The $1.4 billion hack in opposition to Bybit wasn’t simply the biggest exploit in crypto historical past — it was a significant check of the trade’s disaster administration capabilities, highlighting its maturation because the collapse of FTX.

On Feb. 21, North Korea’s Lazarus Group made off with $1.4 billion in Ether (ETH) and associated tokens in a breach that originally despatched chills all through your complete crypto world however was shortly quelled because the trade rallied behind Bybit to handle the fallout.

Right here’s a take a look at how the assault unfolded, how Bybit responded, and the place the stolen funds are transferring.

Supply: Elliptic

Feb. 21: Bybit hacked

The Bybit hack was first noticed by onchain sleuth ZachXBT, who warned platforms and exchanges to blacklist addresses related to the hack.

Quickly thereafter, Bybit co-founder and CEO Ben Zhou confirmed the exploit and started offering updates and knowledge on the breach.

A autopsy from Chainalysis initially acknowledged that Lazarus executed phishing assaults to entry the alternate’s funds, however the evaluation was later up to date to report that the hackers gained management of a Protected developer’s pc somewhat than compromising Bybit’s methods.

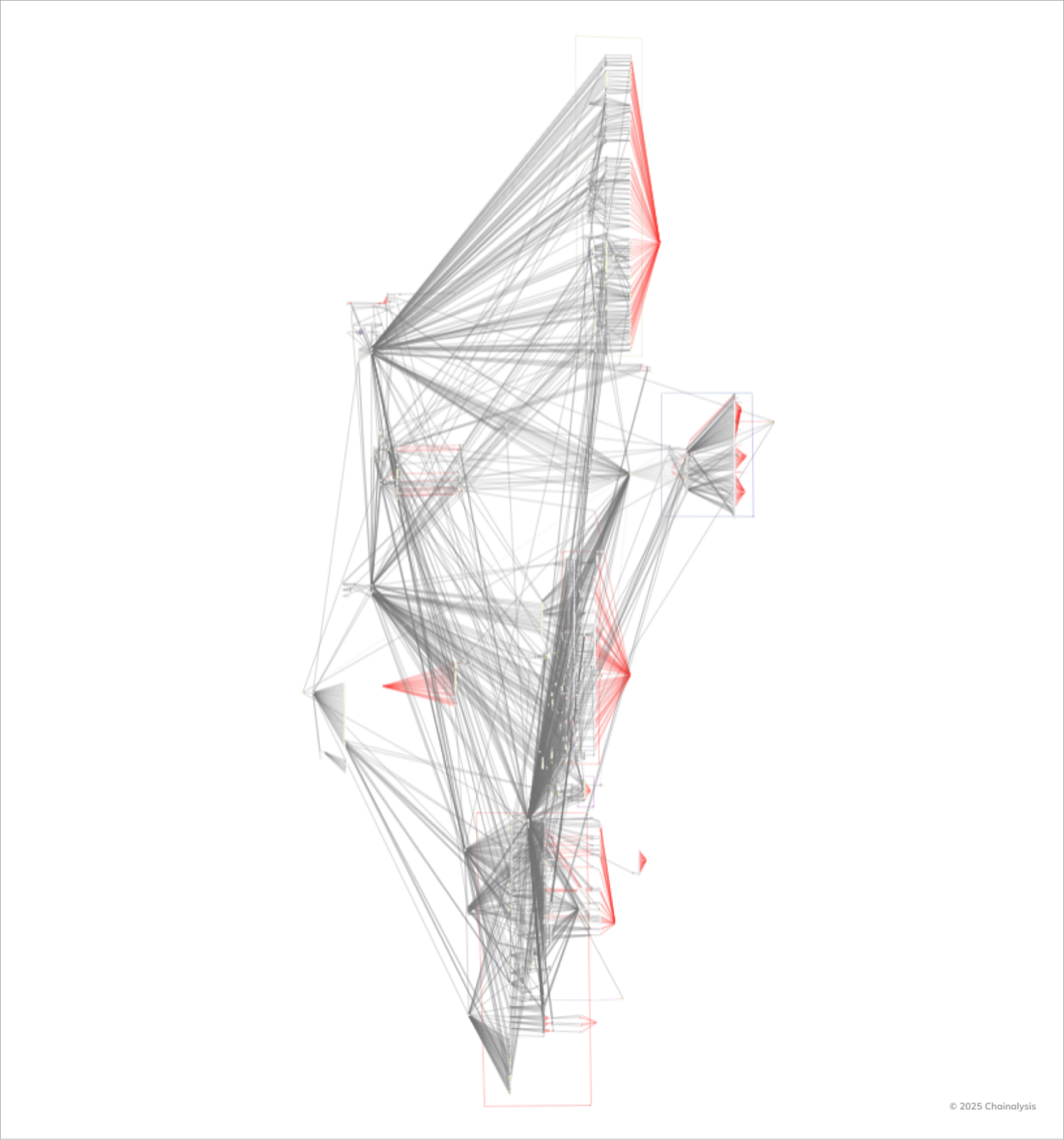

The attackers managed to “reroute” some 401,000 ETH, value $1.14 billion on the time of the exploit, and transfer it by way of a community of middleman wallets.

The advanced community of wallets, swaps and crosschain transfers the hackers have used to obscure the funds. Supply: Chainalysis

Feb. 21: Bybit assures wallets are secure, Ethena solvency

The alternate was fast to guarantee customers that its remaining wallets had been secure, announcing simply minutes after Zhou confirmed the exploit that “all different Bybit chilly wallets stay totally safe. All consumer funds are secure, and our operations proceed as regular with none disruption.”

A couple of hours after the hack, buyer withdrawals remained open. Zhou stated in a Q&A session that the alternate had permitted and processed 70% of withdrawal requests at the moment.

Decentralized finance platform Ethena told users that its yield-bearing stablecoin, USDe, was nonetheless solvent after the hack. The platform reportedly had $30 million of publicity to monetary derivatives on Bybit however was capable of offset losses by way of its reserve fund.

Feb. 22: Crypto trade lends Bybit a serving to hand, hackers blacklisted

A lot of crypto exchanges reached out to help Bybit. Bitget CEO Gracy Chen announced that her alternate had lent Bybit some 40,000 ETH (round $95 million on the time).

Crypto.com CEO Kris Marszalek said he would direct his agency’s safety group to supply help.

Different exchanges and outfits started freezing funds linked with the hack. Tether CEO Paolo Ardoino posted on X that the agency had frozen 181,000 USDt (USDT) linked with the hack. Polygon’s chief info safety officer, Mudit Gupta, said the Mantle group was capable of get well some $43 million in funds from the hackers.

Associated: Adam Back slams ‘EVM mis-design’ as root cause of Bybit hack

Zhou posted a thanks word on X, tagging plenty of outstanding crypto corporations he mentioned helped Bybit, together with Bitget, Galaxy Digital, the TON Basis and Tether.

Supply: Ben Zhou

Bybit additionally announced a bounty program with a reward of as much as 10% of recovered funds, inserting as much as $140 million up for grabs.

Feb. 22: Run on withdrawals, Lazarus strikes funds

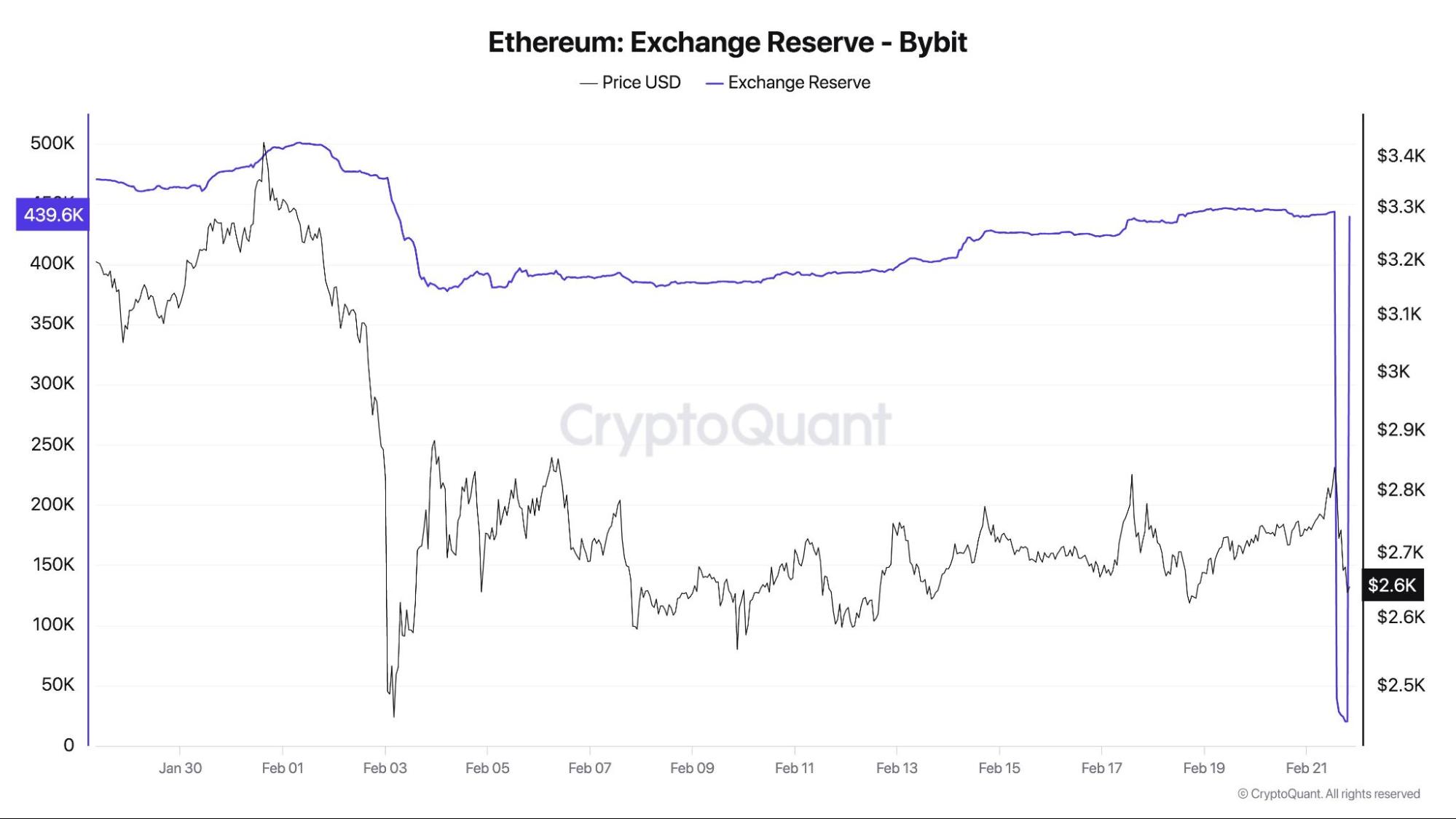

Following the incident, person withdrawals introduced the alternate’s total asset value down by over $5.3 billion.

Regardless of the run on withdrawals, the alternate saved withdrawal requests open, albeit with delays, and Bybit’s unbiased proof-of-reserves auditor, Hacken, confirmed that reserves nonetheless exceeded liabilities.

In the meantime, blockchain trails confirmed that Lazarus had continued splitting the funds into intermediary wallets, additional obfuscating their motion.

In a single instance, blockchain evaluation agency Lookonchain acknowledged that Lazarus had transferred 10,000 ETH, value almost $30 million, to a pockets recognized as “Bybit Exploiter 54” to start laundering funds.

Blockchain safety agency Elliptic wrote that the funds had been doubtless headed for a mixer — a service that conceals the hyperlinks between blockchain transactions — though “this may occasionally show difficult because of the sheer quantity of stolen property.”

Feb. 23: eXch, Bybit continues restoring funds, blacklists develop

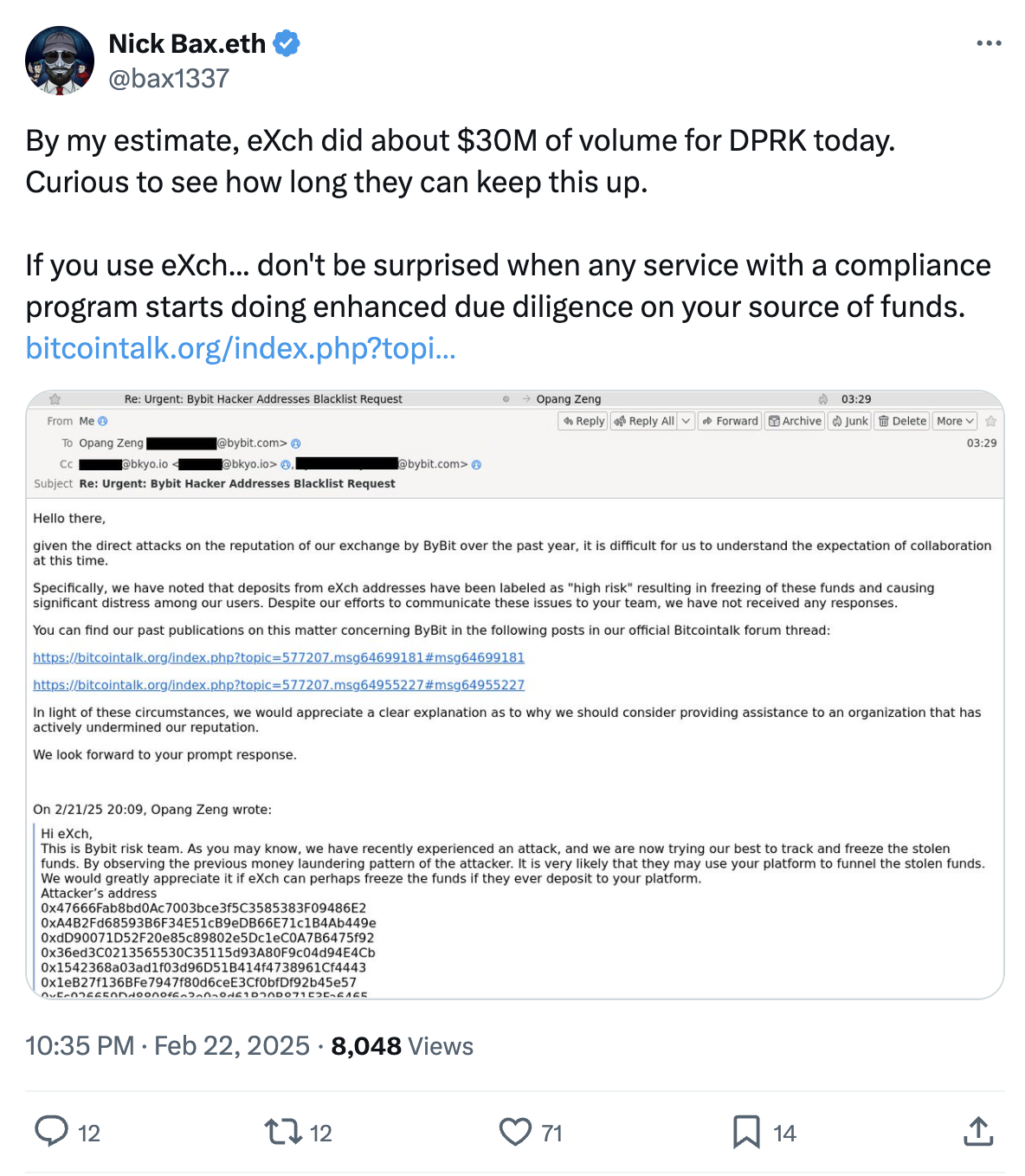

Blockchain analysts ZachXBT and Nick Bax each alleged that hackers had been capable of launder funds on the non-Know Your Buyer crypto alternate eXch. ZachXBT claimed that eXch laundered $35 million of the funds after which by chance despatched 34 ETH to a scorching pockets of one other alternate.

Supply: Nick Bax

EXch denied that it laundered funds for North Korea however admitted to processing an “insignificant portion of funds from the ByBit hack.”

The funds “finally entered our handle 0xf1da173228fcf015f43f3ea15abbb51f0d8f1123 which was an remoted case and the one half processed by our alternate, charges from which we will likely be donated for the general public good,” eXch mentioned.

To assist establish wallets that had been concerned within the incident, Bybit released a blacklisted wallet utility programming interface (API). The alternate mentioned the device would assist white hat hackers in its aforementioned bounty program.

Associated: In pictures: Bybit’s record-breaking $1.4B hack

Bybit additionally managed to restore its Ether reserves to just about half of the place they had been earlier than the hack, largely by way of spot buys in over-the-counter trades following the incident but in addition together with the Ether lent from different exchanges.

Feb. 24: Lazarus noticed on DEXs, Bybit closes the ETH hole

Blockchain sleuths continued to observe the circulation of funds now related to Lazarus. Arkham Intelligence observed addresses associated with the hackers on decentralized exchanges (DEXs) attempting to commerce the stolen crypto for Dai (DAI).

A pockets receiving a few of the stolen ETH from Bybit reportedly interacted with Sky Protocol, Uniswap and OKX DEX. In response to buying and selling platform LMK, the hacker managed to swap no less than $3.64 million.

In contrast to different stablecoins corresponding to USDT and USDC (USDC), Dai can’t be frozen.

Zhou introduced that Bybit had “totally closed the ETH hole” — i.e., replenishing the $1.4 billion in Ether misplaced within the hack. His announcement was adopted by a third-party proof-of-reserves report.

Bybit acquired its Ether reserves again to pre-hack ranges. Supply: Darkfost

Feb. 25: Struggle on Lazarus

Bybit launched a devoted web site for its restoration efforts, which Zhou promoted whereas calling on the cryptocurrency community to unite against Lazarus Group. The positioning distinguishes between those that helped and people who reportedly refused to cooperate.

Nearly $95 million in reported funds had been moved to eXch. Supply: LazarusBounty

It highlights the people and entities who assisted in freezing stolen funds, awarding them a ten% bounty break up evenly between the reporter and the entity that froze the funds.

It additionally names eXch as the only real platform that refused to assist, claiming it ignored 1,061 studies.

Feb. 26: FBI confirms studies about Lazarus and Protected compromise

The US Federal Bureau of Investigation (FBI) confirmed the extensively reported suspicion that North Korean hackers perpetrated the Bybit exploit, naming TraderTraitor actors, higher referred to as Lazarus Group amongst cybersecurity circles.

In a public service announcement, the FBI urged the personal sector — together with node operators, exchanges and bridges — to dam transactions coming from Lazarus-linked addresses.

Supply: Pascal Caversaccio

The FBI recognized 51 suspicious blockchain addresses linked with the hack, whereas cybersecurity agency Elliptic has identified over 11,000 intermediaries.

In the meantime, post-hack investigations discovered that compromised SafeWallet credentials led to the exploit, not by way of Bybit’s infrastructure, as beforehand reported.

Feb. 27: THORChain quantity explosion

Safety agency TRM Labs flagged the pace of the Bybit hackers’ laundering efforts as “notably alarming,” with the hackers reportedly transferring over $400 million by Feb. 26 by way of middleman wallets, crypto conversions, crosschain bridges and DEXs. TRM additionally famous that a lot of the stolen proceeds had been being transformed into Bitcoin (BTC), a tactic generally linked to Lazarus. Most transformed Bitcoin stays parked.

In the meantime, Arkham Intelligence found that Lazarus had moved no less than $240 million in ETH by way of embattled crosschain protocol THORChain by swapping it into Bitcoin. Cointelegraph discovered that THORChain’s total swap volume exploded past $1 billion in 48 hours.

THORChain developer “Pluto” introduced their immediate departure from the project after a vote to dam transactions linked to the North Korean hackers was overturned. In the meantime, Lookonchain reported that the hackers had laundered 54% of stolen funds.

What the Bybit hack means for crypto

Bybit could have been capable of totally restore its misplaced reserves, however the incident has raised bigger questions in regards to the blockchain trade and the way hacks may be addressed.

Ethereum developer Tim Beiko swiftly dismissed a call to roll back the Ethereum network to refund Bybit. He mentioned the hack was essentially completely different from earlier incidents, including that “the interconnected nature of Ethereum and settlement of onchain <> offchain financial transactions, make this intractable at the moment.”

The fallout from the Bybit exploit suggests Lazarus Group is turning into extra environment friendly at transferring blockchain-based funds. Investigators at TRM Labs suspect this may occasionally point out an enchancment in North Korea’s crypto infrastructure or enhancements within the underground monetary community’s potential to soak up illicit funds.

As the worth locked in blockchain platforms grows, so does the sophistication of attacks. The trade stays a primary goal for North Korean state hackers who reportedly funnel their earnings to fund its weapons program.

Journal: ETH whale’s wild $6.8M ‘mind control’ claims, Bitcoin power thefts: Asia Express