Bitcoin (BTC) rebounded above $81,000 on March 11 as US shares’ futures sought reduction from a brutal sell-off.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

BTC value bounces again amid calls for brief squeeze

Information from Cointelegraph Markets Pro and TradingView confirmed each day BTC value good points approaching 4%.

New four-month lows had accompanied the day before today’s Wall Road buying and selling session as recession fears despatched risk-asset buyers fleeing.

The S&P 500 and Nasdaq Composite Index completed the day down 2.7% and 4%, respectively. On the time of writing, Nasdaq 100 futures had recovered round 0.4% from a visit to their lowest ranges since September 2024.

Commenting, buying and selling useful resource The Kobeissi Letter steered that markets had entered an unsustainable downtrend.

“Are we overdue for a large quick squeeze?” it queried in a thread on X, noting risk-asset sentiment in “excessive concern” territory.

“Even bears who're calling for a chronic bear market would wish to see some reduction rallies. Markets don't transfer in a straight-line long-term. Ultimately, a (tradable) quick squeeze is inevitable.”

Nasdaq 100 futures 1-day chart. Supply: Cointelegraph/TradingView

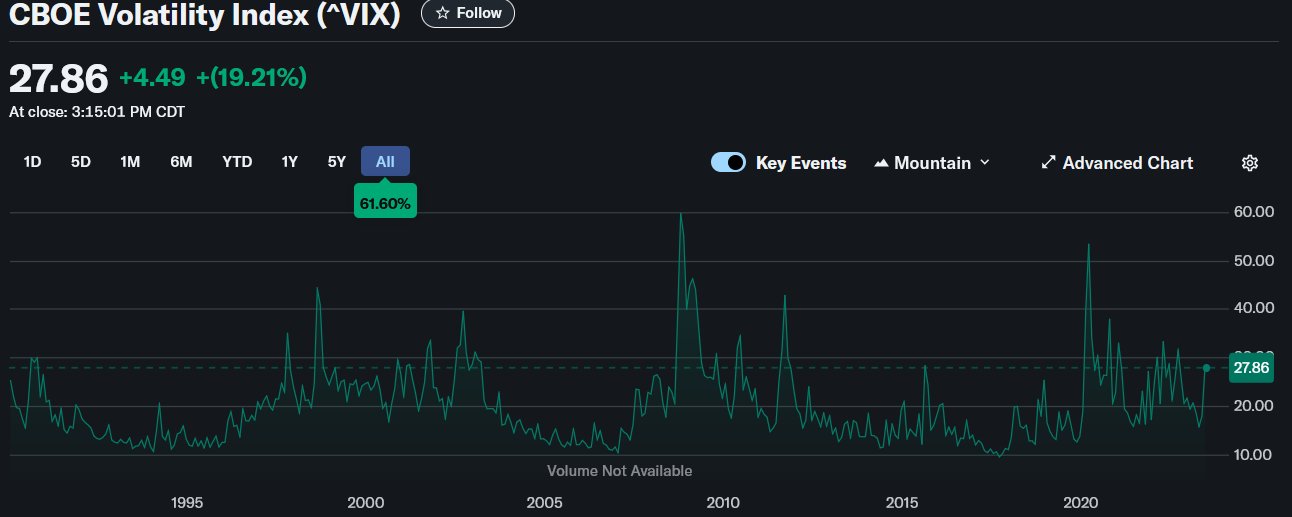

Kobeissi and others referenced unusually excessive readings from the VIX volatility index whereas making the case for a sustained restoration.

“$VIX has solely been increased 11% of the time, going again to 1990,” community economist Timothy Peterson, creator of several Bitcoin value forecasting instruments, continued.

“Put one other method, there may be an 89% probability that as we speak was the underside.”

VIX volatility index. Supply: Timothy Peterson/X

Bitcoin evaluation sees “very tough time” forward

Bitcoin thus noticed some much-needed upside on quick timeframes after reaching $76,600 on Bitstamp.

Associated: Biggest red weekly candle ever: 5 things to know in Bitcoin this week

“$BTC simply had a bullish divergence on the 4H timeframe,” in style dealer Cas abbe reacted whereas analyzing relative energy index (RSI) indicators.

“I am not saying that is the reversal however a short-term pump appears to be like imminent now.”

BTC/USD 4-hour chart with RSI information. Supply: Case Abbe/X

Beforehand, dealer and analyst Rekt Capital informed X followers to watch for similar RSI cues from the each day chart to substantiate a extra sustainable BTC value comeback.

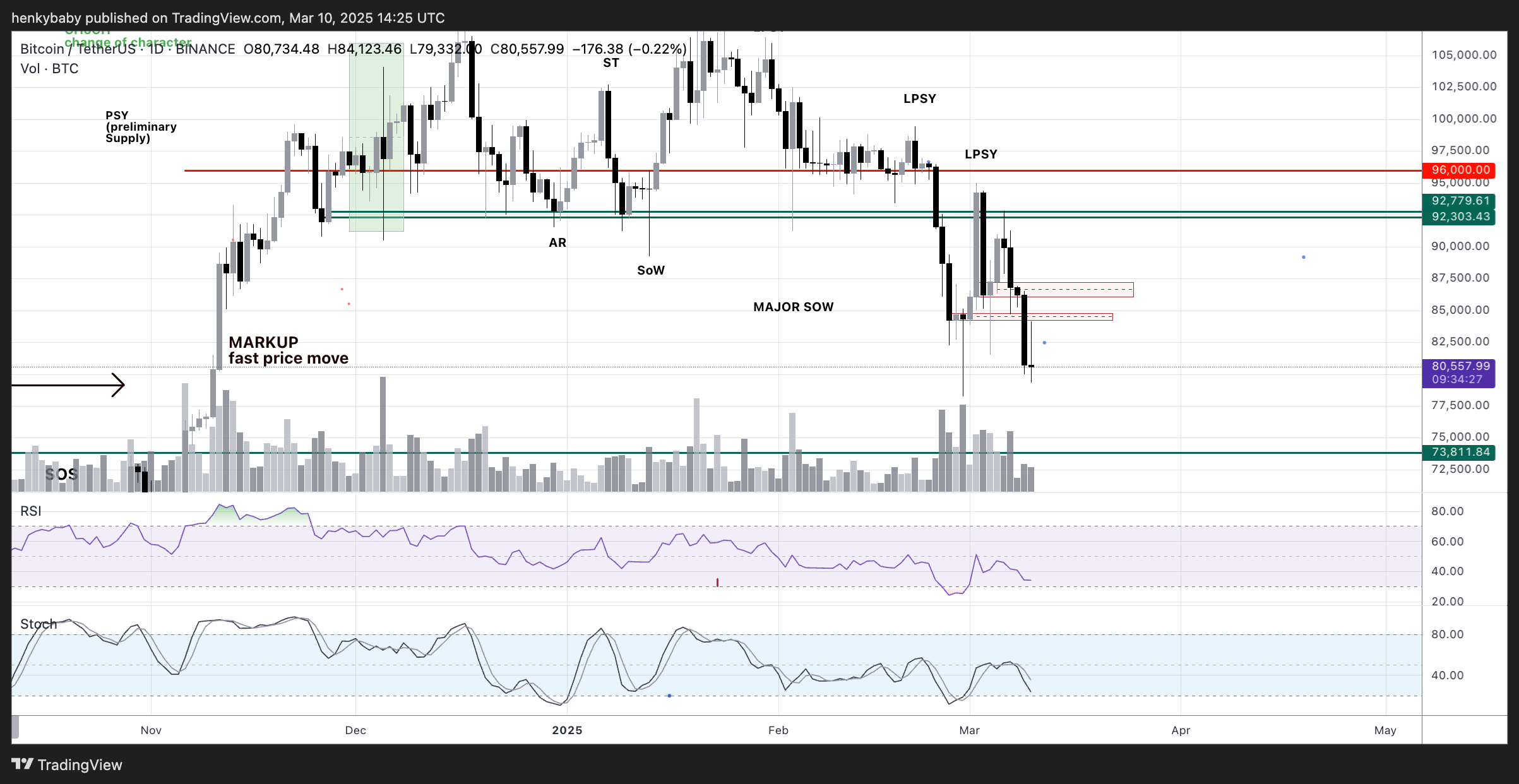

Zooming out, different in style crypto market contributors remained gloomy. Amongst them was the pseudonymous X dealer HTL-NL, who concluded that BTC/USD was unlikely to match all-time highs.

BTC/USDT 1-day chart. Supply: HTL-NL/X

“Earlier than anybody of you suppose that is particularly occurring in crypto: it’s not,” one other of his newest posts stated alongside a chart of S&P 500 futures.

“It occurs to all danger off belongings. It’s referred to as a recession in all probability. US is in for a really powerful time.”

S&P 500 futures 1-day chart. Supply: HTL-NL/X

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.