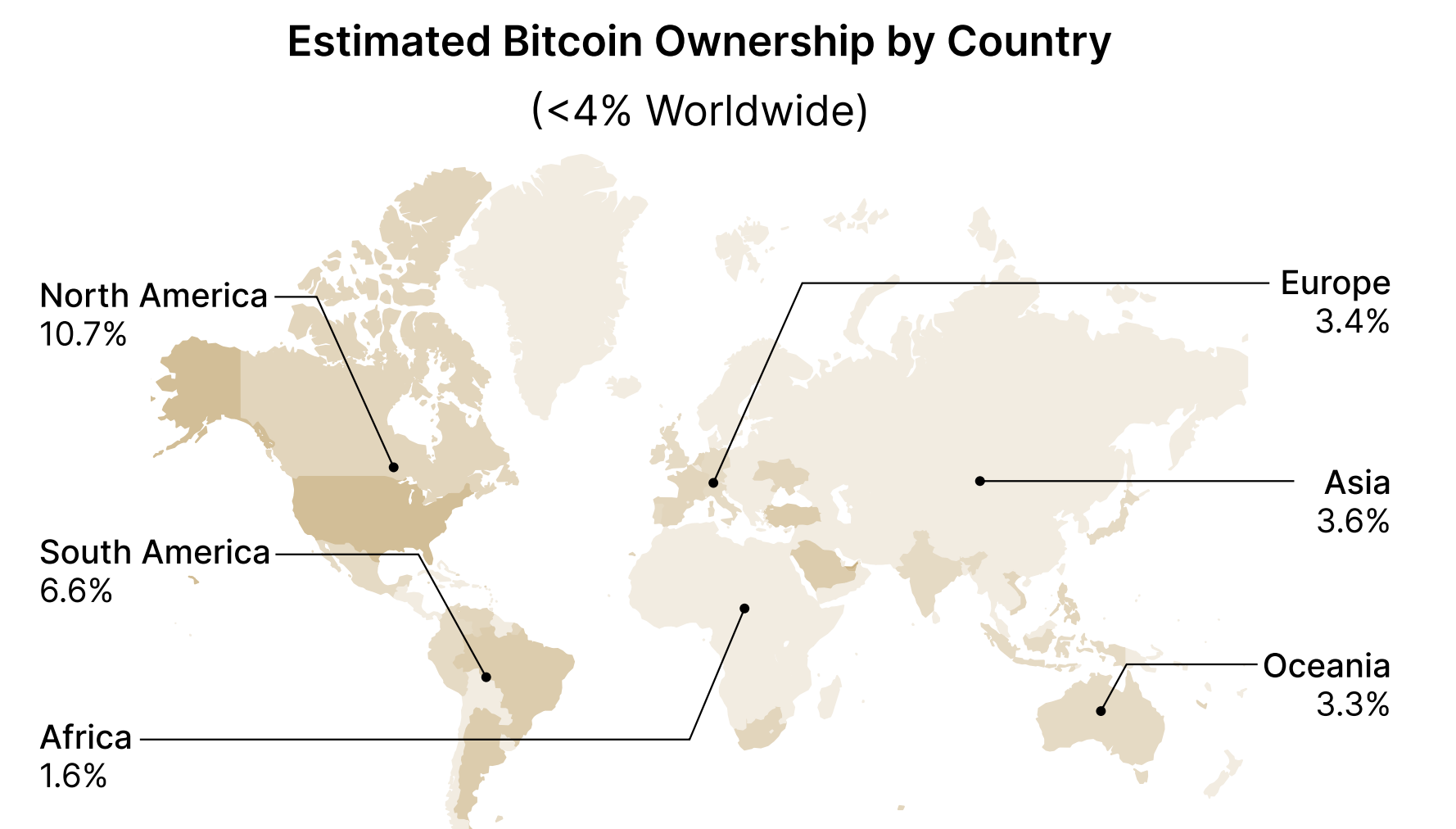

Solely 4% of the worldwide inhabitants presently holds Bitcoin (BTC), with the best focus of possession in america, the place an estimated 14% of people personal BTC.

In line with a analysis report from River, a BTC monetary companies firm, North America stays the continent with the best adoption fee amongst people and establishments, whereas Africa is presently the bottom at just one.6%.

General, BTC adoption tended to be larger in additional developed areas than in creating areas. River estimates that BTC has solely achieved 3% of its most adoption potential — signaling that the digital forex remains to be within the early stages of global adoption.

Bitcoin’s adoption path remains to be solely at 3%. Supply: River

The monetary companies firm arrived on the 3% determine by calculating Bitcoin's complete addressable market, which incorporates governments, companies, and establishments — at just one%.

River additionally took institutional underallocation and particular person possession charges under consideration to reach on the 3% metric.

Though Bitcoin has come a great distance since its early cypherpunk days, lately becoming a US government reserve asset, a number of hurdles stand in the way in which of Bitcoin mass adoption on a worldwide scale.

Estimated Bitcoin possession by geographic area. Supply: River

Associated: Bitcoin risks weekly close below $82K on US BTC reserve disappointment

What's stopping mass adoption?

Bitcoin stands on the intersection of expertise and finance — two matters which are dense sufficient on their very own, not to mention collectively.

The largest downside dealing with Bitcoin's mass adoption is an absence of financial and technical education, which fuels misconceptions about BTC — together with the concept that it's a rip-off or a Ponzi Scheme.

Digital property are additionally infamous for his or her excessive volatility — a good friend of the short-term dealer however the enemy of anybody utilizing BTC as a medium of alternate or a retailer of worth.

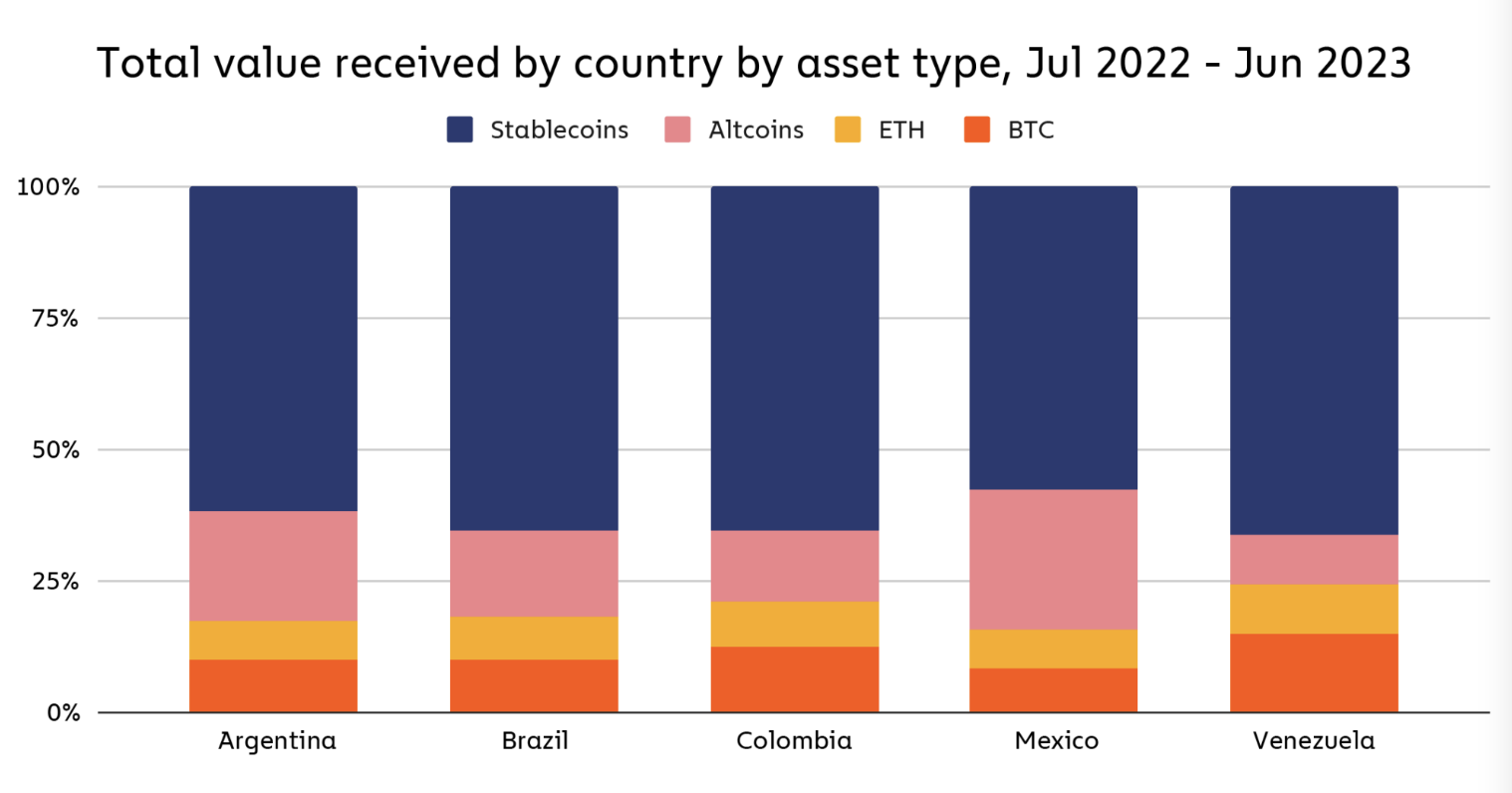

A 2023 report from Chainalysis revealed that stablecoins had been essentially the most broadly transferred digital asset in Latin American counties. Supply: Chainalysis

Excessive volatility disproportionality impacts residents in creating economies, who've turned to US dollar stablecoins as a digital retailer of worth attributable to their low transaction charges and relative stability in comparison with different cryptocurrencies.

In the course of the latest White Home Crypto Summit on March 7, United States Treasury Secretary Scott Bessent introduced that the US will use stablecoins to ensure US dollar hegemony and defend its standing as the worldwide reserve forex.

Journal: Bitcoin payments are being undermined by centralized stablecoins