Bitcoin (BTC) dropped to a four-month low of $76,700 on March 11, following a 6% weekly decline within the S&P 500 index.

The inventory market correction pushed the index to its lowest stage in six months as buyers priced in larger odds of a world financial downturn.

Regardless of Bitcoin's 30% drop from its all-time excessive of $109,350, 4 key indicators counsel that the correction could also be over.

Bitcoin bear market wants 40% drop, sturdy USD

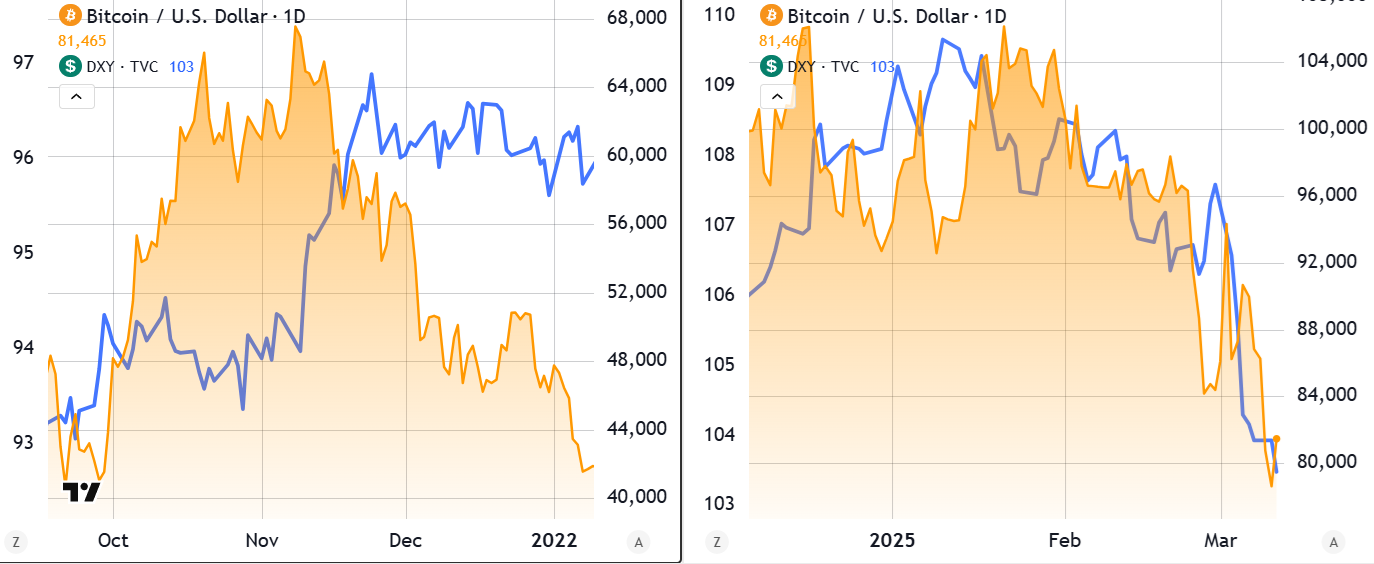

Some analysts argue that Bitcoin has entered a bear market. Nonetheless, the present value motion differs considerably from the November 2021 crash, which began with a 41% drop from $69,000 to $40,560 in simply 60 days.

A comparable situation in the present day would suggest a decline to $64,400 by the tip of March.

Bitcoin/USD in Nov. 2021 vs. Feb. 2025. Supply: TradingView / Cointelegraph

The present correction mirrors the 31.5% drop from $71,940 on June 7, 2024, to $49,220 over 60 days.

Moreover, through the late 2021 bear market, the US greenback was strengthening in opposition to a basket of foreign exchange, as mirrored within the DXY index, which surged from 92.4 in September 2021 to 96.0 by December 2021.

DXY (left, blue) vs. BTC/USD (proper). Nov. 2021 vs. Feb. 2025. Supply: TradingView / Cointelegraph

This time, nevertheless, the DXY began 2025 at 109.2 and has since declined to 104. Merchants argue that Bitcoin maintains an inverse correlation with the DXY index, as it's primarily seen as a risk-on asset quite than a safe-haven hedge in opposition to greenback weak point.

General, present market circumstances present no indicators of buyers transferring to money positions, which helps Bitcoin’s value.

BTC derivatives wholesome as buyers worry AI bubble

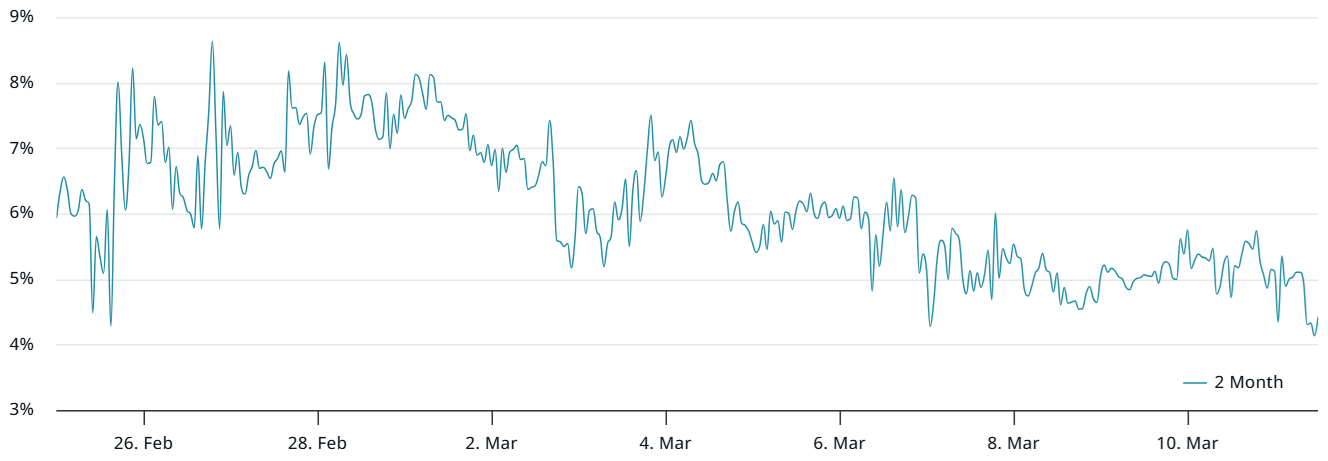

The Bitcoin derivatives market stays steady, as the present annualized premium on futures stands at 4.5%, regardless of a 19% value drop between March 2 and 11.

For comparability, on June 18, 2022, this indicator fell beneath 0% after a pointy 44% decline from $31,350 to $17,585 in simply 12 days.

Bitcoin 2-month futures annualized premium. Supply: laevitas.ch

Equally, the Bitcoin perpetual futures funding price is hovering close to zero, signaling balanced leverage demand between longs and shorts. Bearish market circumstances usually drive extreme demand for short positions, pushing the funding price beneath zero.

A number of publicly traded corporations with market values exceeding $150 billion have seen sharp declines from their all-time highs, together with Tesla (-54%), Palantir (-40%), Nvidia (-34%), Blackstone (-32%), Broadcom (-29%), TSM (-26%), and ServiceNow (-25%). Investor sentiment, particularly within the synthetic intelligence sector, has turned bearish amid rising recession fears.

Associated: Bitcoin $70K retracement part of ‘macro correction’ in bull market — Analysts

Merchants are involved a couple of potential US authorities shutdown on March 15, as lawmakers should go a invoice to lift the debt ceiling. Nonetheless, according to Yahoo Finance, the Republican social gathering stays divided.

The important thing factors of rivalry in Home Speaker Mike Johnson’s proposal are elevated spending on protection and immigration.

Threat-on markets, together with Bitcoin, are more likely to react positively if an settlement is reached.

Actual property disaster shouldn't be essentially damaging

Early indicators of an actual property disaster might speed up capital outflows into different scarce property. Based on Feb. 27 data from the US Nationwide Affiliation of Realtors, residence contract signings fell to an all-time low in January.

Moreover, a Feb. 23 opinion piece in The Wall Road Journal revealed that over 7% of Federal Housing Administration-insured loans are not less than 90 days overdue, surpassing the height of the 2008 subprime disaster.

In essence, Bitcoin's path to reclaiming $90,000 is supported by a weaker US greenback, historic proof {that a} 30% value correction doesn't sign a bear market, resilience in BTC derivatives markets, contagion from authorities shutdown dangers, and early indicators of an actual property disaster.

This text is for basic data functions and isn't supposed to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don't essentially replicate or characterize the views and opinions of Cointelegraph.