Bitcoin (BTC) begins the second week of March at a bearish crossroads as new multimonth lows get nearer.

-

Merchants and analysts agree that little stands in the best way of a $78,000 retest as BTC/USD seals its worst-ever weekly candle.

-

CPI and PPI are due as markets enter a broad risk-off part and shares’ futures tumble.

-

How low can Bitcoin go? $69,000 outdated all-time highs from 2021 are again on the menu.

-

Sentiment is on the ground, and never simply in crypto — however not everybody believes that the state of affairs on the bottom is absolutely all that unhealthy.

-

Whales have been shopping for all through the previous week, indicating a strong risk-return foundation at present worth ranges.

BTC worth dives 14% in every week

Diving to $80,000 into the weekly shut, Bitcoin’s newest weekly candle stands out for all of the incorrect causes.

In US greenback phrases, BTC/USD shed extra worth in seven days than at any time in historical past, information from Cointelegraph Markets Pro and TradingView reveals.

BTC/USD 1-week chart. Supply: Cointelegraph/TradingView

To date, bulls have narrowly prevented a rematch with multimonth lows from late February, however amongst some Bitcoin merchants, the temper is predictably cautious.

“Bitcoin is again within the essential zone of the weekly parabolic development,” fashionable analyst Kevin Svenson wrote in a part of his latest analysis on X.

“We're nonetheless holding the present lows of final week, no new low has been created but. That is $BTC's final probability to take care of an exponential increased low.”

BTC/USD 1-week chart with parabolic trendline. Supply: Kevin Svenson/X

Dealer SuperBro in the meantime joined these making ready for a $78,000 rematch.

“Closed above the prior candle's low and 50% degree, however cracked the uptrend from Oct '23,” a part of a reaction to the weekly shut said.

“A candle like that not often activates a dime, so regardless of bullish divergences on the LTF I am ready for a sweep of the lows.”

BTC/USD 1-week chart. Supply: SuperBro/X

Others sought extra information to substantiate a really bearish breakdown.

“Are we in a bear market now? Merely no. There is not sufficient confluence to substantiate that in any respect,” fashionable dealer CrypNuevo argued in a dedicated X thread.

Even for him, nevertheless, new lows have been on the playing cards, with the world round $77,000 significantly essential.

“We are able to see some liquidations precisely at $77k in HTF, though they don't seem to be as dependable as LTF liquidations,” he continued.

BTC order guide liquidity information. Supply: CrypNuevo/X

CPI week overshadowed by market nerves

This week's key US macroeconomic information releases will not be in brief provide, however markets are already flipping to an more and more “risk-off” stance.

The February print of the Shopper Value Index (CPI) and Producer Value Index (PPI) are each due, together with the acquainted job openings and jobless claims figures.

Each CPI and PPI overshot the mark final month amid an inflation rebound, which shook mark confidence.

Since then, neither crypto nor shares have succeeded in recovering, and with the subsequent Federal Reserve rates of interest choice coming subsequent week, there may be little signal of optimism.

The most recent information from CME Group’s FedWatch Tool places the chances of a reduce on March 19 at simply 3%. In the meantime, the Fed’s Could assembly is seeing rate-cut odds quickly lower.

Fed goal charge chance comparability. Supply: CME Group

“Amid all of the commerce battle chaos, now we have seen financial development expectations crash sharply,” buying and selling useful resource The Kobeissi Letter wrote in a part of its latest X analysis.

“The Atlanta Fed decreased their Q1 2025 GDP development estimate to as little as -2.8% final week. In consequence, we noticed rate of interest reduce expectations transfer up SHARPLY final week.”

Kobeissi famous that on quick timeframes, shares have been gearing up for a “pink” open.

“Crypto's decline was a transparent indication of rising risk-off sentiment this weekend,” it summarized.

Again to 2021 for BTC worth?

With regards to BTC worth backside targets, the panorama is trying ever extra nerve-racking for bulls.

With $80,000 hanging within the stability, one basic forecasting instrument suggests {that a} dependable flooring could solely lie at Bitcoin’s outdated all-time excessive — not from final 12 months, however from 2021.

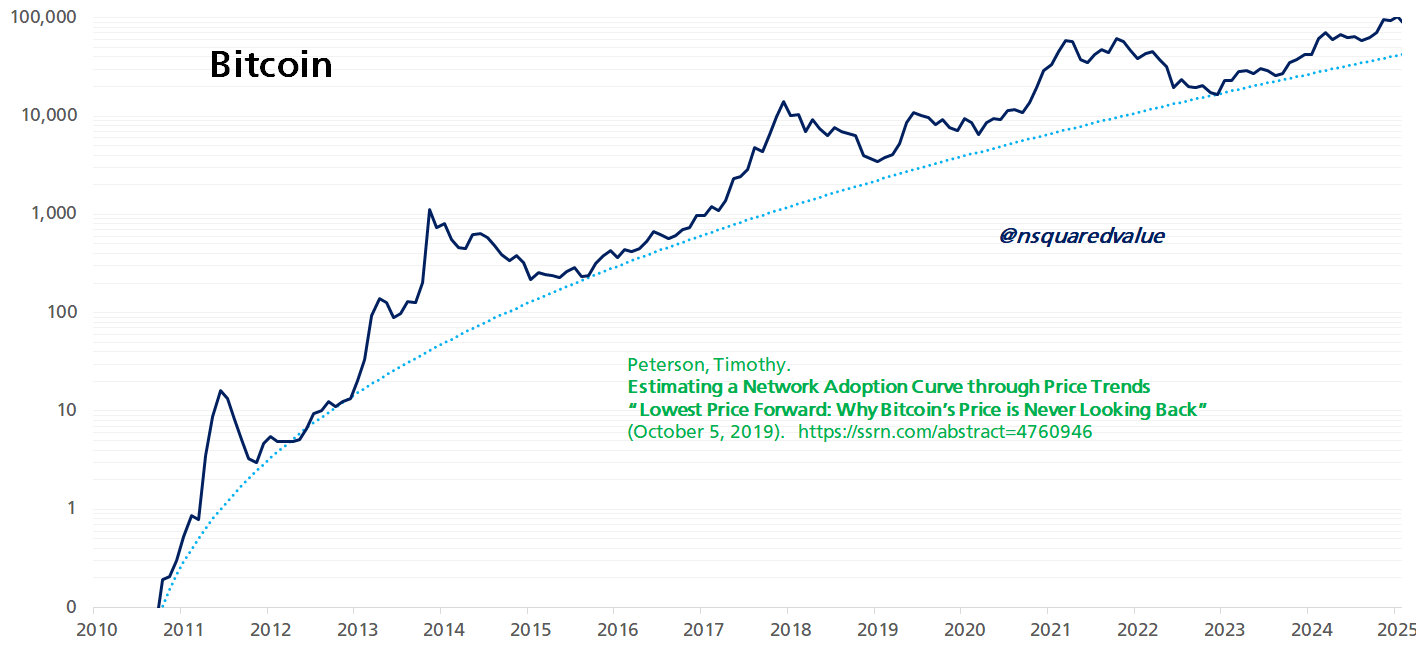

Created by community economist Timothy Peterson in 2019, Lowest Value Ahead successfully delivers BTC worth ranges that won't be violated sooner or later.

In mid-2020, it correctly predicted that BTC/USD would by no means commerce under $10,000 from September onward.

Now, the brand new line within the sand lies someplace round $69,000.

“Lowest Value Ahead doesn’t let you know the place Bitcoin will probably be. It tells you the place Bitcoin gained’t be,” Peterson told X followers in a latest put up this month.

“There's a 95% probability it will not fall under $69k.”

Bitcoin Lowest Value Ahead chart. Supply: Timothy Peterson/X

Peterson’s instrument will not be alone in eyeing new macro lows for BTC/USD to come back.

As Cointelegraph reported, requires a visit to the mid-$70,000 vary are rising, with Bitcoin’s 50-week easy transferring common (SMA) a key goal at $75,560.

The 200-day SMA, historically a bull market assist line, failed as assist across the newest weekly shut for the primary time since final October.

BTC/USD 1-week chart with 50-week, 200-day SMA. Supply: Cointelegraph/TradingView

“An unsightly begin to the week,” Arthur Hayes, former CEO of crypto trade BitMEX, wrote in response, referring to open curiosity (OI).

“Appears to be like like $BTC will retest $78k. If it fails, $75k is subsequent within the crosshairs. There are a number of choices OI struck $70-$75k, if we get into that vary will probably be violent.”

The present multimonth low of just above $78,000 got here on the finish of February.

Crypto, macro sentiment match historic lows

It's no secret that Bitcoin and wider crypto market sentiment is struggling within the present surroundings, however the extent of the bearishness could come as a shock.

The most recent information from the Crypto Fear & Greed Index places the general temper firmly again within the “excessive concern” zone, with the market having fun with a mere one-day break final week.

The Index has barely been decrease in recent times, with Bitcoin’s journey to $78,000 final month sparking a three-year report studying of simply 10/100.

Crypto Worry & Greed Index (screenshot). Supply: Various.me

It's not simply crypto. As famous by finance and buying and selling useful resource Barchart, shares are additionally nervous — to an extent not often seen this century.

“Sentiment is extraordinarily bearish, which is definitely bullish,” Peterson argued about the identical information.

“Lowest studying for the reason that backside of GFC and COVID crash. Markets soared after that. Alternatives of the last decade.”

Supply: Barchart

Skilled Capital Administration founder and CEO Anthony Pompliano in the meantime referred to as on crypto traders not to concentrate to sentiment gauges in any respect.

“The Worry & Greed Index for crypto one 12 months in the past was at ‘Excessive Greed’ of 92. At the moment we're at ‘Excessive Worry’ of 17. Bitcoin is 20% increased over the identical time-frame,” an X put up from Mar. 10 reads.

“Do not get tricked by on-line sentiment. It's all noise.”

Bitcoin whales get up

Is there gentle on the finish of the tunnel of what has turn out to be a hefty crypto bull market pullback?

Associated: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8

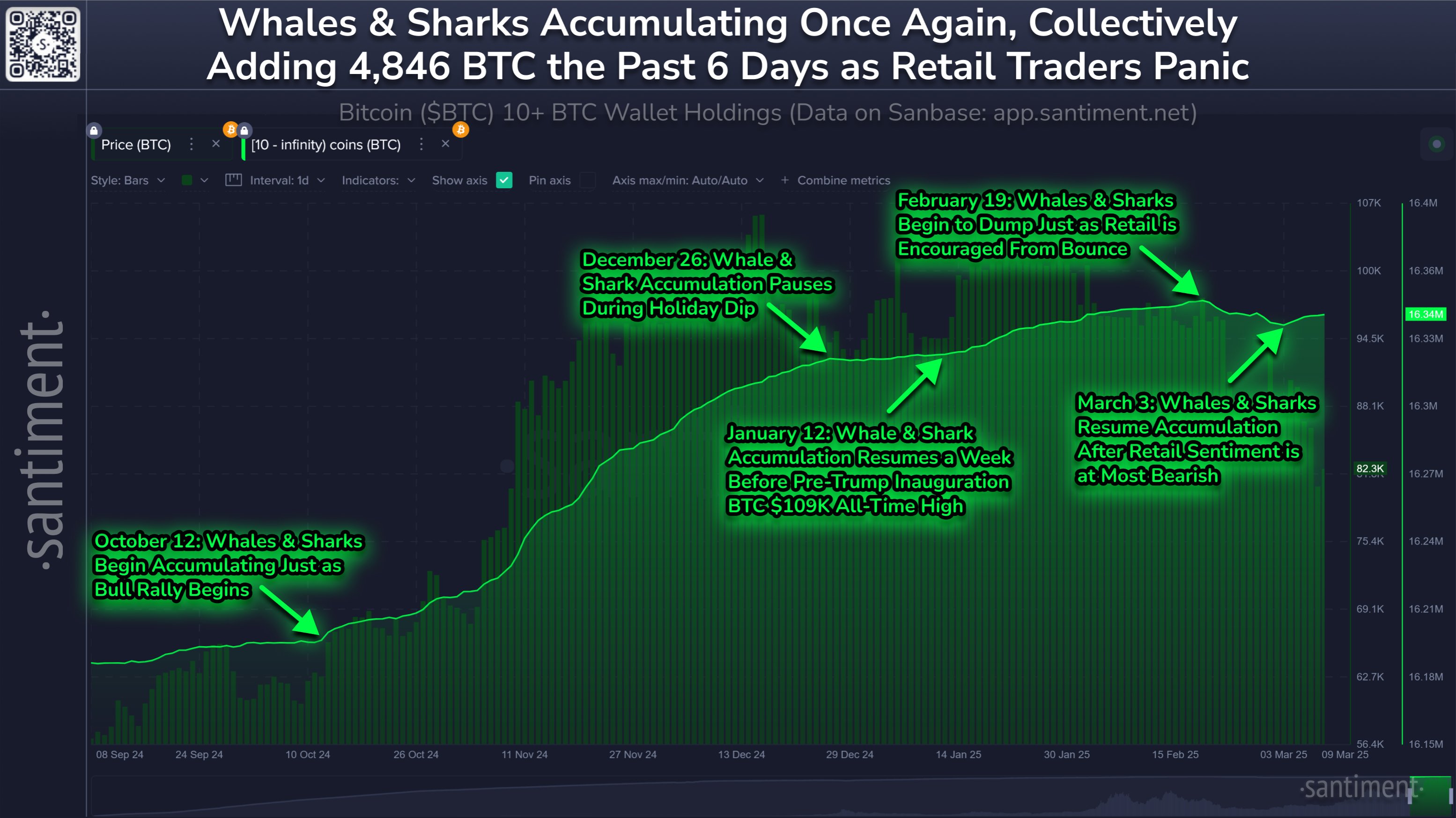

Constructive cues could also be few and much between, however for analysis agency Santiment, one stands out: giant investor accumulation.

Over the primary full week of March, it reveals, Bitcoin whales and “sharks” — entities with 10 BTC or extra — felt it applicable to start out growing their BTC publicity once more.

“Briefly, their gentle dumping from mid-February to early March contributed to crypto's newest dump,” Santiment wrote in a part of X commentary.

“However since March 3, wallets with 10+ $BTC have accrued practically 5,000 Bitcoin again into their collective wallets.”

Bitcoin whale, shark accumulation. Supply: Santiment/X

Researchers acknowledged that worth motion has but to mirror their conviction, however a delayed response may nicely imply that the market sees a contemporary aid rally subsequent.

“Costs haven't reacted to their shopping for simply but, however do not be shocked if the 2nd half of March seems significantly better than the massacre we have seen since Bitcoin's ATH 7 weeks in the past... assuming these giant key stakeholders proceed their coin gathering,” they concluded.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.