Bitcoin’s weekly chart was on monitor to shut under $90,000 for the primary time since November 2024, however a late surge pushed costs larger following US President Donald Trump’s announcement of a crypto strategic reserve.

Bitcoin weekly chart. Supply: Cointelegraph/TradingView

Regardless of February’s month-to-month candle closing at $84,299, BTC’s (BTC) weekly shut fashioned a doji candle, closing at $94,222. With costs retesting the $95,000 overhead resistance, one analyst remained cautious a couple of repeat of 2019’s “Xi pump.”

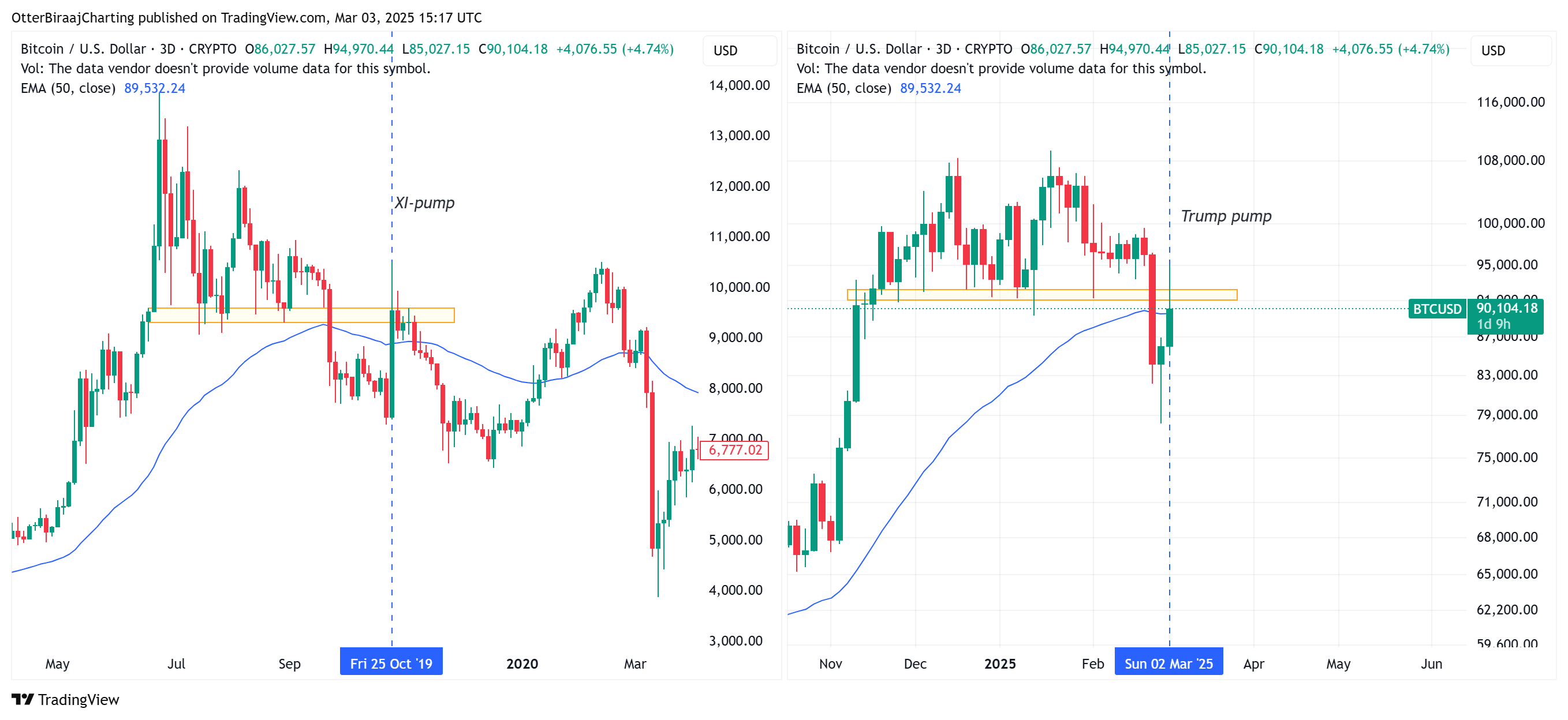

Will Trump-pump comply with the Xi-pump path?

In 2019, throughout a protracted bearish buying and selling interval that stretched from June to October, Bitcoin’s market sentiment was low. Nonetheless, on Oct. 25, 2019, China’s President XI Jinping’s announcement supporting blockchain expertise triggered a big worth rise.

Nonetheless, in subsequent days, China imposed a sequence of crackdowns on crypto belongings and actions like mining, resulting in new lows inside 30 days.

Chilly Blooded Shiller, an nameless crypto analyst, drew similarities between the ‘Xi-pump’ and the present Trump pump, suggesting that sentiment rallies can usually fizzle out attributable to lack of energy, and the market shortly adjusts itself to the prior pattern.

Bitcoin 2019 Xi pump vs 2025 Trump pump comparability. Supply: Cointelegraph/TradingView

As illustrated within the chart, the similarities between each durations adopted related retests of prior help ranges. Within the first case under $10,000 in 2019 and under $95,000 in 2025, and the asset fashioned new lows 30 days later. The analyst added that in 2019, merchants shortly acknowledged the pump as a “brief squeeze and managed to get some excellent entries.”

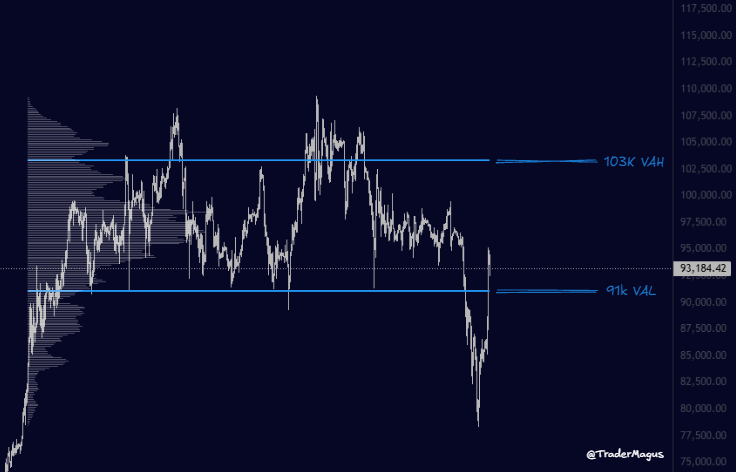

Likewise, Magus, a crypto dealer, mentioned that bulls wanted to show themselves this week and perform re-acceptance of the worth space excessive (VAH) at $103,000 and worth space low (VAL) at $91,000.

Bitcoin quantity profile evaluation by Magus. Supply: X.com

The VAH and VAL outline a spread the place nearly all of buying and selling quantity occurred throughout a particular time interval on a chart, on this case, since November 2024. Nonetheless, Magus additionally remained cautious of the Xi pump, stating,

“It is a textbook swing setup for me usually however when you've been round lengthy sufficient you keep in mind the Xi pump My intestine tells me this transfer was exaggerated due to sentiment.”

Related: Trump’s crypto reserve plan faces Congress vote, may limit rally

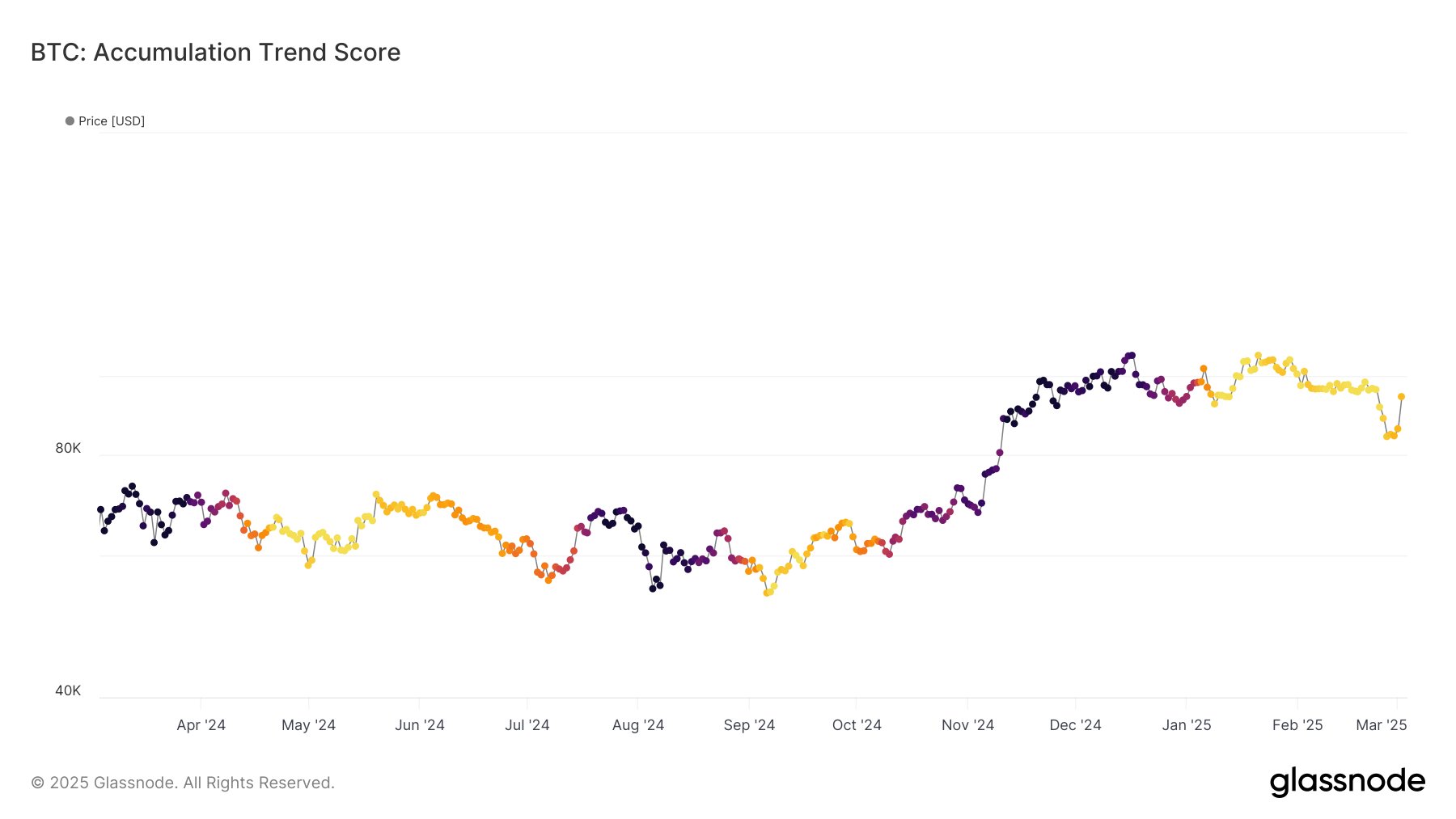

Bitcoin stays in distribution, not accumulation

Information from Glassnode steered that regardless of BTC’s rally, the short-term holders’ (STH) value foundation dropped under 1 after initially shifting above $92,700. Bitcoin’s present worth is under $92,700, which means that STHs remained in a “fragile place” with profitability present at breakeven.

Moreover, the information analytics platform additionally said that Bitcoin’s accumulation pattern rating remained below 0.5 for 58 consecutive days, underling an extended interval of internet distribution.

Bitcoin accumulation pattern rating. Supply: X.com

A distribution interval is outlined as a section of profit-taking by buyers, which is commonly in keeping with market corrections. Glassnode added,

“Accumulation and distribution phases have alternated inside a 57-65 day window on common. With the most recent learn at 0.9, the Development Rating signifies giant entities are nonetheless in a internet distribution regime, with no confirmed transition to accumulation but.”

Related: Biggest CME gap ever at $85K: 5 things to know in Bitcoin this week

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.