Bitcoin is predicted to “blast off” in three weeks as international liquidity tendencies flip in favor of crypto and threat property.

New X analysis from Andre Dragosch, European head of analysis at asset administration agency Bitwise, predicts international cash provide hitting new all-time highs.

3-week countdown to BTC value comeback

A brand new Bitcoin (BTC) value tailwind is brewing as US greenback power drops to its lowest ranges for the reason that begin of November final yr.

The US Greenback Index (DXY), which measures greenback power in opposition to a basket of buying and selling companion currencies, is threatening to drop beneath 104, information from Cointelegraph Markets Pro and TradingView exhibits.

For Dragosch, the implications are already clear.

“If this development continues like that, international cash provide will quickly reclaim new all-time highs,” he wrote, describing DXY because the “most bullish chart you will notice at this time.”

“ what which means for BTC…”

US Greenback Index (DXY) 1-day chart. Supply: Cointelegraph/TradingView

The dollar has but to profit considerably from the brand new US authorities administration, whereas trade tariffs proceed to weigh on risk-asset sentiment.

Analyst Colin Talks Crypto eyed a rebound in whole M2 cash provide for clues a couple of new Bitcoin breakout.

As Cointelegraph reported, Bitcoin stays extremely delicate to international liquidity tendencies, with bull markets intently tied to phases of growth.

“The rally for shares, bitcoin, crypto goes to be epic,” Colin Talks Crypto told X followers this week, reiterating a previous prediction.

“March twenty fifth is the approximate date.”

Danger property vs. international M2 cash provide chart. Supply: Colin Talks Crypto/X

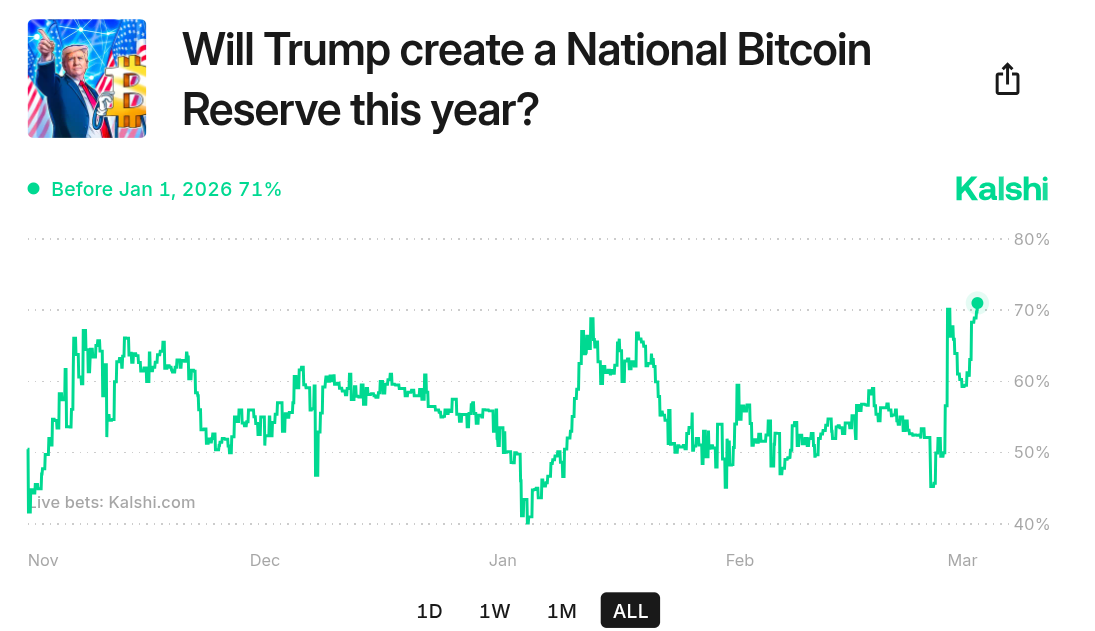

US Bitcoin reserve odds cross 70%

Bitcoin and altcoins may nicely obtain a much-needed enhance forward of time.

Associated: Bitcoin price metric that called 2020 bull run says $69K new bottom

March 7 will see US President Donald Trump host the primary White Home Crypto Summit, with Commerce Secretary Howard Lutnick suggesting that the occasion ought to yield affirmation of a strategic Bitcoin reserve.

Whereas different sources say the transfer might be delayed attributable to a scarcity of congressional help, some longtime crypto market individuals say the reserve is inevitable.

“The Strategic Bitcoin Reserve is coming,” Skilled Capital Administration founder and CEO Anthony Pompliano summarized on X.

“Everybody needs digital sound cash.”

In a market be aware on March 5, Matt Hougan, chief funding officer at crypto index fund and ETF supervisor Bitwise, forecasted that the reserve would go ahead and consist “fully” of BTC.

The most recent information from prediction service Kalshi provides a 71% likelihood of a Bitcoin reserve this yr — the highest-ever odds.

Supply: Kalshi

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.