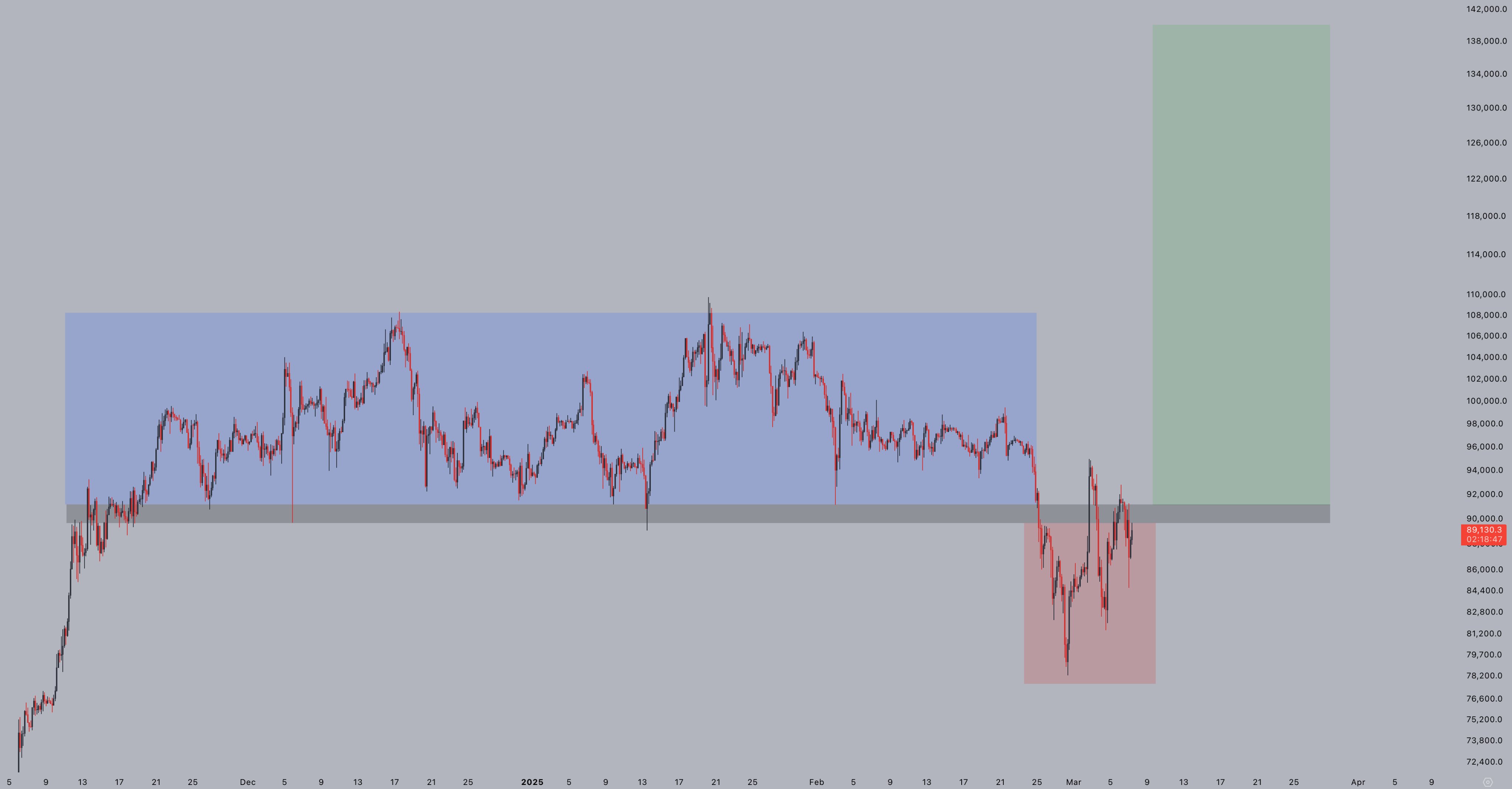

Bitcoin has struggled to commerce above $90,000 since falling under $95,000 on Feb. 24. The crypto asset has been subjected to extreme value fluctuations over the previous week, with Bitcoin’s (BTC) realized volatility, reaching its highest stage since Q3 2024, in keeping with Glassnode.

BTC annualized realized volatility. Supply: Glassnode

Whereas the market braced for additional value swings forward of the first-ever US crypto summit on the White Home, analysts have additionally centered on the US greenback’s present plunge and its potential affect on Bitcoin.

Bitcoin, US Greenback Index correlation hints at new highs

James Coutts, chief crypto analyst at Actual Imaginative and prescient, provided an in depth evaluation analyzing the historic relevance of the declining US Greenback Index (DXY) and Bitcoin. With the DXY exhibiting its fourth-largest 3-day decline in historical past, exceeding -2% to -2.5%, Coutts stated it may catalyze new Bitcoin highs.

Bitcoin and DXY percentile change. Supply: X

Addressing historic information since 2013, the Coutts backtested the correlation between DXY dips and Bitcoin developments and analyzed the information DXY declines within the 2% and a pair of.5% vary.

When DXY worth drops 2.5% or extra:

-

Bitcoin has risen 100% of the time.

-

The most effective case may produce a +1 commonplace deviation transfer of 65% or a $143,000 Bitcoin value

-

The bottom case predicts a median return of 37% or $123,000 Bitcoin value

-

The worst-case end result entails a 14% acquire or a $102,000 Bitcoin value

Within the case of a DXY drop of two% or extra:

-

Bitcoin has risen 17 out of 18 occasions, with a 94% win price over 90 days

-

Greatest-case, a +1 commonplace deviation transfer of 57.8% or $141,000

-

Base-case, a median return of 31.6% or $118,000

-

Worst case, a 14.6% decline or $76,500

With DXY dropping by 3% between March 3 and March 6, Coutts made a “daring name” and predicted new all-time highs (ATH) by Could 2025.

DXY 1-week % change. Supply: X

Equally, Julien Bittel, macro analysis head at World Macro Investor, echoed the potential for an uptrend for Bitcoin primarily based on DXY’s present decline. The analyst stated,

“1) Monetary circumstances lead threat belongings by a few months. 2) Proper now, monetary circumstances are easing – and quick...”

Related: Bitcoin forgets Strategic Reserve 'sell the news event' with 4% bounce

Bitcoin eyes $140K after “Energy of three” breakout

Santiment, an information analytics platform, highlighted that greater than 50,000 wallets had been added to the community over the previous month. The information suggested that 37,390 new wallets held lower than 0.1 BTC, 12,754 wallets held between 0.1-100 BTC, and 6 whale wallets held not less than 100 BTC every.

Bitcoin’s community development chart by Santiment. Supply: X

One of these exercise means that traders stay optimistic concerning the long-term prospects regardless of the value trending downward over the previous month.

From a technical perspective, Jelle, a crypto investor, believed that Bitcoin’s “Energy of Three” setup remained lively in the mean time. The analyst stated,

“Bitcoin nonetheless seems to be wanting to reclaim $91,200. As soon as it does - the ability of three setups comes into play; with a goal of $140,000.”

Bitcoin Energy of three setup. Supply: X

Related: Bitcoin has ‘more than 50% chance’ of new high by June: Cory Klippsten

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.