On March 4, Ethereum’s native token, Ether (ETH), dropped to a brand new yearly low of $1,996, marking the altcoin’s lowest worth since November 2023. In that 24-hour interval, roughly $100 million in Ethereum positions were liquidated, with ETH futures open curiosity (OI) declining 10.31% throughout all exchanges.

Ethereum 1-day chart. Supply: Cointelegraph/TradingView

Is Ether worth at a generational entry or misplaced trigger?

The second largest cryptocurrency is drawing combined opinions from the crypto business. Ethereum’s Pectra improve was deployed on the Sepolia testnet on March 5, and Gabriel Halm, a analysis analyst at IntoTheBlock, believed it may probably ease ETH’s current promoting stress. Earlier this week, Halm said,

“Whereas Ethereum’s upcoming Pectra improve received’t essentially set off an immediate worth bump, it marks a major step ahead within the ongoing enhancements to the Ethereum ecosystem.”

Likewise, Louie, a crypto analyst, drew a similarity between Ethereum’s present bearish predicament and Bitcoin in 2023. The analyst implied that each property show comparable worth buildings, market sentiment and catalysts, which can finally permit ETH to “rhyme” BTC’s bullish breakout from 2023.

Ethereum vs Bitcoin comparability chart. Supply: X.com

Quite the opposite, Matthew Hyland, a market analyst, stated that Ethereum is presumably already in a bear market. With Ethereum objectively in a 357-day downtrend, Hyland believed no correlation existed between BTC and ETH within the present market. The analyst stated,

“Up till a yr in the past every part was in a bull collectively and a bear collectively, now its combined.”

Moreover, the analyst talked about that ETH’s worth backside will probably define the start of the following cycle.

In the meantime, the confirmed double prime sample on the weekly and month-to-month charts will increase the likelihood of a deeper correction for the altcoin.

Nebraskangooner, a crypto commentator, told his 379,900 followers that primarily based on the sample, the measured breakdown goal is round $1,200, one other 42% beneath ETH’s present worth.

Related: Why is the crypto market down today?

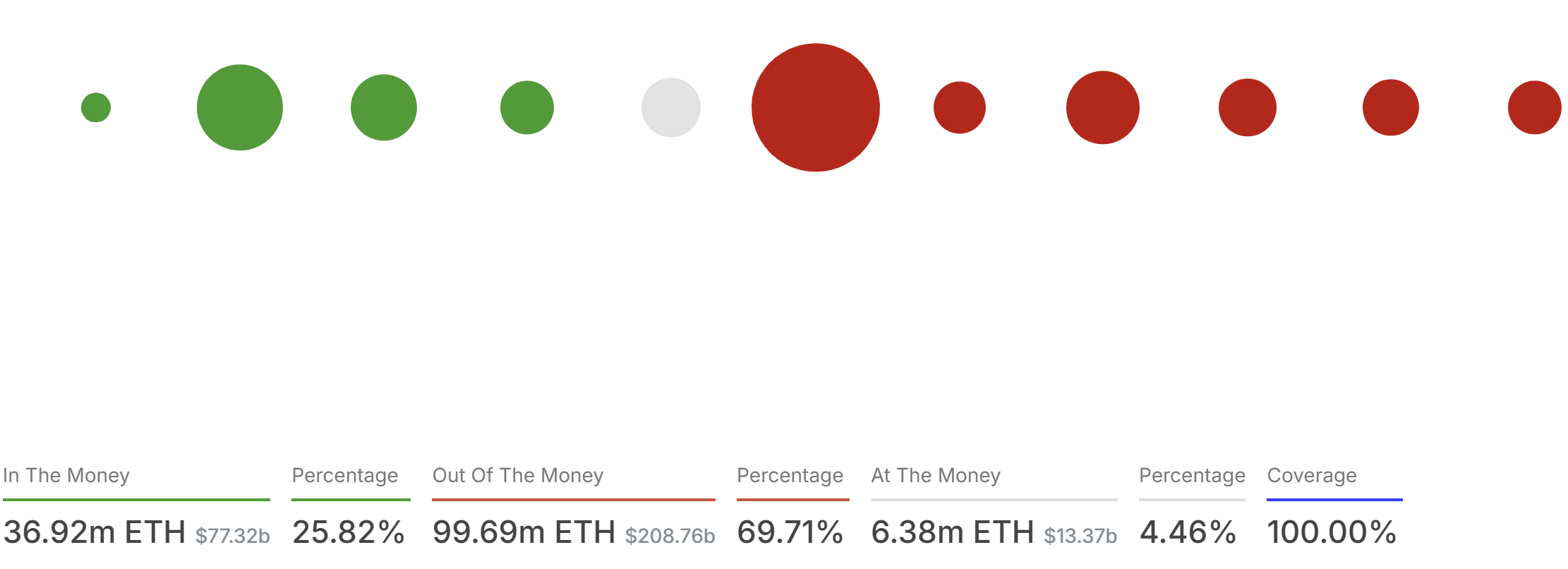

Solely 26% of Ethereum addresses are worthwhile

Between Dec. 1, 2024, and March 4, 2025, Ethereum worth declined 50% in simply 78 days. Whereas such drastic corrections are frequent with low-cap crypto property, ETH has misplaced greater than $250 billion in market cap throughout that interval.

This sharp, bearish turnaround has undoubtedly affected buyers as properly, with information from IntoTheBlock suggesting that solely 26% of all addresses holding 36.92 million ETH are in revenue. A staggering 70% of addresses are “out of the cash,” with solely 4.46% of addresses at breakeven worth.

Lively addresses by profitability. Supply: IntoTheBlock

From a technical perspective as properly, Ethereum’s weekly shut has taken place below a 980-day uptrend, relationship again to earlier cycle lows in June 2022. A break beneath the ascending trendline signifies a long-term pattern reversal, which could be a warning signal for the bulls.

Nonetheless, the altcoin recovered sharply over the previous 24 hours, leaping 12% from current lows at $1,996 to upward of $2,242.

Ethereum 1-week chart. Supply: Cointelegraph/TradingView

The relative power index (RSI) has additionally dropped to multi-year lows, which additional confirms the bearish nature of Ethereum’s long-term market construction. But, it may probably indicate weak point in promoting stress as properly within the short-term, resulting in aid rallies.

Related: Bitcoin sags toward $80K as US dollar strength bounces off 12-week low

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.