The decentralized finance (DeFi) platform linked to US President Donald Trump considerably elevated its Ether holdings over the previous week because the cryptocurrency’s worth briefly dipped under $2,000.

Trump’s World Liberty Financial (WLFI) DeFi platform has tripled its Ether (ETH) holdings over the previous seven days as ETH fell under the $2,000 psychological mark, reversing from $1,991 on March 4, Cointelegraph Markets Professional knowledge exhibits.

ETH/USD, 1-month chart. Supply: Cointelegraph

Information provided by Arkham Intelligence exhibits WLFI now holds about $10 million extra in Ether than per week earlier. Its newest acquisitions additionally embrace an extra $10 million in Wrapped Bitcoin (WBTC) and $1.5 million in Movement Network (MOVE) tokens.

Supply: Arkham Intelligence

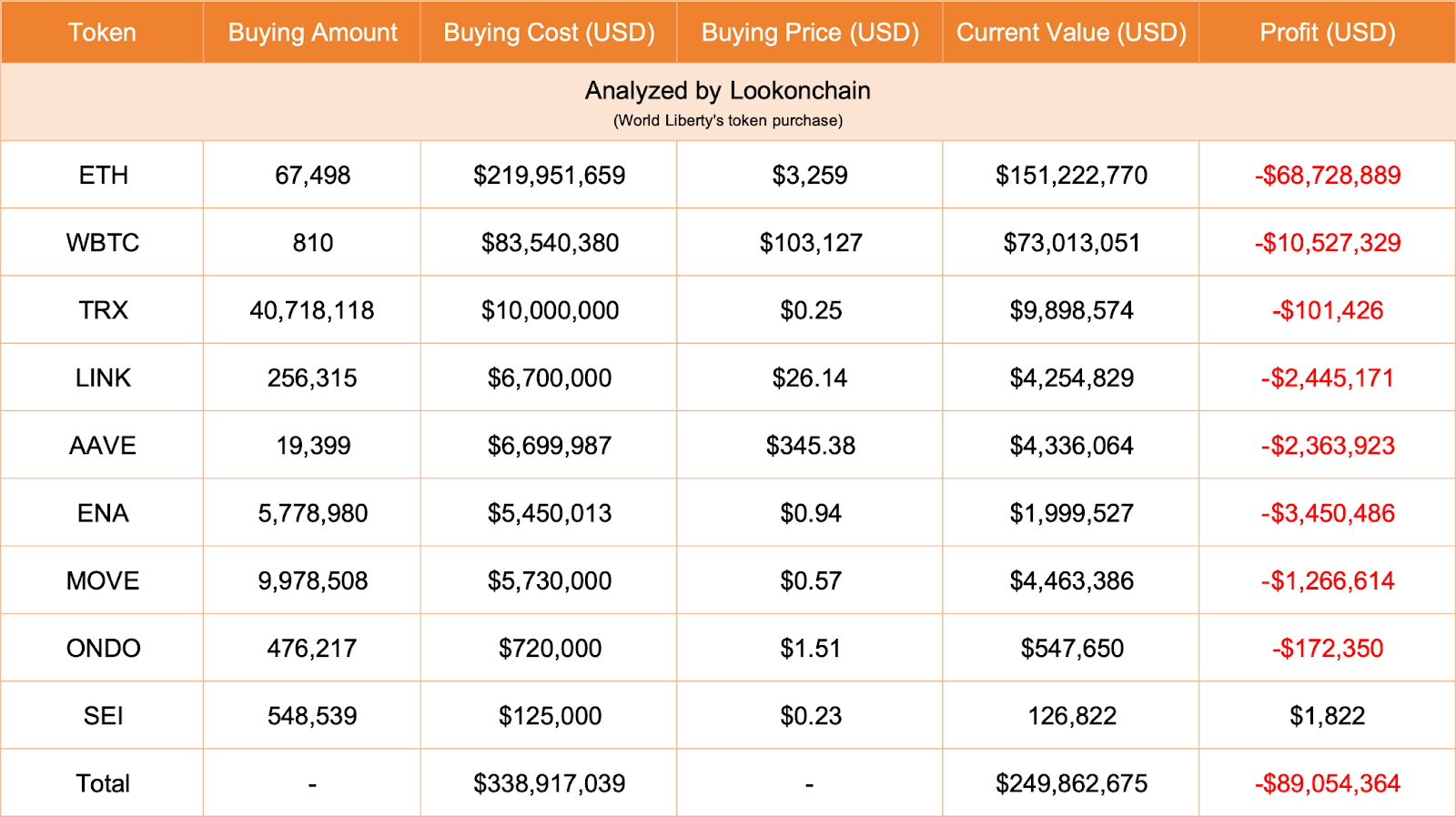

Trump’s DeFi platform is at the moment sitting on a complete unrealized lack of over $89 million throughout the 9 tokens it invested in, Lookonchain knowledge exhibits.

Supply: Lookonchain

The dip shopping for got here throughout a interval of heightened market volatility and investor issues, pushed by each macroeconomic issues and crypto-specific occasions, together with the $1.4 billion Bybit hack on Feb. 21, the largest exploit in crypto history.

The current dip additionally resulted in a “broader flight toward safety in crypto markets,” prompting buyers to hunt safer property with extra predictable yields, reminiscent of tokenized real-world property (RWA), in line with a Binance Analysis report shared with Cointelegraph.

Associated: Can Ether recover above $3K after Bybit’s massive $1.4B hack?

Trump’s WLFI launches “Macro Technique” fund for Bitcoin, Ether, altcoins

WLFI’s newest digital asset investments occurred practically a month after the platform unveiled the “Macro Technique” fund for Bitcoin (BTC), Ether and different cryptocurrencies “on the forefront of reshaping world finance.”

According to a Feb. 11 announcement, the fund goals to strengthen these initiatives and develop their roles within the evolving monetary ecosystem:

“Collectively, we're constructing a legacy that bridges the worlds of conventional and decentralized finance, setting new requirements for the trade.”

The fund goals to “improve stability” by diversifying the platform’s holdings throughout a “spectrum of tokenized property” to make sure a “resilient monetary system” and to spend money on “rising alternatives inside the DeFi panorama.”

Supply: WLFI

The announcement got here three weeks after widespread hypothesis concerning the Trump household launching a “giant” business on Ethereum, in line with Joseph Lubin, co-founder of Ethereum and founding father of Consensys.

Associated: Solana sees $485M outflows in February as crypto capital flees to ‘safety’

“Primarily based on what I'm conscious of, the Trump household will construct a number of large companies on Ethereum,” Lubin wrote. “The Trump administration will do what is nice for the USA, and that can contain ETH.”

Lubin instructed that the Trump administration may ultimately combine Ethereum know-how into authorities actions, just like its present use of web protocols.

Ether is at the moment the biggest holding of WLFI, adopted by $14.9 million price of WBTC and $13.2 million price of the USDT (USDT) stablecoin.

Journal: Trump’s crypto ventures raise conflict of interest, insider trading questions