Bitcoin (BTC) registered a each day and weekly shut at $80,688 on March 9, the bottom shut since Nov. 11, 2024.

Bitcoin additionally dropped beneath its key 200-day exponential transferring common (200-D EMA) for the second time in two weeks, indicating additional excessive timeframe (HTF) weak point within the charts.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

Whereas the Crypto Concern & Greed Index continues to indicate “excessive worry” on March 10, one BTC market simulation nonetheless highlights bullish projections for the latter half of 2025.

Monte Carlo mannequin alerts an 800% BTC value rise

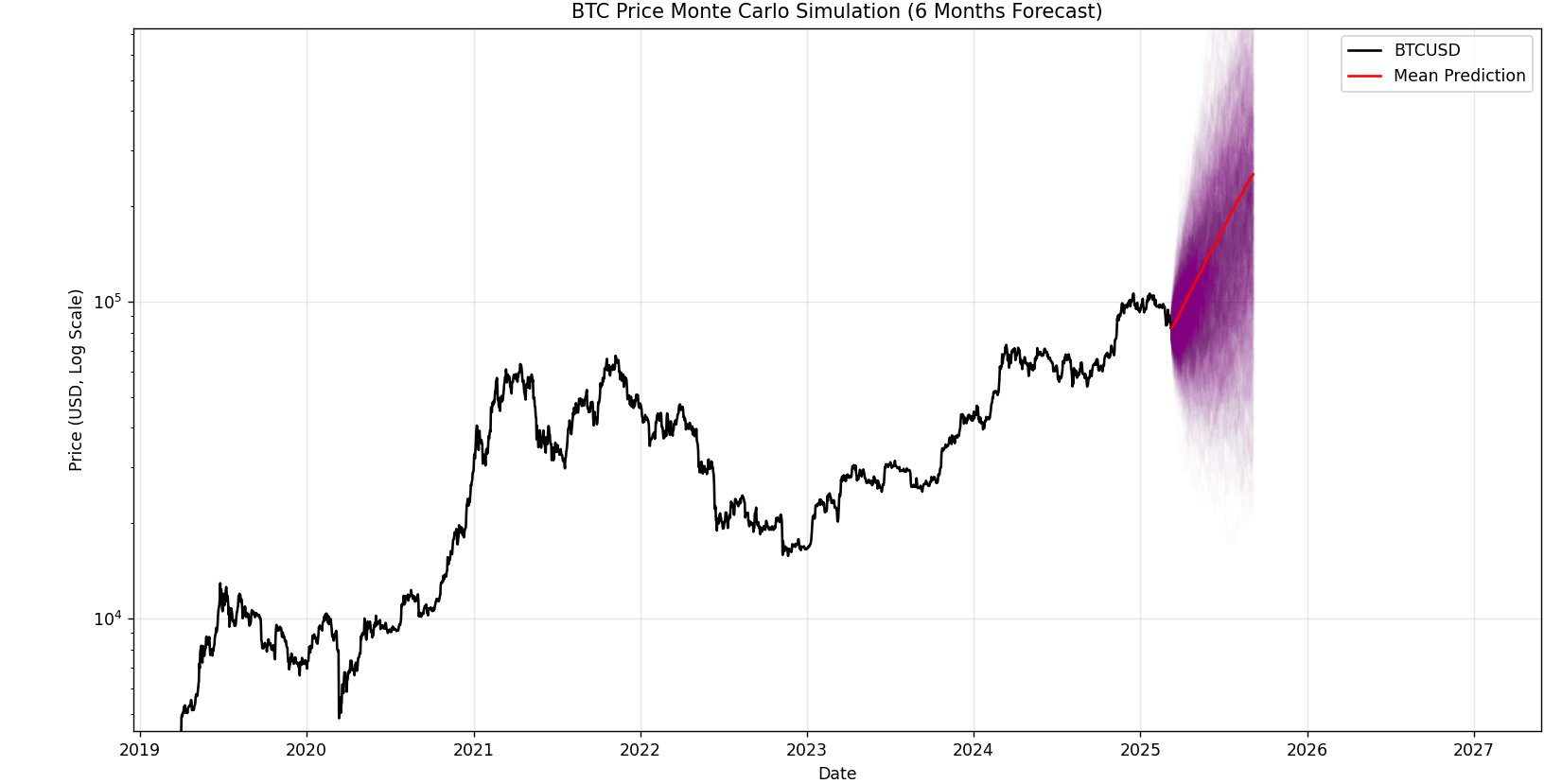

Mark Quant, a crypto researcher, performed a Monte Carlo simulation to investigate Bitcoin's value, offering a six-month forecast for the crypto asset.

The Monte Carlo mannequin is a computational technique utilizing random sampling to simulate value projections and assess threat. It could actually generate a number of potential eventualities based mostly on variable components resembling volatility and market developments.

Bitcoin Monte Carlo projections by Mark Quant. Supply: X.com

Primarily based on the preliminary value of $82,655, the examine estimated a imply remaining value of $258,445 by the tip of September 2025. Nonetheless, on a broader scale, the value was anticipated to fluctuate between $51,430, i.e., a fifth percentile return and $713,000 on the ninety fifth percentile.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

Nonetheless, you will need to observe {that a} Monte Carlo mannequin depends strongly on the Geometric Brownian Movement (GBM) mannequin, which assumes that the asset worth follows a random path with a continuing parameter drift.

On this evaluation, Bitcoin's inherent volatility is constructed into the mannequin, capturing long-term historic efficiency and patterns whereas adapting to future shifts. Basically, the Monte Carlo evaluation stays as becoming as “rolling the cube."

Final week, Quant additionally highlighted a correlation between the entire crypto market cap and the worldwide liquidity index, indicating that the TOTAL market cap worth could attain new highs above $4 trillion in Q2 2025.

Bitcoin eyes new CME hole after $80K retest

Bitcoin value dropped 6.38% over the weekend, making a contemporary CME futures gap within the charts. The CME Bitcoin futures hole describes the value distinction between the closing of CME Bitcoin futures buying and selling on Friday and its reopening on Sunday night.

Bitcoin CME hole. Supply: Cointelegraph/TradingView

As illustrated within the chart, the CME hole presently lies between $83,000 and $86,000, a pretty big hole of $3,000. Primarily based on previous conduct, Bitcoin tends to “fill” or return into these gaps on the upper timeframe charts, with the earlier seven gaps stuffed out prior to now 4 months.

Mark Cullen, a technical analyst, additionally highlighted the CME hole, which took type over the weekend, and speculated the potential for a brief squeeze earlier than the US markets open on March 10. Nonetheless, the dealer added,

“Lose the weekly open at ~80K and there's a hole right down to low 70K's.”

Related: US dollar plunge powers Bitcoin bull case, but other metrics concern: Analyst

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.