A strategic Bitcoin reserve in america reduces the likelihood that the federal government will ever “ban” the cryptocurrency and will encourage many extra nations to undertake Bitcoin, based on crypto observers.

On March 7, US President Donald Trump signed an order establishing a Strategic Bitcoin Reserve and a digital asset stockpile.

White Home crypto czar David Sacks mentioned that the reserve can be capitalized with “Bitcoin owned by the federal authorities that was forfeited as a part of prison or civil asset forfeiture proceedings,” estimated at round 200,000 BTC. This apparently disillusioned merchants, because it led to an immediate 6% fall in the price of Bitcoin.

Nevertheless, many say the markets could have it mistaken, and the information needs to be seen as bullish.

President Trump signing SBR government order. Supply: David Sacks

Authorities much less more likely to “ban” Bitcoin

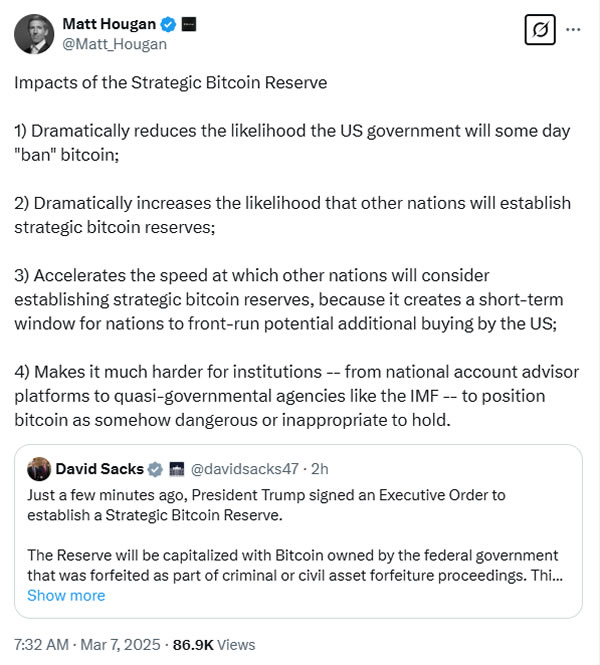

Bitwise chief funding officer Matt Hougan said one of many impacts of a US strategic Bitcoin (BTC) reserve (SBR) is that it “dramatically reduces the probability the US authorities will sometime ‘ban’ Bitcoin.”

In November, the Federal Reserve Financial institution of Minneapolis suggested that Bitcoin might in the future drive the federal authorities to stability its price range.

“A authorized prohibition towards Bitcoin can restore distinctive implementation of everlasting major deficits, and so can a tax on Bitcoin,” it mentioned on the time.

Supply: Matt Hougan

Different nations might comply with swimsuit

The US Bitcoin reserve additionally dramatically will increase the possibilities that different nations will set up Bitcoin reserves and accelerates the pace at which different nations will think about establishing them, mentioned Hougan, because it creates a brief window for them to “front-run” potential Bitcoin shopping for by the US.

The US is the worldwide chief in nation-state Bitcoin holdings, with 207,189 BTC price round $18 billion at present costs, according to BitBO. China is estimated to come back in second with an estimated 194,000 BTC, adopted by the UK, holding 61,000 Bitcoin.

El Salvador is the one nation to have designated BTC as authorized tender. It's nonetheless accumulating and at the moment holds 6,103 BTC price round $534 million, according to the nation’s Bitcoin Workplace.

“I count on lots of the G20 to take discover and ultimately comply with America’s management,” mentioned Coinbase CEO Brian Armstrong.

Legitimizes Bitcoin within the eyes of establishments

Hougan additionally opined {that a} US Bitcoin strategic reserve makes it a lot more durable for establishments corresponding to businesses just like the Worldwide Financial Fund “to place Bitcoin as someway harmful or inappropriate to carry.”

The IMF has been towards sovereign nations, corresponding to El Salvador, investing in BTC. On March 3, the IMF approved a funding program with El Salvador for $1.4 billion on the situation that it downgraded its Bitcoin accumulation technique.

The memorandum of understanding indicated a situation of “no voluntary accumulation of BTC by the general public sector in El Salvador.”

Bitwise head of analysis Ryan Rasmussen continued with the notion, saying that the top recreation was by no means “the US authorities buys the entire world’s Bitcoin.”.

He listed what the US SBR means: “Different nations will purchase BTC, wealth managers don't have any excuse, monetary establishments don't have any excuse, pensions and endowments don't have any excuse, concern of the US promoting is gone, the US will possible purchase extra, probability of states shopping for simply went up, and the chance the federal government outlaws Bitcoin is definitively zero.”

Associated: What to expect at Donald Trump’s crypto summit

The co-founder and CEO at Lightspark, David Marcus, merely said, “It is a balanced final result and the precise resolution for now,” including he was “pleased purpose has prevailed.”

Bitcoin has come a good distance

In the meantime, crypto lawyer John Deaton points out that Treasury Secretary Scott Bessent and Secretary of Commerce Howard Lutnick “have been directed by the POTUS to seek out ‘price range impartial’ methods to amass BTC.”

“Two years in the past, we'd’ve been laughed off stage for suggesting that such a factor might occur.”

It was solely a 12 months in the past that regulators authorized the primary US spot Bitcoin ETF, added ETF Retailer President Nate Geraci.

Bitcoin is at the moment rebounding, having reached $88,000 on the time of writing.

Journal: Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express