The XRP (XRP) every day chart registered its lowest candle shut in 99 days on March 10. The altcoin dropped beneath the $2 assist degree however registered a short-term restoration of 12% on March 11.

XRP 1-hour chart. Supply: Cointelegraph/TradingView

On the excessive timeframe (HTF) charts, XRP should maintain above its psychological degree at $2, however different metrics recommend {that a} deeper drawdown is feasible.

XRP markets lacks patrons as futures flip bearish

XRP worth is at present down 37.1% from its all-time excessive of $3.40. When costs dipped by an identical share on Feb. 3, spot market bids rapidly absorbed the promoting stress, pushing XRP above $2.50.

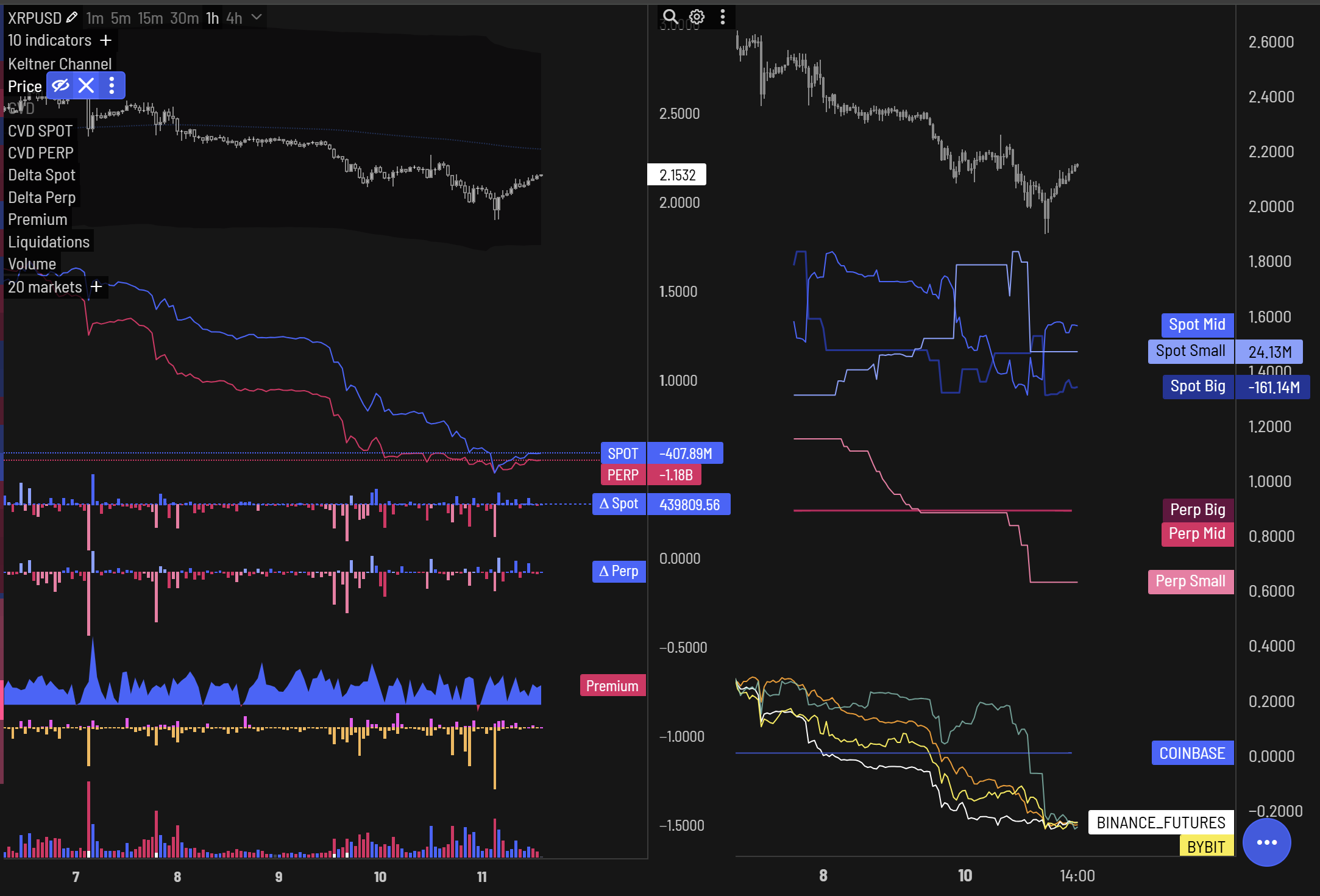

XRP’s spot and perpetual aggregated information. Supply: aggr.commerce

Nevertheless, XRP‘s spot and perpetual markets have been comparatively bearish over the previous week. Knowledge from aggr.trade signifies that XRP’s spot cumulative quantity delta (CVD) has dropped by 50% in March.

A unfavorable CVD means that there's extra promoting quantity than shopping for. The present CVD worth is -$408 million, which indicators waning demand, with sellers taking management.

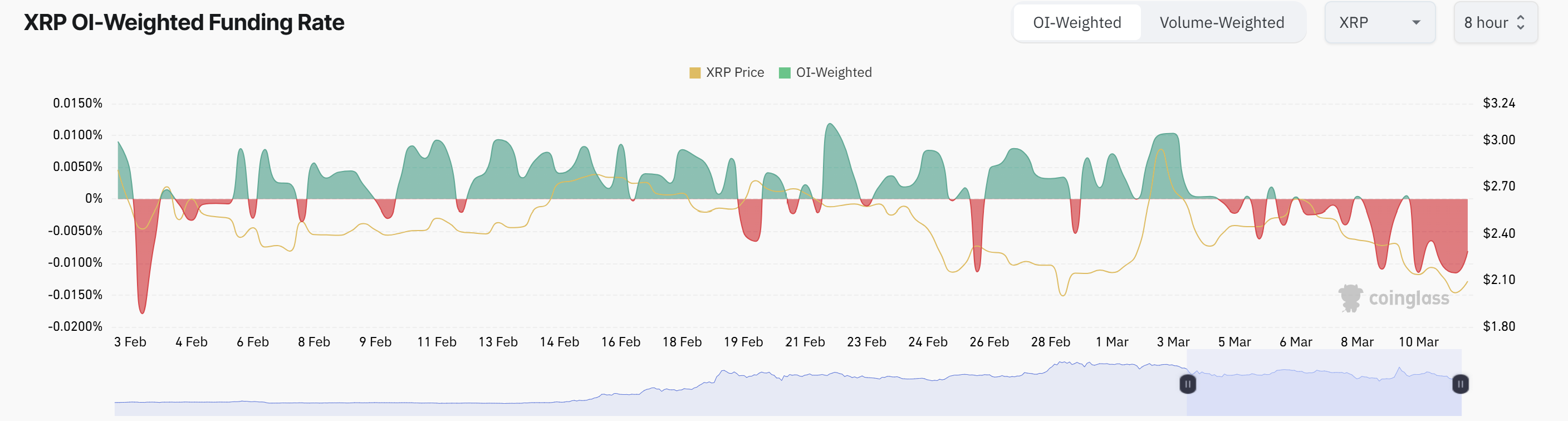

Likewise, futures merchants are additionally turning bearish, with perpetual CVD dropping to -1.18 billion on March 11. XRP’s open interest-weighted funding rate has additionally turned considerably unfavorable, which signifies extra brief positions have been added over the previous few days.

XRP funding price chart. Supply: Coinglass

XRP whales proceed promoting spree

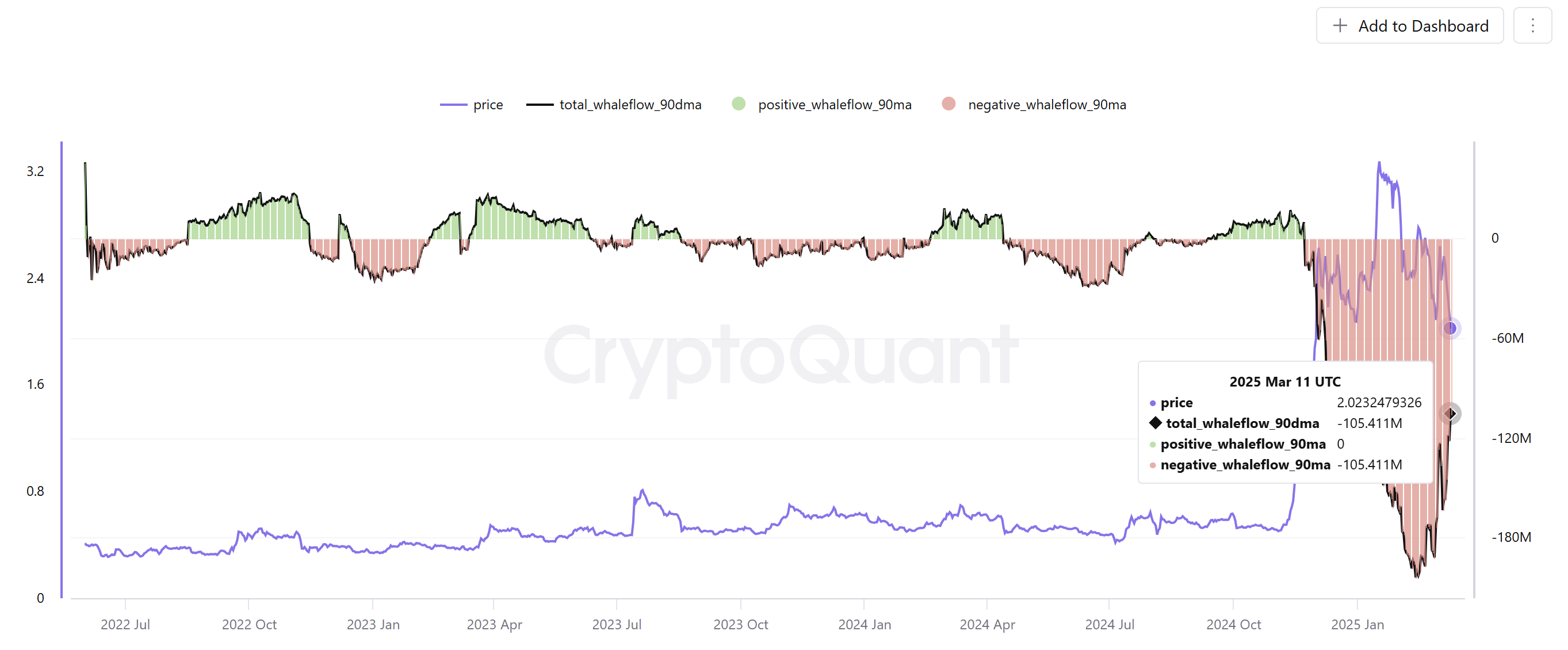

Final week, XRP’s quantity bubble map confirmed a surge in exercise towards the tip of February. Ki-Younger Ju, CryptoQuant founder, observed that this uptick aligned with an ongoing distribution section for XRP.

Distribution refers to a interval out there cycle when massive buyers slowly offload their positions to safe features, normally occurring near the height of an upward development.

Related: Why is the XRP price down today?

Present information reveals that the distribution section has intensified over the previous seven days. Particularly, whale outflows, measured as a 30-day transferring common—have steadily risen.

This enhance suggests that giant holders continued to dump their XRP positions, additional driving the distribution development.

XRP complete whale flows. Supply: CryptoQuant

Between March 4 and March 10, these massive XRP holders offloaded roughly $838 million in positions. This vital sell-off displays the continuing bearish development for XRP.

XRP worth H&S sample hints at $1.60 retest

On March 11, XRP’s 1-day chart closed beneath $2.05, which is the essential neckline of the every day head-and-shoulders sample. This sample has probably robust bearish penalties when noticed on a excessive timeframe (HTF) chart.

XRP 1-day chart. Supply: Cointelegraph/TradingView

Cheaper price are doubtless if XRP fails to reclaim $2.05 as assist, as illustrated within the chart above.

The rapid goal zone for XRP worth stays between 0.5 and 0.618 Fibonacci retracement traces. Also referred to as the “golden zone,” the retest vary lies between $1.90 and $1.60. The chance of retesting the 0.618 Fibonacci or $1.60 is excessive within the present bearish surroundings.

Failure to carry this vary might result in a retest of the long-term demand zone between $1.58 and $1.27.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.