At its core, tokenization transforms traditional assets into digital tokens that may be traded on a blockchain. Whether or not or not it's actual property, debt, bonds or shares of an organization, tokenization brings effectivity and transparency to those processes. It additionally broadens retail buyers’ entry to those asset lessons. A brand new analysis report by Brickken and Cointelegraph Analysis surveys the underlying enterprise fashions and offers an in-depth evaluation of why many TradFi corporations are leaping on the tokenization development.

The anatomy of tokenized asset issuance

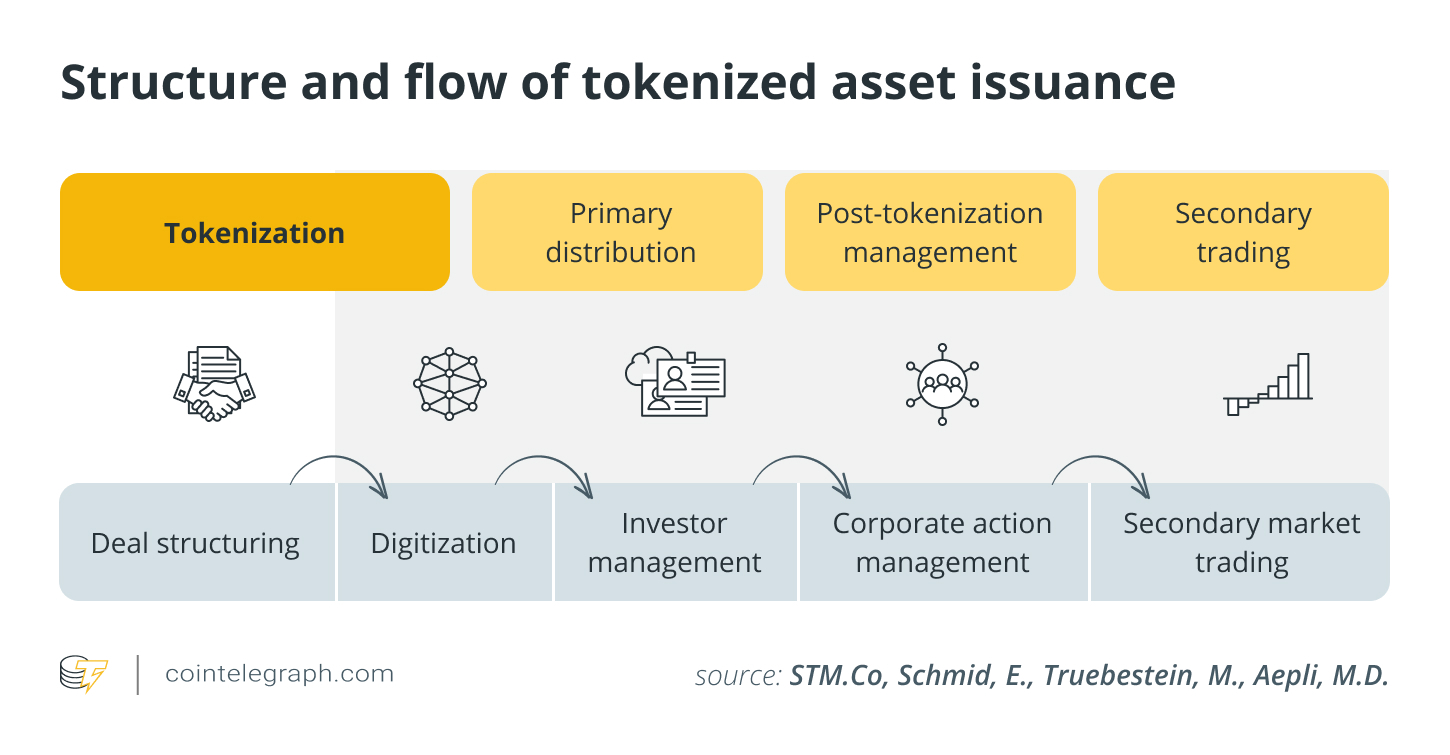

The journey begins with deal structuring, the place the asset, be it a property, a bond or a private equity fund, is recognized and legally organized. Usually, the asset is held by a so-called Particular Objective Car (SPV), a devoted authorized entity designed to guard investor rights.

As soon as the groundwork is laid, the asset enters the digitization section and is recorded onchain. After being minted, good contracts can automate processes resembling compliance checks, dividend funds and shareholder voting. This automation slashes administrative prices and eliminates inefficiencies, making the system quicker and extra dependable.

Throughout main distribution, tokens are issued to buyers in change for capital. That is akin to the digital model of an preliminary public providing (IPO). Traders full Know Your Customer checks, obtain tokens representing fractional possession and acquire instantaneous entry to a safe, clear, blockchain-based document of their funding.

After the preliminary issuance, the tokens are managed by means of post-tokenization actions. The distribution of dividends, shareholder votes and ownership changes are all automated by way of good contracts. Secondary buying and selling platforms can present extra, liquid off-ramps for buyers seeking to money out. As an alternative of ready months and even years to promote conventional belongings, tokenized belongings will be traded with the press of a button.

Revolutionizing asset lessons by means of tokenization

Tokenization isn’t restricted to a single kind of asset. From actual property to debt devices and even carbon credit, its potential functions are almost infinite.

Debt tokenization is a game-changer within the conventional capital markets. By representing bonds or loans as digital tokens, issuers simplify buying and selling and convey much-needed liquidity to those historically static belongings. A notable instance is the European Funding Financial institution, which issued a 100 million euro digital bond on the Ethereum blockchain, a transparent signal of how tokenization is modernizing monetary devices.

The world of fund administration can also be starting to see a seismic shift. Tokenized funds resembling Franklin Templeton’s OnChain US Government Money Fund use blockchain expertise to course of transactions and handle share possession. In line with Safety Token Market, over $50 billion value of belongings throughout all asset lessons have been tokenized by the top of 2024, with $30 billion coming from actual property. As extra establishments embrace blockchain expertise, these figures are anticipated to skyrocket in 2025.

Tokenization is not a theoretical idea, a non-profitable sector or a distinct segment market. It’s been examined, fine-tuned and is poised to reshape the monetary panorama. With streamlined processes, enhanced liquidity and broader entry, this expertise is unlocking alternatives that have been as soon as out of attain.

As 2025 continues, we are able to count on even higher adoption throughout asset lessons, deeper integration with DeFi platforms and extra innovation in tokenized markets. For each conventional and institutional buyers, the way forward for tokenization appears promising.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.

This text is for common info functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don't essentially mirror or symbolize the views and opinions of Cointelegraph.

Cointelegraph doesn't endorse the content material of this text nor any product talked about herein. Readers ought to do their very own analysis earlier than taking any motion associated to any product or firm talked about and carry full accountability for his or her selections.