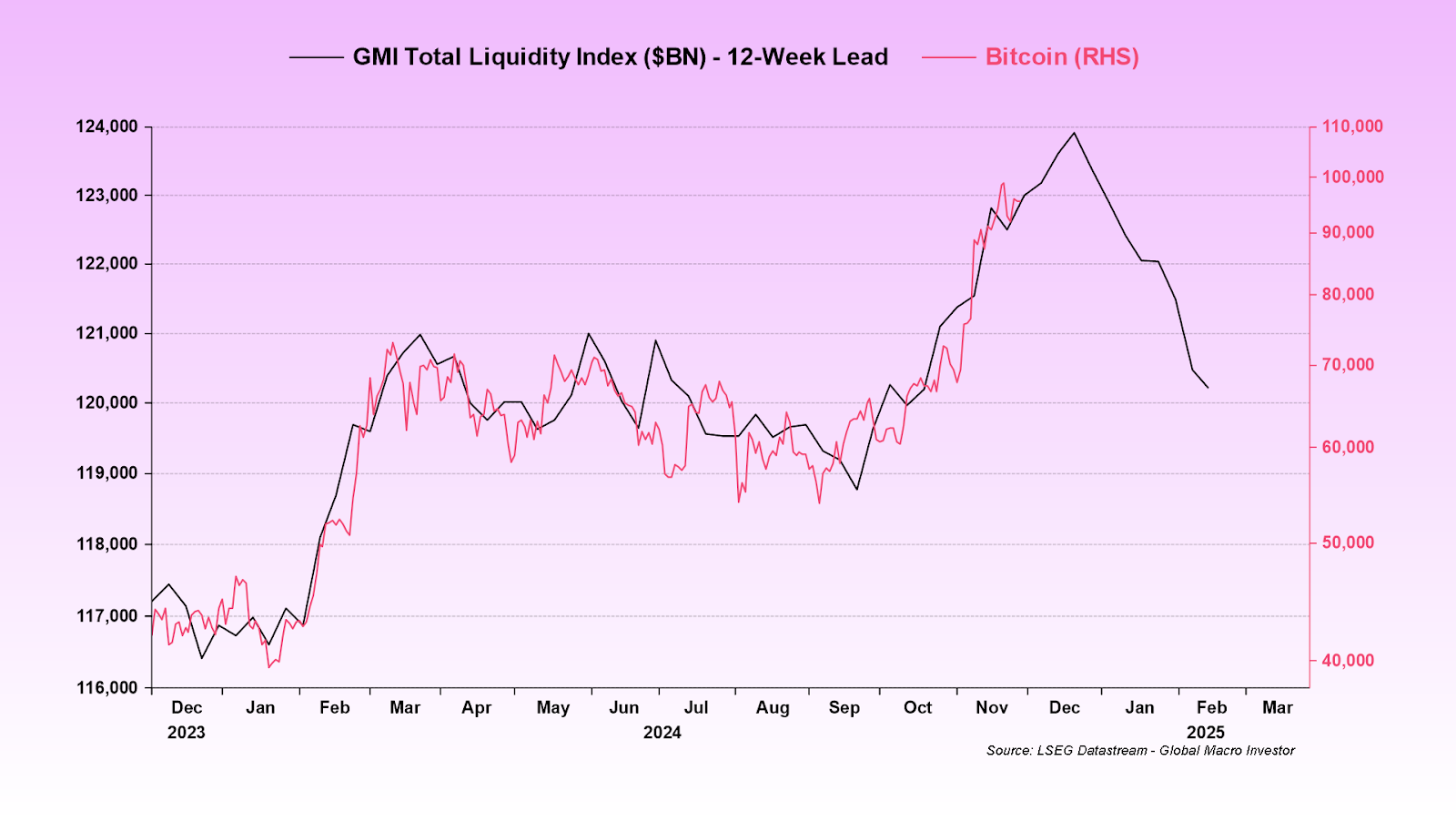

Based mostly on its correlation with the worldwide liquidity index, Bitcoin’s right-hand side (RHS), which marks the bottom bid value somebody is prepared to promote the forex for, could fall under $70,000 across the finish of February after it peaked close to $110,000 in January.

Supply: Raoul Pal

The primary warning of a correction to $70,000 got here from Raoul Pal, founder and CEO of International Macro Investor, in November, when he additionally predicted that Bitcoin would attain a “local top” above $110,000 in January, earlier than the present correction.

Associated: Trump to host first White House crypto summit on March 7

Crypto investor sentiment drops to 2022 low

Whereas analysts anticipate Bitcoin to seek out its backside and begin a restoration within the coming weeks, the crypto market stays restricted by a scarcity of investor confidence.

The Crypto Concern & Greed Index — which measures general crypto market sentiment — fell to a close to three-year low of 20, final seen in July 2022, Alternative.me knowledge exhibits.

Supply: Alternative.me

The final time investor sentiment dropped to related ranges was a month after Bitcoin fell to $17,500, experiencing a month-to-month decline of over 37% in June 2022.

BTC/USD, 1-month chart. Supply: TradingView

The investor sentiment decline was attributable to an array of exterior and crypto-specific components, Bitfinex analysts informed Cointelegraph, including:

“General, the mixture of a pointy Bitcoin value drop, regulatory uncertainty, safety breaches, and declining altcoin valuations has led to excessive worry within the crypto market.”

“Though not a part of the index, we're additionally constantly seeing new highs in lengthy liquidations throughout quite a few flushes akin to on Feb third and the present 24-Twenty seventh February transfer down,” the analysts added.

In the meantime, the broader crypto market remains to be recovering from the $1.4 billion Bybit hack, which occurred on Feb. 21, marking the largest hack in crypto history.

In a constructive sign for the crypto trade, Bybit has continued to honor buyer withdrawals and had totally replaced the stolen $1.4 billion in Ether by Feb. 24, simply three days after the assault.

Journal: China’s ‘point running’ crypto scams, pig butchers kidnap kids: Asia Express