Community economist Timothy Peterson warns that if the US Federal Reserve holds off on charge cuts in 2025, it might trigger a broader market downturn, doubtlessly dragging Bitcoin again towards $70,000.

“What it wants is a set off. I believe that set off could also be so simple as the Fed not reducing charges in any respect this 12 months,” Peterson said in a March 8 X publish. Peterson’s remark comes only a day after Federal Reserve chair Jerome Powell reiterated that he is in no hurry to regulate rates of interest.

Fed charge reduce delay might spark bear market

"We don't should be in a rush and are well-positioned to attend for better readability,” Powell said in a speech in New York on March 7.

Supply: Timothy Peterson

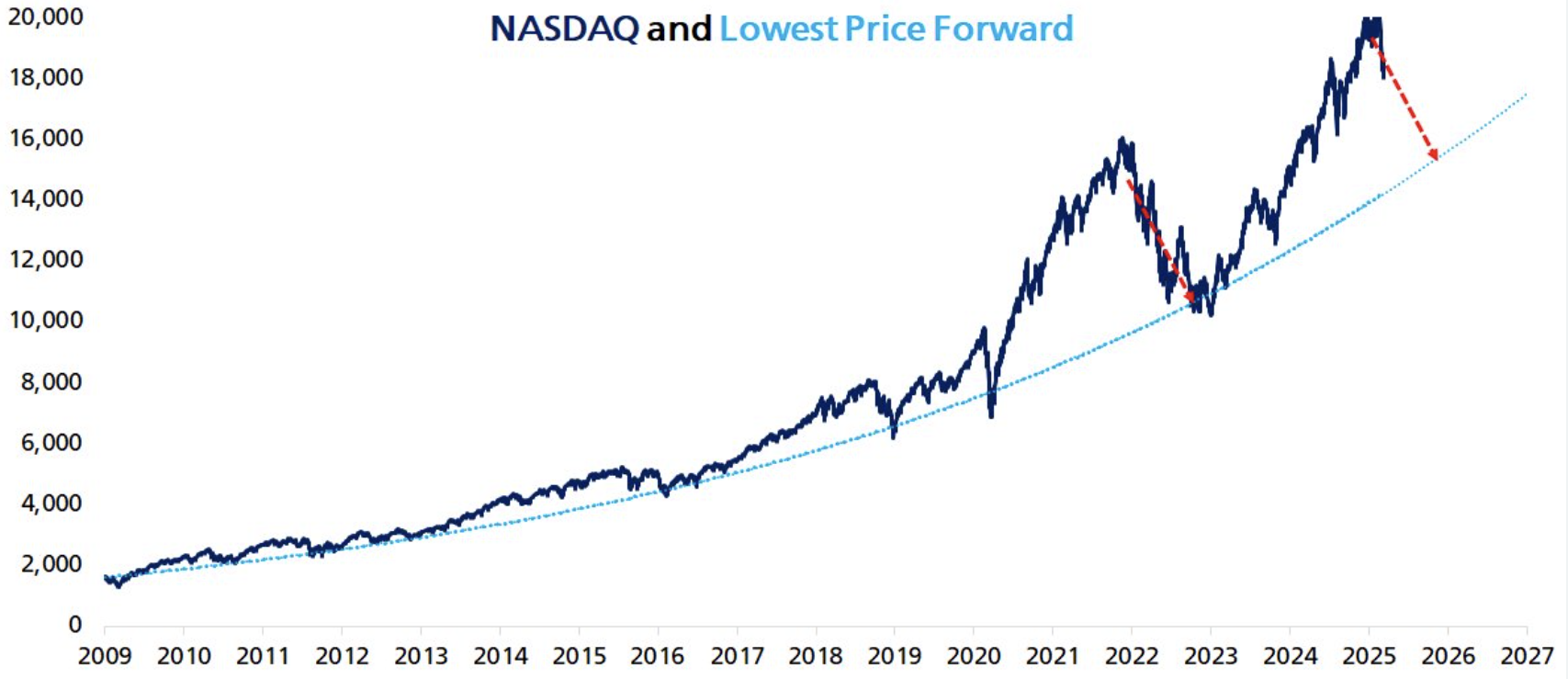

Peterson, who's the writer of the paper “Metcalfe’s Regulation as a Mannequin for Bitcoin’s Worth,” estimated how low the Nasdaq may fall to foretell Bitcoin’s (BTC) potential backside in “the subsequent bear market.”

Utilizing Peterson’s Nasdaq lowest value ahead mannequin, Peterson estimated that the underside would take about seven months to type, with the Nasdaq dropping 17% over the interval.

Making use of a “1.9” occasions multiplier to that quantity for Bitcoin’s decline, he estimated a 33% decline in Bitcoin, bringing it all the way down to $57,000 from its present value at publication, $86,199, according to CoinMarketCap information.

Supply: Timothy Peterson

Nevertheless, he stated Bitcoin doubtless gained’t drop that far, anticipating a backside nearer to the low $70,000 vary based mostly on historic tendencies from 2022.

“Merchants and opportunists hover over Bitcoin like vultures,” he stated, explaining that after the market expects Bitcoin to hit $57,000, “it gained’t get there as a result of there are at all times some buyers who step in as a result of the value is ‘low sufficient.”

Bitcoin's 2022 low didn’t drop as anticipated

“I bear in mind in 2022 when everybody stated the underside could be $12k. It solely went to $16k, 25% larger than anticipated,” he stated earlier than mentioning that the 25% improve from $57,000 is $71,000.

The final time Bitcoin traded on the $71,000 value degree was on Nov. 6, after Donald Trump won the US election, earlier than rallying for a month and reaching $100,000 by Dec. 5.

Associated: Bitcoin investors share mixed reactions to White House Crypto Summit

In January 2025, BitMEX co-founder Arthur Hayes echoed an identical value prediction.

“I'm calling for a $70k to $75k correction in BTC a mini monetary disaster, and a resumption of cash printing that may ship us to $250k by the top of the 12 months,” Hayes said in a Jan. 27 X publish.

In December 2024, crypto mining firm Blockware Solutions stated Bitcoin’s “bear case” for 2025 could be $150,000, assuming the Federal Reserve reverses course on rate of interest cuts.

Journal: Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’