Solana noticed practically half a billion {dollars} in outflows final month as traders shifted to what have been perceived to be safer digital property, reflecting rising uncertainty within the cryptocurrency market.

Solana (SOL) was hit by over $485 million price of outflows over the previous 30 days, with investor capital primarily flowing to Ethereum, Arbitrum and the BNB Chain.

The capital exodus got here amid a wider flight to “security” amongst crypto market members, in line with a Binance Analysis report shared with Cointelegraph.

Solana outflows. Supply: deBridge, Binance Analysis

“Total, there's a broader flight in direction of security in crypto markets, with Bitcoin dominance rising 1% prior to now month to 59.6%,” the report acknowledged.

”A few of the capital flowed into BNB Chain memecoins, pushed partly by CZ’s tweets about his canine, Brocolli,” it added.

Past Solana, complete cryptocurrency market capitalization dropped by 20% in February, pushed by rising unfavorable sentiment, Binance Analysis famous.

Alongside macroeconomic considerations, the crypto investor sentiment drop was primarily because of the $1.4 billion Bybit hack on Feb. 21, the largest exploit in crypto history.

Disappointment in Solana-based memecoin launches has additionally curbed investor urge for food, notably after the launch of the Libra token, which was endorsed by Argentine President Javier Milei.

The venture’s insiders allegedly siphoned over $107 million worth of liquidity in a rug pull, triggering a 94% value collapse inside hours and wiping out $4 billion in investor capital.

Supply: Kobeissi Letter

“Memecoins have developed from community-driven social experiments right into a chaotic panorama dominated by worth extraction from retail traders,” Anastasija Plotnikova, co-founder and CEO of blockchain regulatory agency Fideum, informed Cointelegraph, including:

“Insider rings, pump-and-dump schemes, and sniper teams have changed the natural, collectible nature of authentic memecoins, creating an unhealthy taking part in subject.”

Associated: Bybit hackers may be behind Solana memecoin scams — ZachXBT

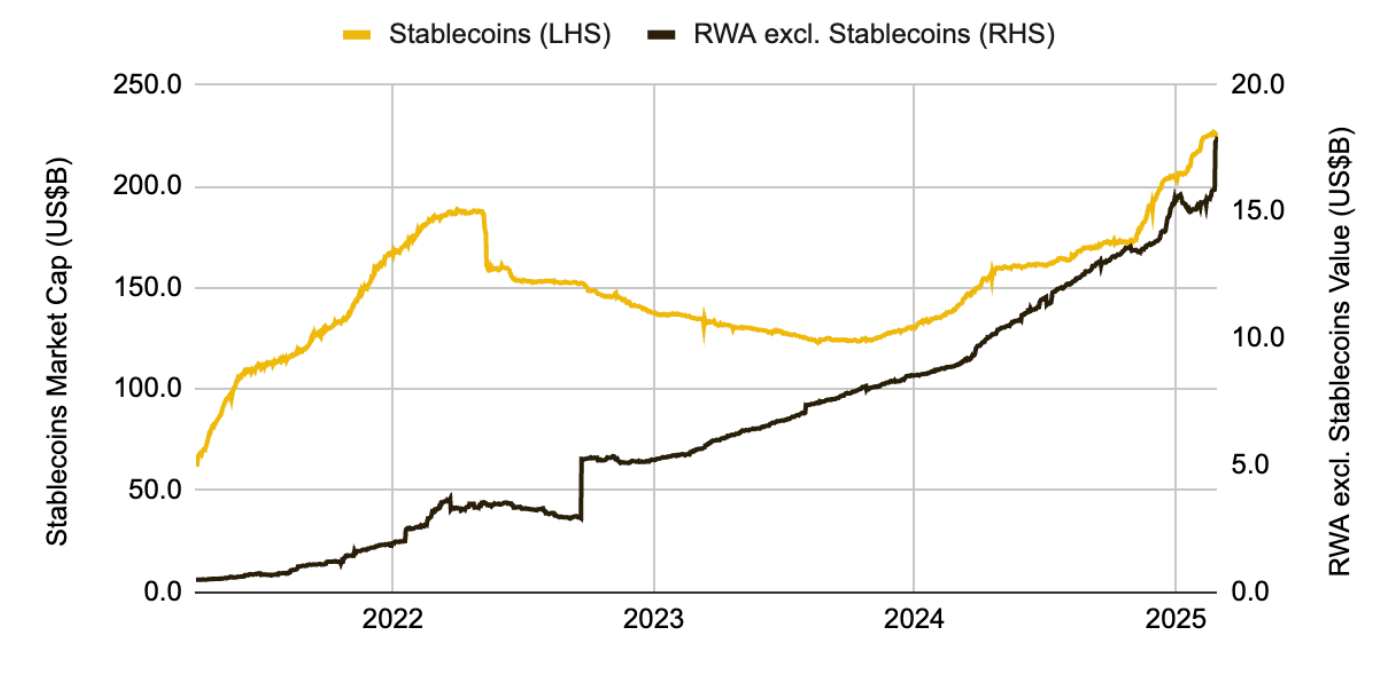

Stablecoins, RWAs hit file highs amid market uncertainty

Stablecoins and real-world property (RWAs) rose to all-time highs as investor capital continued to movement into extra predictable property with steady value or yield-generation mechanics.

Stablecoins, RWAs worth. Supply: Binance Analysis

Stablecoins surpassed the file $224 billion excessive whereas onchain RWAs surpassed a cumulative all-time excessive of $17.1 billion throughout 82,000 asset holders, Cointelegraph reported on Feb. 3.

Associated: Solana sees 40% decline in user activity as memecoin rug pulls erode trust

Binance Analysis attributed this capital rotation to the latest market turbulence:

“Influenced by macroeconomic elements reminiscent of escalating commerce tensions and diminished expectations of rate of interest cuts, the crypto market has had a tough February. In such an atmosphere, traders could select to take chips off the desk and maintain stablecoins as a substitute.”

Extra uncertainty in world danger property reminiscent of Bitcoin (BTC) and cryptocurrencies could drive RWAs to a $50 billion excessive throughout 2025, Alexander Loktev, chief income officer at P2P.org, an institutional staking and crypto infrastructure supplier, informed Cointelegraph.

Journal: How crypto laws are changing across the world in 2025