Bitcoin energetic addresses are nearing a three-month excessive, signaling a possible crypto market capitulation which will stage a value reversal from the newest correction.

Lively addresses on the Bitcoin community surged to over 912,300 on Feb. 28, a degree not seen since Dec. 16, 2024, when Bitcoin (BTC) traded for round $105,000, Glassnode knowledge reveals.

Bitcoin variety of energetic addresses. Supply: Glassnode

The surge in energetic addresses could sign a “capitulation second” for the crypto market, according to crypto intelligence platform IntoTheBlock. The agency famous in a Feb. 28 publish on X:

“Traditionally, spikes in on-chain exercise have usually coincided with market peaks and bottoms—pushed by panic sellers exiting and opportunistic patrons.”

“Whereas no single metric ensures a value reversal, this surge suggests the market might be at an important turning level,” the publish added.

In monetary markets, capitulation refers to traders promoting their positions in a panic, resulting in a big value decline and signaling an imminent market backside earlier than the beginning of the subsequent uptrend.

Associated: Altseason 2025: ‘Most altcoins won’t make it,’ CryptoQuant CEO says

Bitcoin should maintain above $80,500 to keep away from additional losses

Bitcoin’s capability to stay above the $80,500 threshold could act as a “potential catalyst for market stabilization,” in keeping with Stella Zlatareva, dispatch editor at digital asset funding platform Nexo.

Zlatareva instructed Cointelegraph:

“Choices knowledge signifies that BTC’s capability to reclaim $80,500 can be a key think about near-term momentum. A breakout above this degree may pave the way in which for additional upside, whereas a failure to determine it as assist could result in additional testing on the draw back.”

Associated: Trump to host first White House crypto summit on March 7

Nonetheless, Bitcoin could revisit this important assist if its value declines under $84,000.

Bitcoin trade liquidation map Supply: CoinGlass

A possible correction under $84,000 would set off over $1 billion price of leveraged lengthy liquidations throughout all exchanges, CoinGlass knowledge reveals.

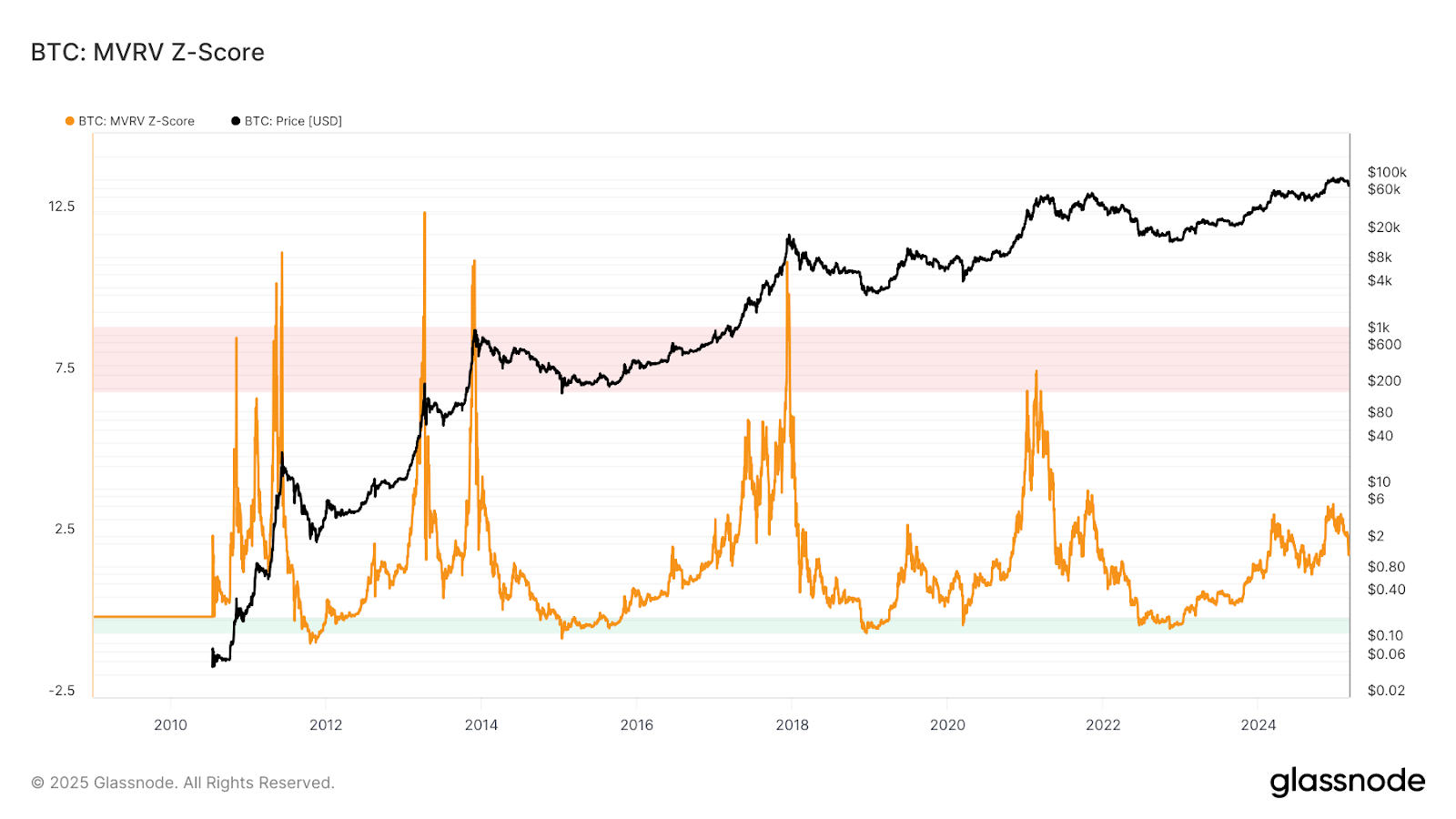

Regardless of short-term volatility, Bitcoin’s value is nearer to forming a market backside than reaching an area prime, in keeping with Bitcoin’s market worth to realized worth (MVRV) Z-score — a technical indicator used to find out whether or not an asset is overbought or oversold.

Bitcoin MVRV Z-Rating. Supply: Glassnode

Bitcoin’s MVRV Z-score stood at 2.01 on March 1, signaling that Bitcoin’s value is approaching the inexperienced territory on the backside of the chart, changing into more and more oversold, Glassnode knowledge reveals.

Journal: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – Mar. 1