Solana noticed almost half a billion {dollars} in outflows final month as traders shifted to what had been perceived to be safer digital property, reflecting rising uncertainty within the cryptocurrency market.

Solana (SOL) was hit by over $485 million value of outflows over the previous 30 days, with investor capital primarily flowing to Ethereum, Arbitrum and the BNB Chain.

The capital exodus got here amid a wider flight to “security” amongst crypto market members, in accordance with a Binance Analysis report shared with Cointelegraph.

Solana outflows. Supply: deBridge, Binance Analysis

“General, there's a broader flight in the direction of security in crypto markets, with Bitcoin dominance growing 1% up to now month to 59.6%,” the report acknowledged.

”A number of the capital flowed into BNB Chain memecoins, pushed partially by CZ’s tweets about his canine, Brocolli,” it added.

Past Solana, whole cryptocurrency market capitalization dropped by 20% in February, pushed by rising destructive sentiment, Binance Analysis famous.

Alongside macroeconomic considerations, the crypto investor sentiment drop was primarily as a result of $1.4 billion Bybit hack on Feb. 21, the largest exploit in crypto history.

Disappointment in Solana-based memecoin launches has additionally curbed investor urge for food, significantly after the launch of the Libra token, which was endorsed by Argentine President Javier Milei.

The undertaking’s insiders allegedly siphoned over $107 million worth of liquidity in a rug pull, triggering a 94% worth collapse inside hours and wiping out $4 billion in investor capital.

Supply: Kobeissi Letter

“Memecoins have advanced from community-driven social experiments right into a chaotic panorama dominated by worth extraction from retail traders,” Anastasija Plotnikova, co-founder and CEO of blockchain regulatory agency Fideum, advised Cointelegraph, including:

“Insider rings, pump-and-dump schemes, and sniper teams have changed the natural, collectible nature of unique memecoins, creating an unhealthy enjoying subject.”

Associated: Bybit hackers may be behind Solana memecoin scams — ZachXBT

Stablecoins, RWAs hit file highs amid market uncertainty

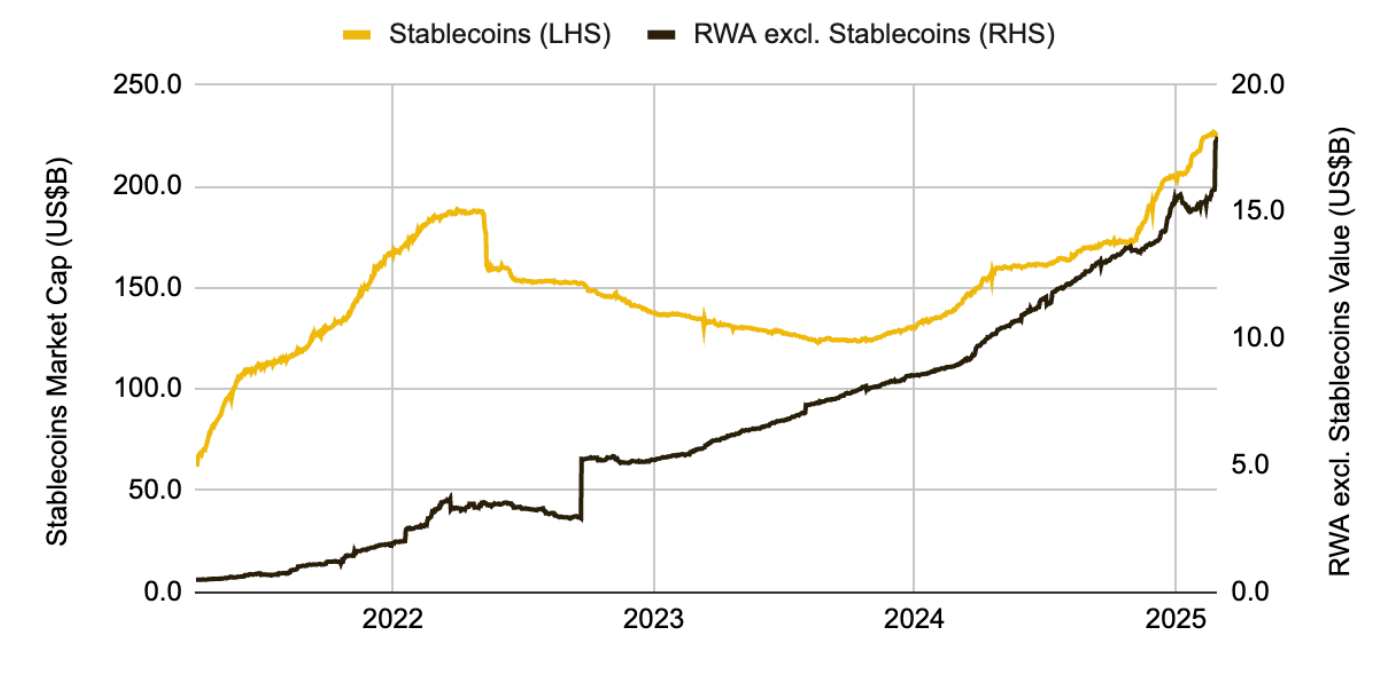

Stablecoins and real-world property (RWAs) rose to all-time highs as investor capital continued to move into extra predictable property with secure worth or yield-generation mechanics.

Stablecoins, RWAs worth. Supply: Binance Analysis

Stablecoins surpassed the file $224 billion excessive whereas onchain RWAs surpassed a cumulative all-time excessive of $17.1 billion throughout 82,000 asset holders, Cointelegraph reported on Feb. 3.

Associated: Solana sees 40% decline in user activity as memecoin rug pulls erode trust

Binance Analysis attributed this capital rotation to the current market turbulence:

“Influenced by macroeconomic elements resembling escalating commerce tensions and diminished expectations of rate of interest cuts, the crypto market has had a tough February. In such an surroundings, traders could select to take chips off the desk and maintain stablecoins as a substitute.”

Extra uncertainty in world danger property resembling Bitcoin (BTC) and cryptocurrencies could drive RWAs to a $50 billion excessive throughout 2025, Alexander Loktev, chief income officer at P2P.org, an institutional staking and crypto infrastructure supplier, advised Cointelegraph.

Journal: How crypto laws are changing across the world in 2025