Bitcoin lively addresses are nearing a three-month excessive, signaling a possible crypto market capitulation which will stage a worth reversal from the newest correction.

Lively addresses on the Bitcoin community surged to over 912,300 on Feb. 28, a stage not seen since Dec. 16, 2024, when Bitcoin (BTC) traded for round $105,000, Glassnode information reveals.

Bitcoin variety of lively addresses. Supply: Glassnode

The surge in lively addresses could sign a “capitulation second” for the crypto market, according to crypto intelligence platform IntoTheBlock. The agency famous in a Feb. 28 submit on X:

“Traditionally, spikes in on-chain exercise have usually coincided with market peaks and bottoms—pushed by panic sellers exiting and opportunistic patrons.”

“Whereas no single metric ensures a worth reversal, this surge suggests the market may very well be at a vital turning level,” the submit added.

In monetary markets, capitulation refers to buyers promoting their positions in a panic, resulting in a major worth decline and signaling an imminent market backside earlier than the beginning of the subsequent uptrend.

Associated: Altseason 2025: ‘Most altcoins won’t make it,’ CryptoQuant CEO says

Bitcoin should maintain above $80,500 to keep away from additional losses

Bitcoin’s skill to stay above the $80,500 threshold could act as a “potential catalyst for market stabilization,” based on Stella Zlatareva, dispatch editor at digital asset funding platform Nexo.

Zlatareva informed Cointelegraph:

“Choices information signifies that BTC’s skill to reclaim $80,500 might be a key consider near-term momentum. A breakout above this stage might pave the best way for additional upside, whereas a failure to ascertain it as assist could result in additional testing on the draw back.”

Associated: Trump to host first White House crypto summit on March 7

Nonetheless, Bitcoin could revisit this significant assist if its worth declines under $84,000.

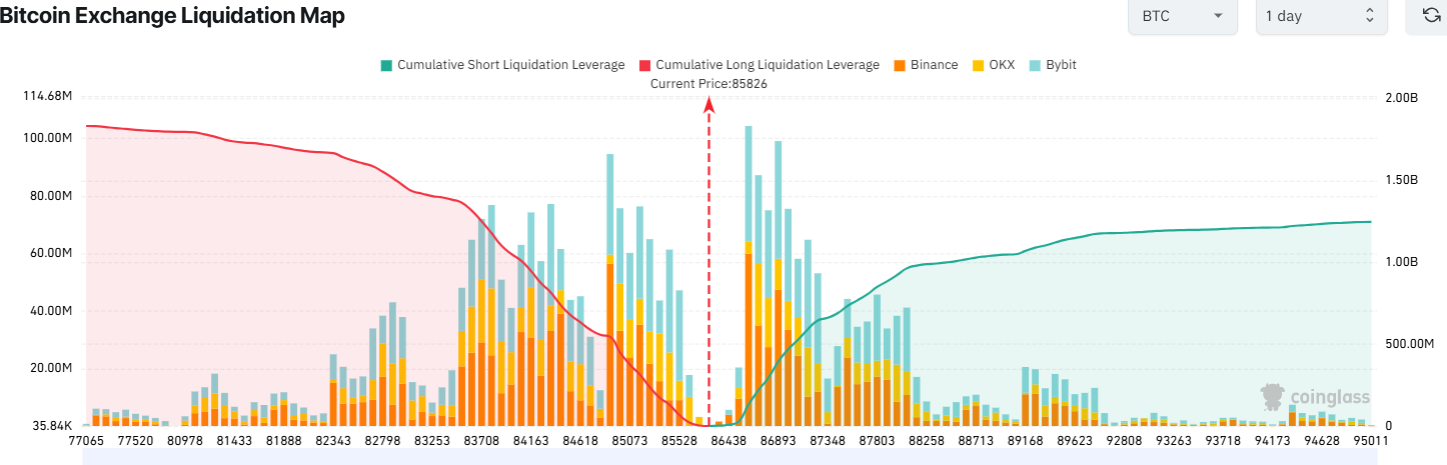

Bitcoin trade liquidation map Supply: CoinGlass

A possible correction under $84,000 would set off over $1 billion price of leveraged lengthy liquidations throughout all exchanges, CoinGlass information reveals.

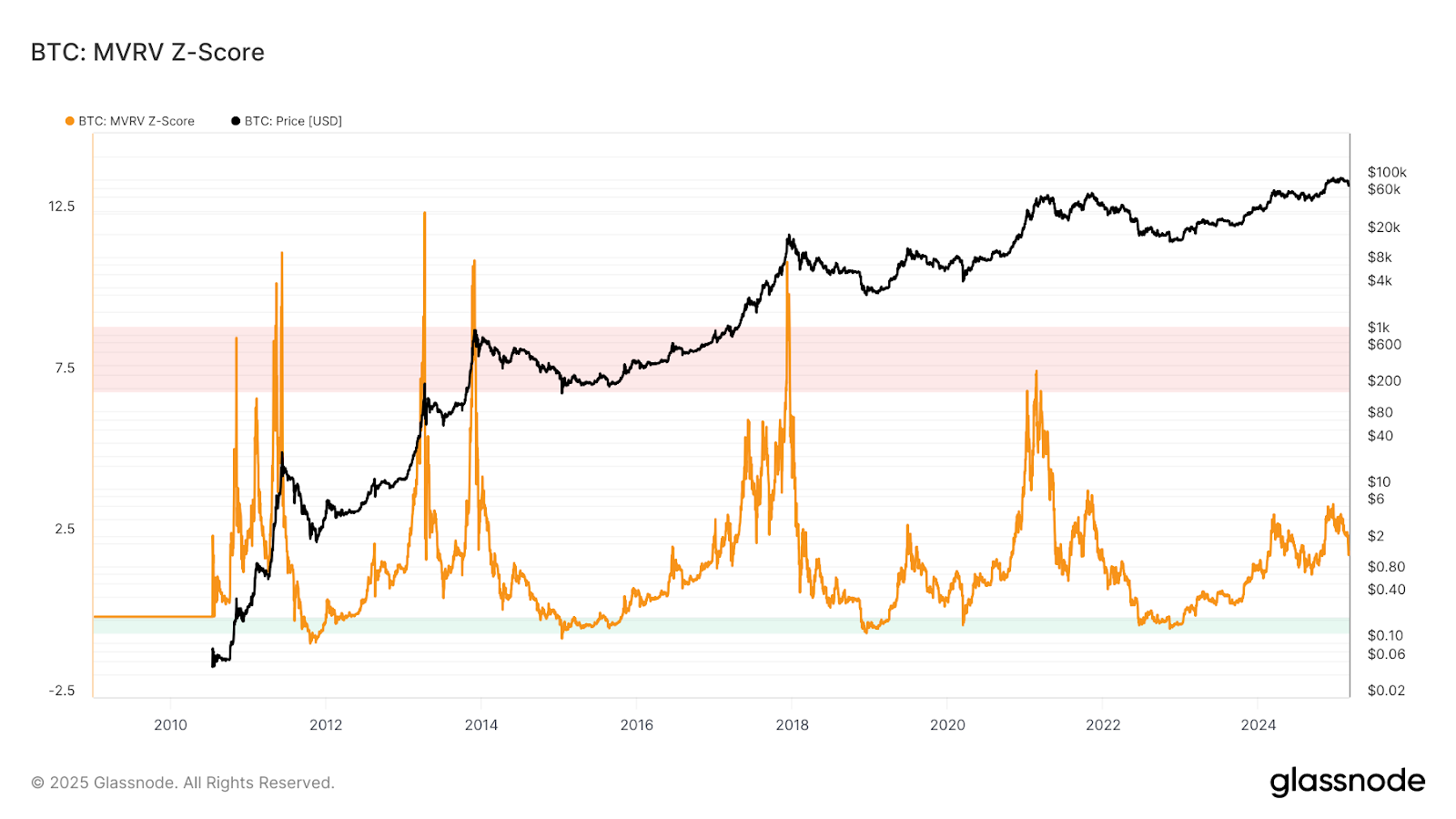

Regardless of short-term volatility, Bitcoin’s worth is nearer to forming a market backside than reaching a neighborhood high, based on Bitcoin’s market worth to realized worth (MVRV) Z-score — a technical indicator used to find out whether or not an asset is overbought or oversold.

Bitcoin MVRV Z-Rating. Supply: Glassnode

Bitcoin’s MVRV Z-score stood at 2.01 on March 1, signaling that Bitcoin’s worth is approaching the inexperienced territory on the backside of the chart, turning into more and more oversold, Glassnode information reveals.

Journal: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – Mar. 1