Japanese funding agency Metaplanet has purchased one other $44 million price of Bitcoin, which has seen its inventory leap by 19% on the day up to now.

Metaplanet CEO Simon Gerovich stated in a March 5 X post that the agency purchased 497 Bitcoin (BTC) at round $88,448 per coin for a complete spend of $43.9 million. He added the corporate has achieved a year-to-date yield of 45%.

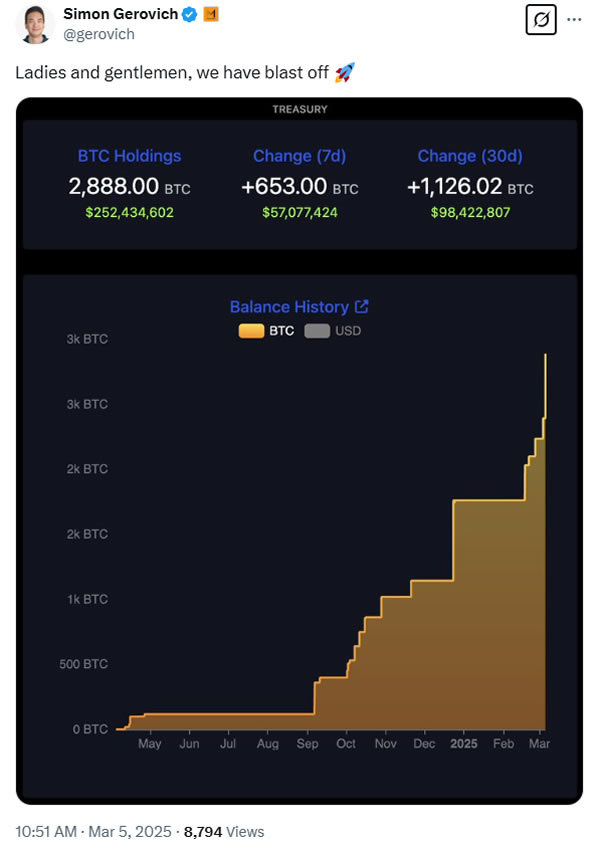

The corporate’s March 5 disclosure stated its newest buy brings its whole Bitcoin holdings to 2,888 BTC at a median buy worth of $84,240 per coin. The stash is price round $251 million, with Bitcoin buying and selling at round $87,150.

Bitcoin has fallen round 8.5% up to now 14 days and hit a three-month low of below $79,000 on Feb. 28 amid concerns of a looming commerce conflict from US President Donald Trump’s deliberate tariffs.

Metaplanet’s inventory worth on the Tokyo Inventory Alternate was up 19% by 2 pm native time on March 5 and was buying and selling round 3,985 Japanese yen ($26.60), according to Google Finance.

Metaplanet inventory March 5. Supply: Google Finance

Its inventory had taken successful over the previous buying and selling week as Bitcoin tanked, however stays probably the greatest performers during the last 12 months, growing over 1,700%.

Metaplanet’s newest purchase is its second buy this week, having scooped up 156 BTC on March 3. Gerovich stated on the time that the agency was exploring a possible itemizing outdoors of Japan, resembling within the US.

Associated: Bitcoin, crypto ‘dip buy hype’ is now at its highest level in 7 months

Metaplanet has acquired 794.5 BTC up to now this 12 months and reported positive factors of round $66 million on these purchases in Q1 2025. It goals to build up 21,000 BTC by 2026 as a part of its broader technique to guide Japan’s Bitcoin renaissance.

These newest acquisitions have propelled Metaplanet to turn into the Twelfth-largest company Bitcoin holder globally and the largest in Asia, having surpassed Hong Kong gaming firm Boyaa Interactive Worldwide, according to BiTBO.

Supply: Simon Gerovich

Gerovich met with officers on the New York Inventory Alternate and Nasdaq in late February to introduce the agency’s “platforms and features.” “We're contemplating the easiest way to make Metaplanet shares extra accessible to buyers around the globe,” he stated on X on March 3.

Journal: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest