Solana’s deliberate protocol upgrades are necessary for the community’s long-term well being however might deal a blow to validators’ earnings, in line with asset supervisor VanEck.

In March, Solana’s validators will vote on two proposed upgrades — generally known as Solana Enchancment Paperwork (SIMDs) — to the blockchain protocol designed to make sure rewards for stakers and alter the inflation price for the community’s native SOL (SOL) token.

Each proposals have generated “vital controversy” as a result of they stand to slash validator revenues by as a lot as 95%, probably imperiling smaller operators, VanEck digital asset analysis head Matthew Sigel said in a March 4 X put up.

“Whereas these modifications could scale back staking rewards, we consider decreasing inflation is a worthy aim that strengthens Solana’s long-term sustainability,” Sigel mentioned.

SOL’s staked provide has risen since 2023. Supply: Coin Metrics

Associated: Solana’s Jito staking pool exceeds $100M in monthly tips: Kairos Research

Rewarding stakers

The primary, SIMD 0123, “would introduce an in-protocol mechanism to distribute Solana’s precedence charges to validator stakers,” Sigel mentioned. Merchants pays further to validators to course of transactions extra promptly.

Sigel mentioned precedence charges account for 40% of community revenues, however validators are at present not required to share charges with stakers. Validators are required to go on different types of income, similar to voting rewards.

The proposal, which is up for a vote on March 6, not solely boosts staking rewards however “additionally discourages off-chain buying and selling agreements between merchants and validators, reinforcing on-chain execution,” Sigel mentioned.

Staking includes locking up SOL as collateral with a validator on the Solana blockchain community. Stakers earn SOL payouts from community charges and different rewards however danger “slashing” — or shedding SOL collateral — if the validator misbehaves.

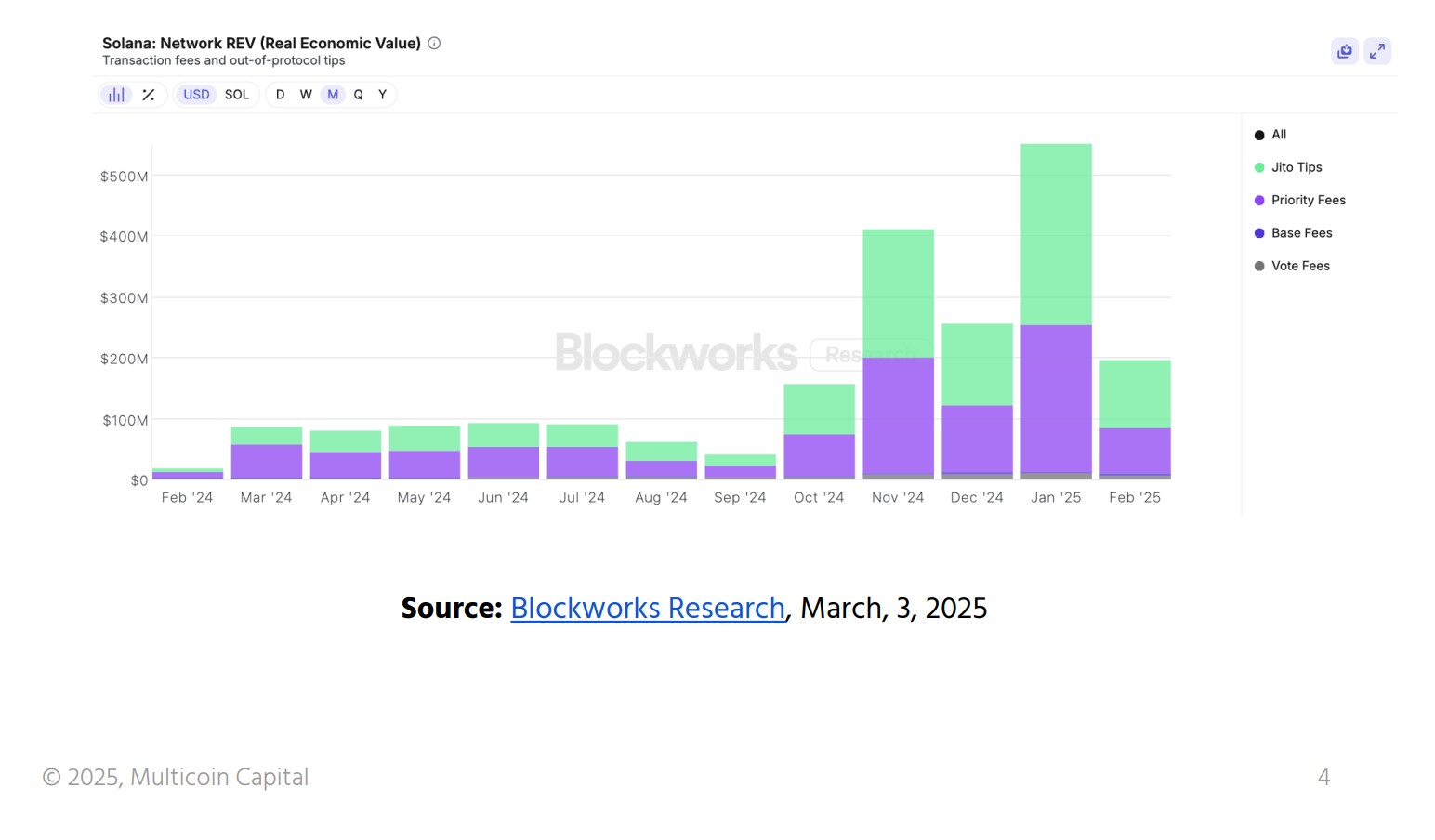

Solana community revenues from charges and suggestions. Supply: Multicoin Capital

Adjusting inflation

The second, SIMD 0228, is the “most impactful proposal into consideration,” in line with Sigel.

It might alter SOL’s inflation price to inversely monitor the % of token provide staked, probably “lowering dilution and decreasing promoting strain from stakers who deal with staking rewards as earnings,” he mentioned.

As of February, Solana’s inflation price stands at 4%, down from its preliminary 8% price however nonetheless nicely above its terminal inflation goal of 1.5%, according to a report by Coin Metrics shared with Cointelegraph. Inflation at present declines at a set price of 15% yearly.

The second proposal was drafted primarily by Multicoin Capital’s Vishal Kankani, according to ChainCatcher. Multicoin, a enterprise capital agency, owns a “vital place” in Jito, Solana’s hottest staking pool, it said in a March report.

As of December, upward of 93% of Solana validators use Jito’s software to maximise earnings from block-building, in line with developer Jito Labs.

The proposals come as asset managers urge regulators to allow SOL exchange-traded funds (ETFs) to checklist on US exchanges. Issuers are additionally asking US regulators to allow cryptocurrency staking in ETFs to boost returns.

Bloomberg Intelligence sets the percentages of SOL ETFs being authorized in 2025 at round 70%.

Journal: Crypto has 4 years to grow so big ‘no one can shut it down’: Kain Warwick, Infinex