Ether (ETH) worth dropped beneath $2,600 on Feb. 24 and has since struggled to maintain a significant restoration. The most recent correction towards the $2,000 stage triggered over $918 million in leveraged lengthy (bull) liquidations in ETH futures inside 15 days, in accordance with CoinGlass information.

Merchants now query what must occur for ETH to interrupt above $2,500.

Ether/USD (left) vs. complete altcoin market cap (proper). Supply: TradingView / Cointelegraph

Ether has underperformed the altcoin market by 10% throughout this era, as proven within the chart above.

Extra concerningly, this decline adopted a memecoin frenzy that boosted Ethereum’s foremost competitor, Solana (SOL). This means that extra components are hampering ETH’s worth, and 4 main points should be addressed earlier than Ether can reclaim a bull market.

Ethereum’s upgrades and elevated competitors

For some, the upcoming Pectra upgrade on the Ethereum community falls quick of what's wanted to drive a significant turnaround, whether or not it lowers base-layer transaction charges or considerably enhances usability.

Even when the adjustments do enhance the person expertise, analysts argue that Ethereum nonetheless lacks interoperability throughout completely different layer-2 options, each when it comes to liquidity and person accessibility.

Current studies of empty blocks on the Ethereum testnet have added to danger notion at a time when buyers have been already skeptical. No matter whether or not this challenge is unrelated to the upcoming improve or simply fixable, some merchants fear that any potential delay may very well be perceived negatively by the market.

In essence, concern stays the dominant sentiment, and for this to vary, a number of urgent points should be resolved.

Critics argue that a part of ETH buyers’ disappointment stems from the rise of oblique opponents, such because the modular layer-1 Berachain, which focuses on integrating liquidity and governance for decentralized finance (DeFi) functions.

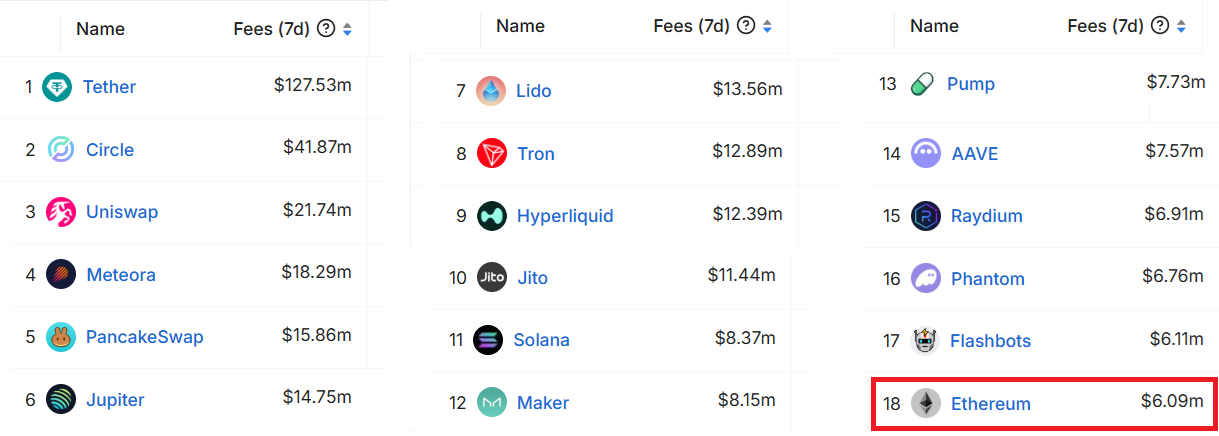

7-day protocol charges rating, USD. Supply: DefiLlama

Berachain has efficiently captured over $3 billion in deposits, as measured by complete worth locked (TVL) on DefiLlama.

Equally, Hyperliquid, a perpetual futures application hosted by itself blockchain, has surpassed $2.8 billion in open curiosity, outpacing opponents on the Ethereum community. In some ways, competitors is rising past the standard mannequin.

For ETH's worth to regain bullish momentum, merchants want reassurance that the Ethereum community provides sensible and clear benefits for its tasks and customers. In the end, Ethereum's concentrate on decentralization and incremental enhancements—whether or not justified or not—may very well be stemming demand in comparison with its competitors.

Weak onchain exercise and institutional demand

The dearth of demand from institutional buyers is obvious within the spot exchange-traded fund (ETF) flows, which were negative in 9 of the final 10 buying and selling days, leading to $406 million in internet withdrawals.

Some analysts prompt that demand may surge following the eventual approval of native staking on Ethereum ETFs, however this idea is now much less sure, on condition that the ETH provide is rising at 0.7% yearly.

Decrease demand for blockchain processing has diminished the burn-fee mechanism, inflicting Ether to change into inflationary. Because of this, the adjusted native staking reward is now beneath 2.5%, whereas deposits in stablecoins yield as much as 4.5% in most DeFi tasks.

In the end, the eventual inclusion of staking in spot ETFs is unlikely to be a game-changer for institutional demand.

Associated: DeFi TVL drops by $45B, erasing gains since Trump election

Lastly, merchants are involved that the US Securities and Trade Fee might approve a spot Solana ETF in 2025, creating direct competitors for buyers who presently solely have entry to Ether and Bitcoin (BTC) ETF merchandise.

Due to this fact, for ETH worth to succeed in $2,500 and past, buyers want clearer proof that Ethereum provides sustainable benefits past its first-mover benefit.

In abstract, Ether’s future will depend on Ethereum community upgrades, elevated community utilization, a subsequent decline in provide, and diminished friction for layer-2 interoperability, guaranteeing that all the ecosystem advantages from its progress.

This text is for basic data functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don't essentially mirror or characterize the views and opinions of Cointelegraph.