Bitcoin (BTC) neared $93,000 on Mar. 2 as US President Donald Trump doubled down on a strategic crypto reserve.

BTC/USD 1-day chart. Supply: Cointelegraph/TradingView

Trump writes: “I additionally love Bitcoin and Ethereum!”

Knowledge from Cointelegraph Markets Pro and TradingView confirmed BTC/USD gaining 8% in uncommon weekend volatility.

Trump ignited a crypto firestorm into the weekly shut after posts on Fact Social referenced a crypto reserve that would come with BTC, Ether (ETH) and a number of other altcoins.

After initially referencing solely XRP (XRP), Solana (SOL) and Cardano (ADA), the President’s account added plans for extra tokens.

“And, clearly, BTC and ETH, as different worthwhile Cryptocurrencies, will likely be on the coronary heart of the Reserve,” it acknowledged in a further post.

“I additionally love Bitcoin and Ethereum!”

Supply: Fact Social

Decreased weekend order e book liquidity thus ensured swift positive aspects throughout crypto markets, with BTC/USD virtually hitting $92,000 on Bitstamp.

“Market adjustments occur when no one expects it,” crypto dealer, analyst and entrepreneur Michaël van de Poppe responded on X.

“The final crash, in all probability the most important manipulation ever for individuals to scoop up large positions in $BTC and $ETH. The underside is in. The low is in on Altcoins. The ultimate simple cycle has began.”

Supply: Lookonchain/X

The run to native highs thus sealed upside of 17% versus the multimonth backside close to $78,000 seen simply two days prior.

As a part of the volatility, XRP managed to surpass ETH by totally diluted valuation (FDV).

“That is what crypto has been ready for,” buying and selling useful resource The Kobeissi Letter added in a part of its personal response.

$93,500 BTC value reclaim remains to be key

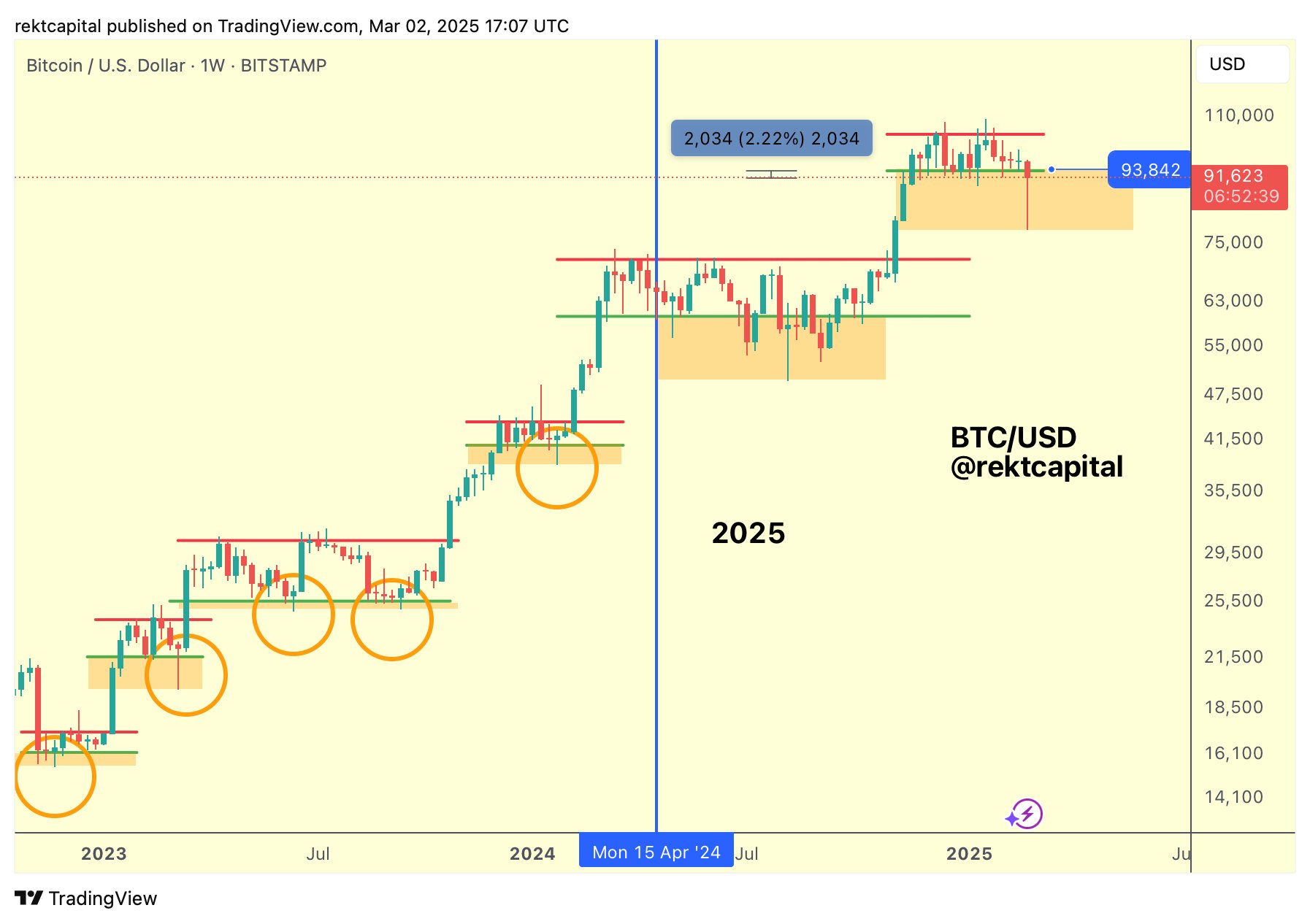

Persevering with, fashionable dealer and analyst Rekt Capital categorised the dive to $78,000 as a “draw back deviation.”

Associated: When will Bitcoin price bottom?

As Cointelegraph reported, such deviation occasions have categorised earlier Bitcoin bull markets.

“Bitcoin has recovered virtually the whole lot of its draw back deviation,” Rekt Capital wrote in a recent evaluation publish.

“Value must now Weekly Shut above the Re-Accumulation Vary Low of $93500 to reclaim the vary. And Bitcoin is simply simply +2% away from doing so.”

BTC/USD 1-week chart. Supply: Rekt Capital/X

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.