The crypto market erased all positive aspects from President Trump’s US Crypto Strategic Reserve announcement, plunging by over 14.7% in 24 hours to succeed in $2.64 trillion on March 4.

High cryptocurrencies and their 24-hour performances. Supply: Messari

A number of components have contributed to the newest drop in crypto costs, together with:

-

As US tariff wars escalated, almost $980 million was wiped off the crypto market in 24 hours.

-

Buyers are risk-off amid the continued correlation between US equities and crypto property.

-

Stiff resistance at 50-weekly SMA that might stifle restoration efforts.

Bitcoin leads the crypto market drop amid commerce warfare escalation

Bitcoin (BTC), which makes up about 60% of the general crypto market, is main the decline after plunging 8.80% within the final 24 hours.

What to know:

-

US tariffs in opposition to Mexico, China and Canada went into impact March 4.

-

Beijing responded with tariffs of as much as 15% on US exports.

-

Ottawa hit again with 25% tariffs on $107 billion price of US items.

-

The tit-for-tat measures have intensified world market uncertainty, prompting crypto merchants to take earnings.

-

The promoting conduct is much like the declines that occurred after Trump’s earlier tariff threats, specifically the Feb. 3 and Feb. 28 market rout.

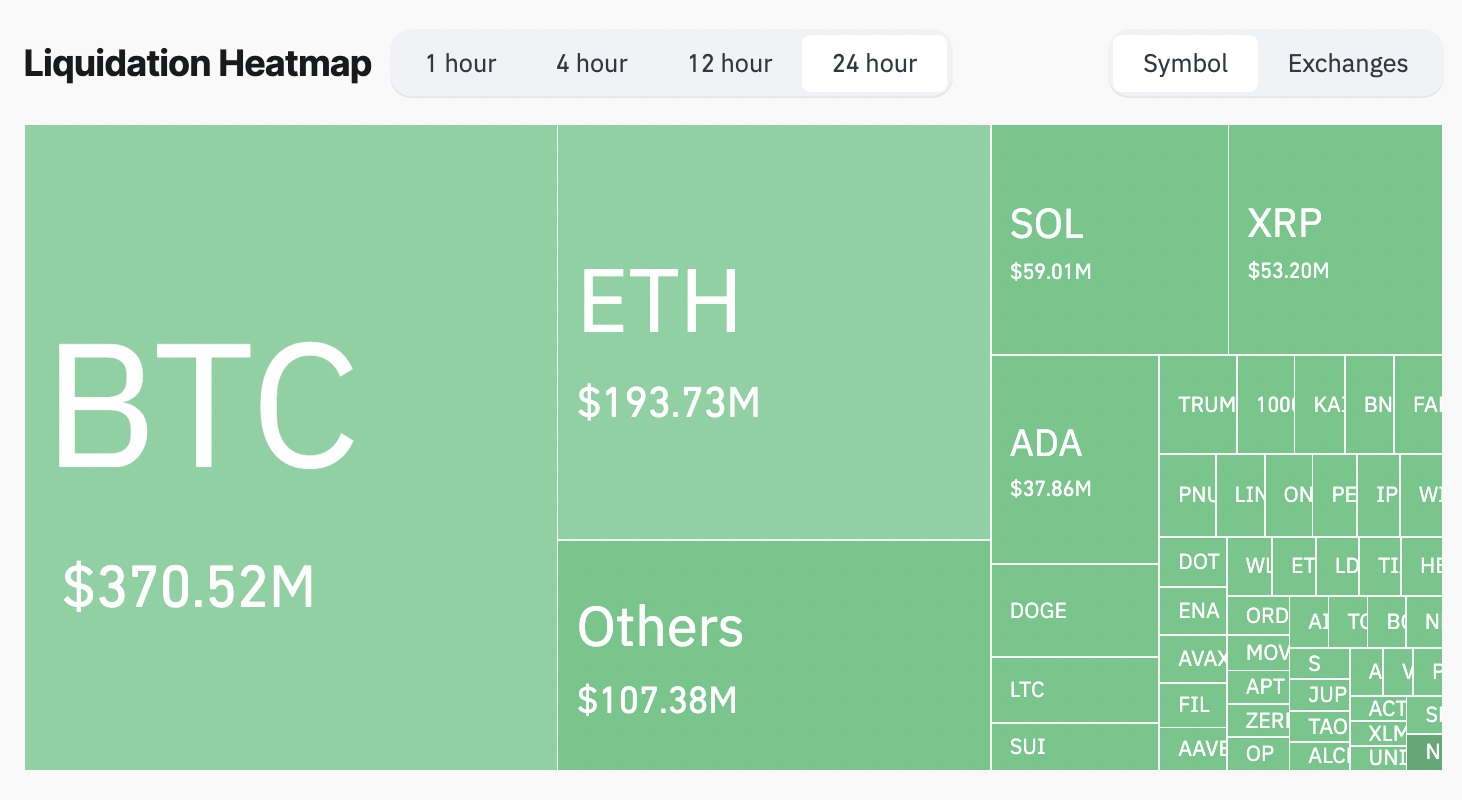

The crypto market’s drop aligns with declines throughout risk-on markets.

Key factors:

-

The S&P 500 dropped by 1.76% on March 3, whereas the Nasdaq composite index declined by 2.64%.

-

The Dow Jones index clocked its second consecutive every day loss, dropping 1.48%.

24-hour efficiency of US equities Supply: Financial Visualizations

-

“Given the robust hyperlink between $BTC and US tech shares, Bitcoin's long-term restoration relies on the NASDAQ100's capacity to pattern increased,” analyst Stefan Luebeck argues.

Associated: Atlanta Fed model predicts GDP to shrink 2.8% in Q1: Trumpcession

-

Within the aftermath of Nvidia formally getting into a bear market, Bitcoin and the crypto market are additionally taking a success, Luebeck mentioned.

Bitcoin and inventory market correlation. Supply: Stefan Luebeck

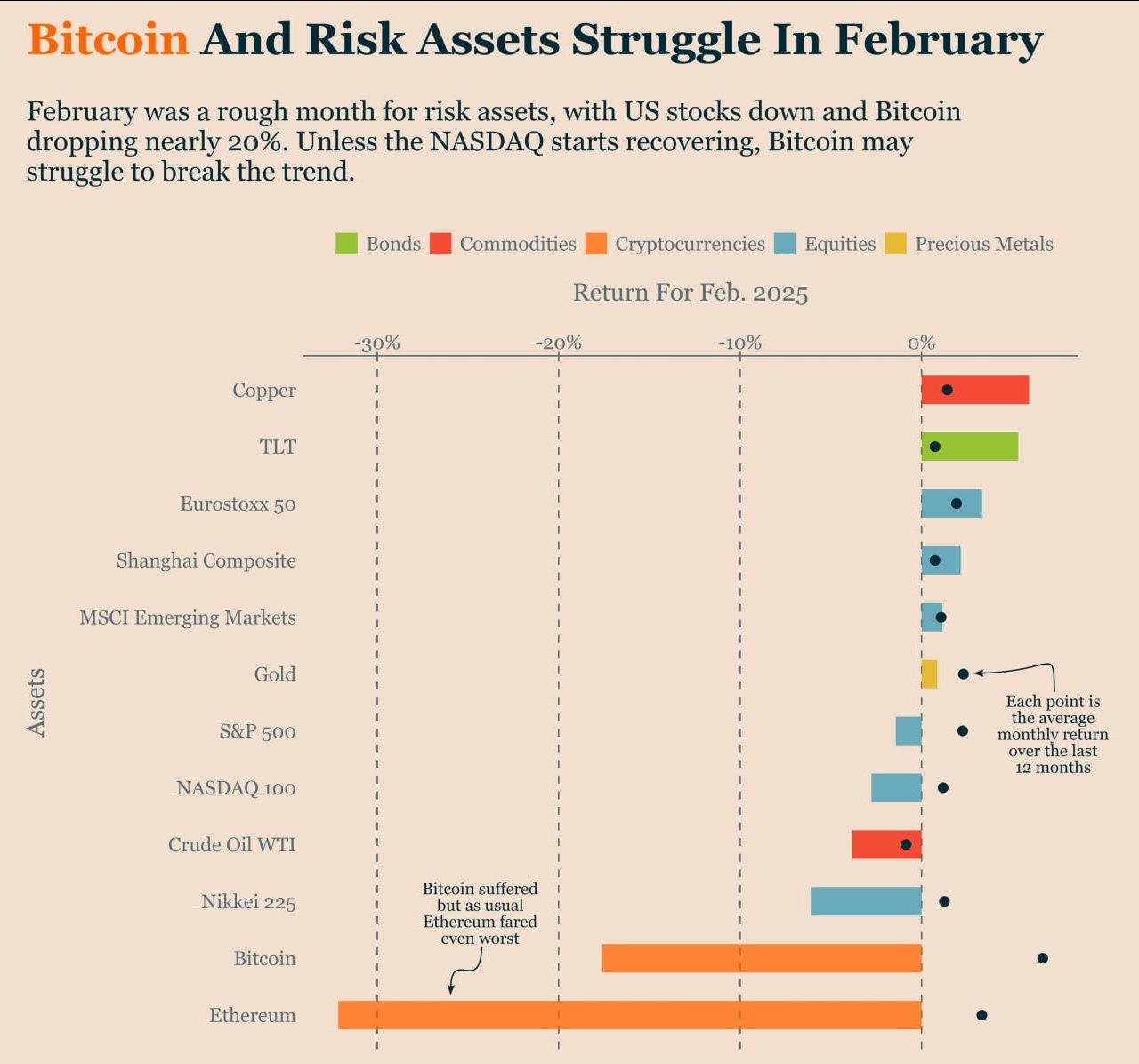

Huge liquidations speed up the sell-off

The crypto market’s decline has additional coincided with liquidations of almost $980 million price of positions.

What to know:

-

A complete of $977.80 million in liquidations has been recorded up to now 24 hours.

-

Lengthy positions took the toughest hit, with $831.96 million liquidated.

Crypto market liquidation heatmap. Supply: CoinGlass

-

Bitcoin and Ethereum had been the most important casualties, with $370.52 million and $193.73 million in liquidations, respectively.

-

When lengthy positions are liquidated, merchants’ holdings are mechanically offered, rising market provide and driving costs decrease.

Market fails to interrupt by means of key distribution space

From a technical perspective, the crypto market’s decline in the present day is a part of a correction pattern that began after hitting a key distribution space.

Key factors:

-

The crypto market has did not decisively break above its 200-4H EMA (blue wave) because the Feb. 3 crash.

-

The final try and reclaim the 200-4H EMA as assist on Feb. 21 failed, resulting in a 20%+ decline.

TOTAL crypto market cap four-hour efficiency chart. Supply: TradingView

-

Because the market retests the 200-4H EMA, indicators of robust promoting sentiment are rising.

-

The repeated rejections at this key stage counsel bears stay in management, holding the market underneath stress.

On the weekly chart:

-

The crypto market’s ongoing correction seems to be a part of its prevailing descending triangle sample.

-

A descending triangle is a bearish continuation sample, forming when the worth makes decrease highs whereas sustaining a flat assist stage on the backside.

TOTAL crypto market cap weekly efficiency chart. Supply: TradingView

-

The sample is confirmed when the worth breaks beneath the assist stage with excessive quantity and drops by as a lot because the triangle’s most peak.

-

As of March 4, the crypto market had entered the sample’s breakdown stage, eyeing a decline towards $2.47 trillion.

-

If promoting stress persists, the 200-week EMA (~$1.76 trillion) may change into the final word draw back goal.

-

Holding the 50-week EMA (~$2.63 trillion) as assist could allow a bounce towards the sample’s decrease trendline, aligning with the $3 trillion stage.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.