Bitcoin (BTC) witnessed strong shopping for over the weekend as US President Donald Trump introduced that Bitcoin, Ether (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA) could be included in a crypto strategic reserve. The announcement massively pumped the chosen cash, which made it dangerous for a contemporary entry after the rally. The cash on this article have been chosen for his or her technical setups fairly than the Trump-based pump.

Other than the crypto strategic reserve, in an indication that might create new demand for Bitcoin, BlackRock added the iShares Bitcoin ETF Belief (IBIT) to its $150 billion mannequin portfolio, in keeping with a Bloomberg report. The worldwide funding agency is adding 1% to 2% allocation to portfolios that permit for various property. This transfer opens the doorways for a possible new demand for the Bitcoin ETF.

Crypto market information day by day view. Supply: Coin360

Nonetheless, some analysts imagine that Bitcoin may witness some extra ache within the close to time period. They anticipate Bitcoin to drop near $70,000 earlier than beginning the subsequent leg of the bull transfer. Nexo dispatch analyst Iliya Kalchev advised Cointelegraph that Bitcoin may “set up agency help within the $72,000 to $80,000 vary.”

May Bitcoin handle to carry above $90,000? If that occurs, choose altcoins other than those chosen for the crypto strategic reserve could discover consumers. Let’s have a look at the highest cryptocurrencies that look sturdy on the charts.

Bitcoin worth evaluation

Bitcoin has reached the 20-day exponential transferring common ($92,366), indicating aggressive shopping for at decrease ranges.

BTC/USDT day by day chart. Supply: Cointelegraph/TradingView

Sellers will attempt to stall the reduction rally on the 20-day EMA. If the value turns down from the 20-day EMA, the BTC/USDT pair may drop to $85,000, which is an important help to be careful for.

If the value rebounds off $85,000, the pair may rise above the 20-day EMA. The pair could then rally to the 50-day easy transferring common ($97,704). Such a transfer will sign that the pair could have bottomed out within the close to time period.

If bears wish to retain the benefit, they should swiftly pull the value under $83,000. In the event that they handle to do this, the pair may retest the crucial $78,258 help.

BTC/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The 20-EMA has began to show up on the 4-hour chart, and the relative power index (RSI) has jumped into the overbought zone, indicating that the bulls are on a comeback. If the value stays above $90,000, the pair may climb to $96,000 after which $100,000.

The primary signal of weak spot will likely be a break under the 50-simple transferring common. That might sink the pair to the 20-EMA, which is prone to appeal to consumers. The bears will likely be again within the driver’s seat in the event that they pull the pair under $83,000.

Hedera worth evaluation

Hedera (HBAR) rose above the 20-day EMA ($0.22) and reached the 50-day SMA ($0.26) on March 1.

HBAR/USDT day by day chart. Supply: Cointelegraph/TradingView

The 20-day EMA is the crucial help to be careful for on the draw back. If the value rebounds off the 20-day EMA, it's going to sign a change in sentiment from promoting on rallies to purchasing on dips. The bulls will once more attempt to propel the HBAR/USDT pair above the 50-day SMA. If they'll pull it off, the pair could rise to $0.32.

Contrarily, a break and shut under the 20-day EMA means that the bears stay sellers on rallies. The pair could hunch to $0.18, the place the bulls will attempt to arrest the decline.

HBAR/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The pair turned down from $0.26 however is prone to discover help on the 20-EMA on the 4-hour chart. If the value rebounds off the 20-EMA with power, it's going to sign shopping for on dips. That improves the prospects of a rally to $0.28.

As a substitute, if the value continues decrease and breaks under the 20-EMA, it's going to counsel that the bulls are dropping their grip. The pair could tumble to the 50-SMA, which is prone to act as sturdy help.

Litecoin worth evaluation

Litecoin (LTC) has been buying and selling inside a symmetrical triangle sample, indicating indecision between the consumers and sellers.

LTC/USDT day by day chart. Supply: Cointelegraph/TradingView

The flattish 20-day EMA ($122) and the RSI close to the midpoint don't give a transparent benefit both to the bulls or the bears. If the value rises and sustains above the 20-day EMA, the bulls will attempt to push the LTC/USDT pair above the resistance line. In the event that they succeed, the pair could rise to $147.

Contrarily, a detailed under the transferring averages means that the short-term benefit has tilted in favor of the bears. The pair could skid to the help line, which is an important degree for the bulls to defend as a result of a break under it could sink the pair to $86.

LTC/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The pair has dipped under the transferring averages on the 4-hour chart, indicating that the bears are attempting to take cost. If the value sustains under the transferring averages, the pair may descend to $114 after which to the help line.

Patrons should push and keep the value above the transferring averages to open the doorways for an increase to $132 and later to the resistance line. The up transfer may choose up momentum after the value closes above the resistance line.

Associated: Here’s what happened in crypto today

Monero worth evaluation

Monero (XMR) bounced off the $205 degree and rose above the transferring averages, signaling strong shopping for on dips.

XMR/USDT day by day chart. Supply: Cointelegraph/TradingView

The flattish 20-day EMA ($224) and the RSI close to the midpoint counsel that the XMR/USDT pair could swing between $205 and $245 for just a few days. If the value stays above the 20-day EMA, the pair may retest the $245 resistance.

Quite the opposite, if consumers fail to keep up the value above the transferring averages, it's going to counsel an absence of demand at increased ranges. The bears will then attempt to pull the value right down to the help of the vary at $205.

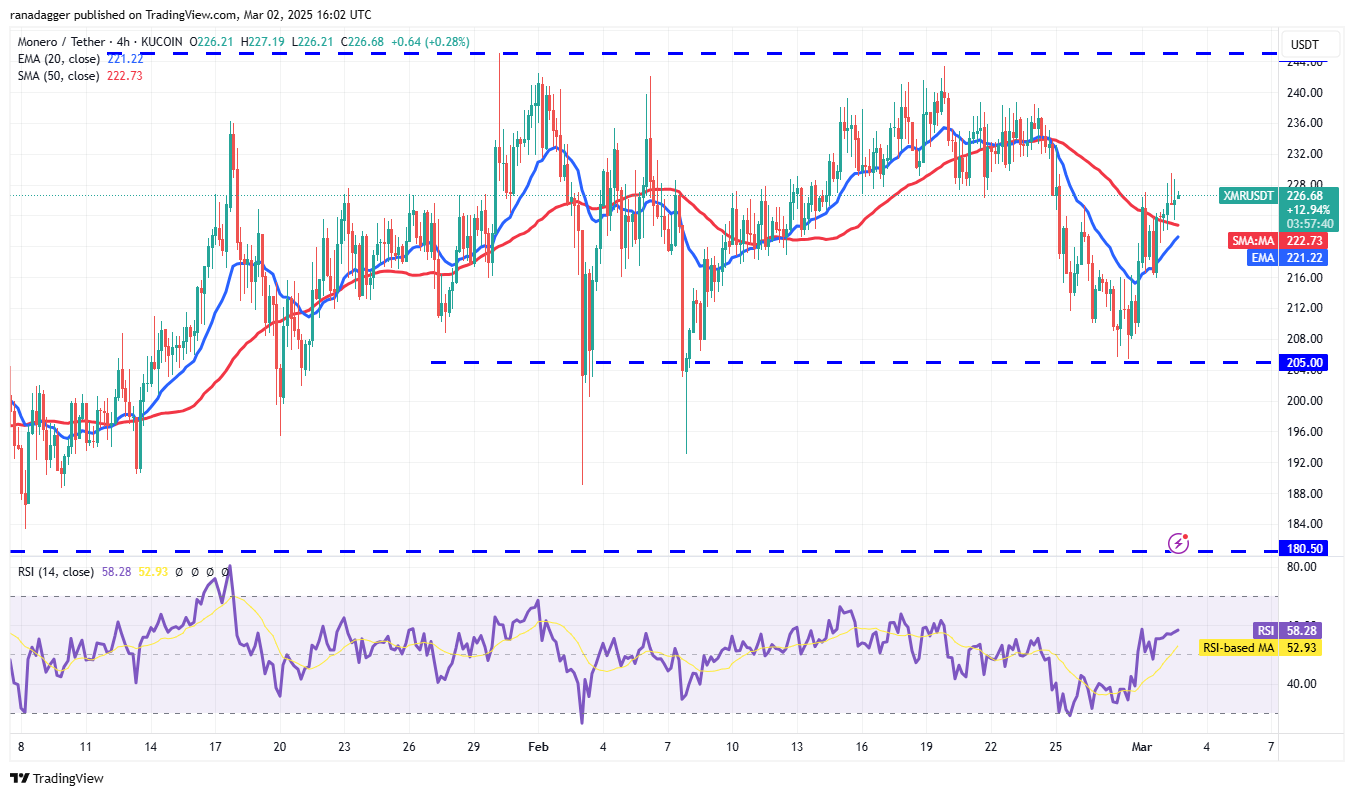

XMR/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The 20-EMA has began to show up on the 4-hour chart, and the RSI is within the constructive zone, indicating a bonus to consumers. The pair may rise to $238, the place the bears are anticipated to step in.

On the draw back, a break and shut under the 20-EMA means that the bears are again within the recreation. The pair could slide to $216, and if this degree cracks, the subsequent cease might be the strong help at $205.

Celestia worth evaluation

Celestia (TIA) has risen above the transferring averages, and the bulls are attempting to maintain the value above the breakdown degree of $4.14.

TIA/USDT day by day chart. Supply: Cointelegraph/TradingView

In the event that they handle to do this, it's going to sign that the markets have rejected the breakdown. There may be minor resistance at $4.50, but when the extent is crossed, the TIA/USDT pair may climb to $5.50. Sellers are anticipated to defend the $5.50 degree aggressively.

This constructive view will likely be invalidated within the close to time period if the value turns down and breaks under the 20-day EMA ($3.66). That might sink the pair to $3 and subsequently to $2.72. Such a transfer will counsel that the bears have flipped the $4.14 degree into resistance.

TIA/USDT 4-hour chart. Supply: Cointelegraph/TradingView

Each transferring averages have began to show up, and the RSI is within the constructive territory on the 4-hour chart, indicating a bonus to consumers. The primary signal of weak spot will likely be a break and shut under the transferring averages. If that occurs, the pair may drop to $3.40 and later to $3.

If consumers wish to retain the benefit, they should defend the 20-EMA and rapidly push the value above $4.31. The $4.50 degree could show to be a stiff resistance, but when the consumers overcome it, the pair may bounce to $5.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.