What's yield farming?

Yield farming, also called liquidity mining, is a decentralized finance (DeFi) technique the place cryptocurrency holders lend or stake their property in numerous DeFi protocols to earn rewards. These rewards usually come within the type of further tokens, curiosity or a share of transaction charges generated by the platform.

Within the yield farming ecosystem, people generally known as liquidity suppliers (LPs) provide their property to liquidity swimming pools, smart contracts that facilitate buying and selling, lending or borrowing on DeFi platforms.

By contributing to those swimming pools, LPs allow the graceful operation of decentralized exchanges (DEXs) and lending platforms. In return for his or her participation, LPs earn rewards, which can embody:

- Transaction charges: A portion of the charges generated from trades or transactions throughout the pool.

- Curiosity funds: Earnings from lending property to debtors.

- Governance tokens: Native tokens of the platform that always grant voting rights on protocol selections and might admire in worth.

Key elements of yield farming

- Liquidity swimming pools: These are collections of funds locked in smart contracts that present liquidity for decentralized buying and selling, lending or different monetary companies. Customers deposit their property into these swimming pools, enabling numerous DeFi features.

- Automated market makers (AMMs): AMMs are protocols that use algorithms to cost property inside liquidity swimming pools, permitting for automated and permissionless buying and selling with out the necessity for a conventional order e book.

- Governance tokens: Tokens distributed to customers as rewards for participating within the protocol. These tokens usually grant holders the fitting to vote on adjustments to the protocol, influencing its future path.

Yield farming vs. conventional monetary yield mechanisms

Yield farming in DeFi differs considerably from conventional monetary yield mechanisms:

- Accessibility: DeFi platforms are usually open to anybody with an web connection, eradicating boundaries related to conventional banking methods.

- Potential returns: Whereas conventional financial savings accounts supply comparatively low rates of interest, yield farming can present considerably greater returns. Nevertheless, these greater yields include elevated dangers, together with market volatility and sensible contract vulnerabilities.

- Intermediaries: Conventional finance depends on centralized establishments to handle funds and transactions. In distinction, DeFi operates on decentralized protocols, lowering the necessity for intermediaries and permitting customers to retain management over their property.

Is yield farming worthwhile in 2025?

As of February 2025, yield farming stays a worthwhile technique, although it's much less profitable than in earlier years as a result of diminished token incentives and heightened competitors amongst liquidity suppliers.

That being mentioned, the DeFi sector continues to develop quickly, with the entire worth locked (TVL) reaching $129 billion in January 2025, reflecting a 137% year-over-year enhance.

Projections recommend that this determine might escalate to over $200 billion by the tip of 2025, pushed by developments in liquid staking, decentralized lending and stablecoins.

This progress, fueled by improvements in liquid staking, decentralized lending and stablecoins, is creating new and doubtlessly profitable yield farming alternatives.

Furthermore, the macroeconomic setting performs a vital function in shaping DeFi yields. In 2024, the US Federal Reserve applied fee cuts, reducing its coverage fee by half a proportion level for the primary time in 4 years.

This financial easing has traditionally elevated the attractiveness of DeFi platforms, as decrease conventional financial savings charges drive traders towards different high-yield alternatives. In consequence, regardless of general yield compression, some DeFi platforms nonetheless supply double-digit annual percentage yields (APYs), far surpassing conventional monetary devices.

Nevertheless, notice that yield farming isn’t nearly incomes passive revenue — it’s a cycle of reinvesting rewards to maximise features. Farmers earn tokens as rewards and sometimes reinvest them into new liquidity swimming pools, making a fast-moving loop of capital circulation or token velocity.

This cycle helps DeFi develop by holding liquidity excessive, however it additionally introduces dangers. If new customers cease including funds, some farming schemes can collapse like a Ponzi construction, relying extra on contemporary liquidity than on actual worth creation.

How does yield farming work?

Embarking on yield farming throughout the DeFi ecosystem could be a profitable endeavor. This step-by-step information will help you in navigating the method, from deciding on a platform to implementing efficient danger administration methods.

Step 1: Selecting a platform

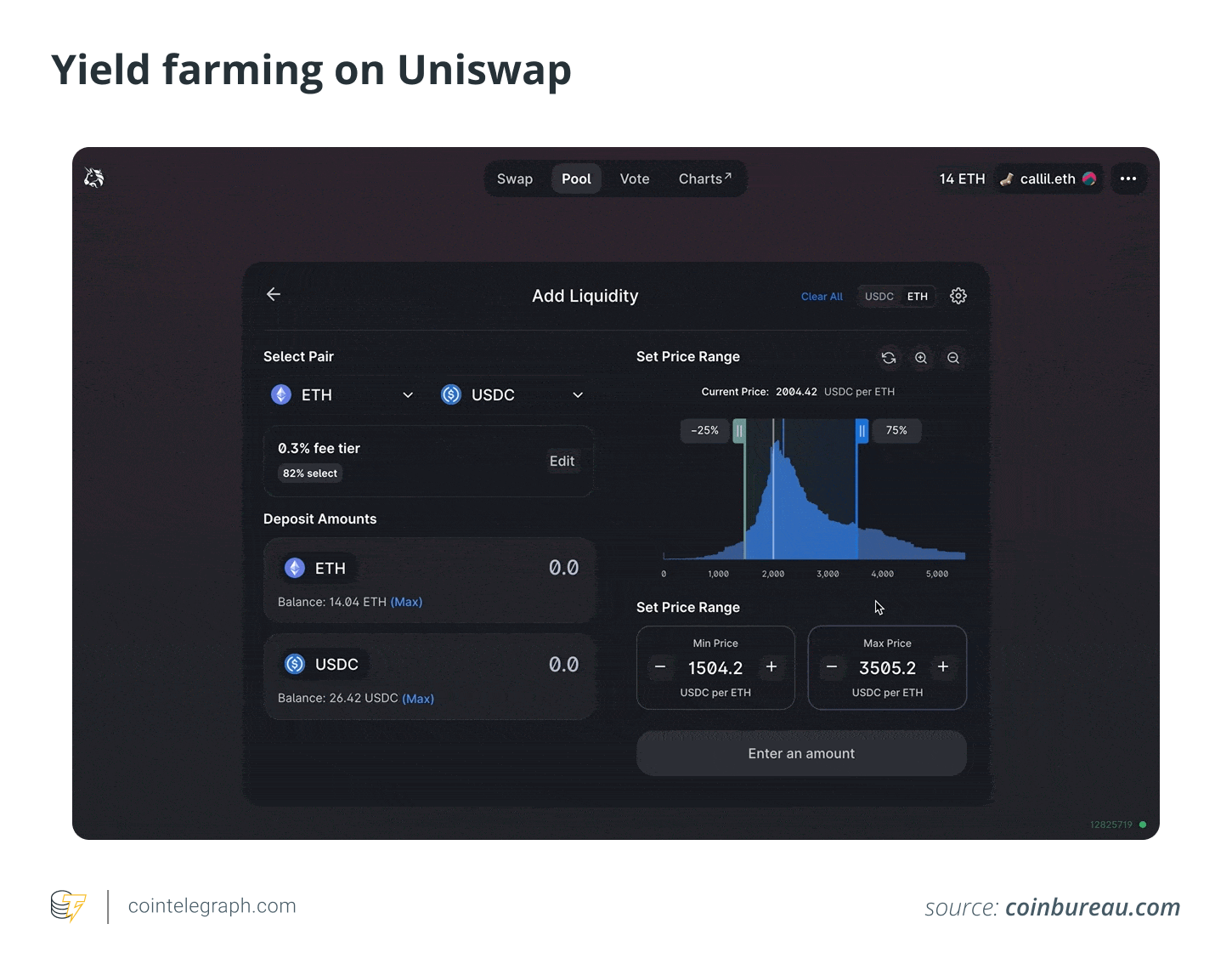

Choosing the fitting DeFi platform is essential for a profitable yield farming expertise. Established platforms equivalent to Aave, Uniswap and Compound are sometimes beneficial as a result of their reliability and user-friendly interfaces.

Moreover, platforms equivalent to Curve Finance, which focuses on stablecoin buying and selling with low charges and minimal slippage, and PancakeSwap, working on the BNB Smart Chain (BSC), which gives decrease transaction charges and a wide range of yield farming alternatives, are additionally price contemplating.

Step 2: Choosing a liquidity pool

When deciding on a liquidity pool for yield farming, it’s important to judge the tokens concerned, the pool’s historic efficiency and the platform’s credibility to mitigate dangers, equivalent to impermanent loss, which will likely be mentioned later on this article.

Do you know? Annual proportion yield (APY) accounts for compounding curiosity, reflecting the entire quantity of curiosity earned over a 12 months, together with curiosity on curiosity, whereas annual proportion fee (APR) denotes the annual return with out contemplating compounding.

Step 3: Staking and farming tokens — Methods to deposit and withdraw funds

Participating in yield farming includes depositing (staking) and withdrawing funds:

Depositing funds:

- Join your pockets: Use a appropriate cryptocurrency pockets (e.g., MetaMask) to connect with the chosen DeFi platform.

- Choose the liquidity pool: Select the specified pool and overview its phrases.

- Approve the transaction: Authorize the platform to entry your tokens.

- Provide liquidity: Deposit the required tokens into the pool.

Withdrawing funds:

- Navigate to the pool: Entry the pool the place your funds are staked.

- Provoke withdrawal: Specify the quantity to withdraw and make sure the transaction.

- Affirm the transaction: Approve the transaction in your pockets to obtain your tokens again.

Step 4: Threat administration suggestions

Mitigating dangers is crucial in yield farming:

- Stablecoin swimming pools: Participating in pools that contain stablecoins like Tether’s USDt (USDT) and USD Coin (USDC) to scale back publicity to market volatility.

- Diversification: Unfold investments throughout a number of swimming pools and platforms to attenuate potential losses.

- Analysis and due diligence: Examine the safety measures, audits and status of platforms earlier than committing funds.

DeFi yield farming calculator: Methods to estimate returns

Yield farming calculators estimate returns by factoring in capital equipped, charges earned and token rewards, with a number of instruments aiding projections.

To precisely estimate potential returns in yield farming, calculators require inputs equivalent to the quantity of capital equipped to a liquidity pool (liquidity supplied), the portion of transaction charges distributed to liquidity suppliers (charges earned) and any further incentives or tokens granted by the protocol (token rewards). By inputting these variables, calculators can mission potential earnings over a specified interval.

A number of platforms present instruments to help in estimating DeFi yields:

- DefiLlama: Provides complete analytics on numerous DeFi protocols, together with yield farming alternatives.

- Zapper: Permits customers to handle and monitor their DeFi investments, offering insights into potential returns.

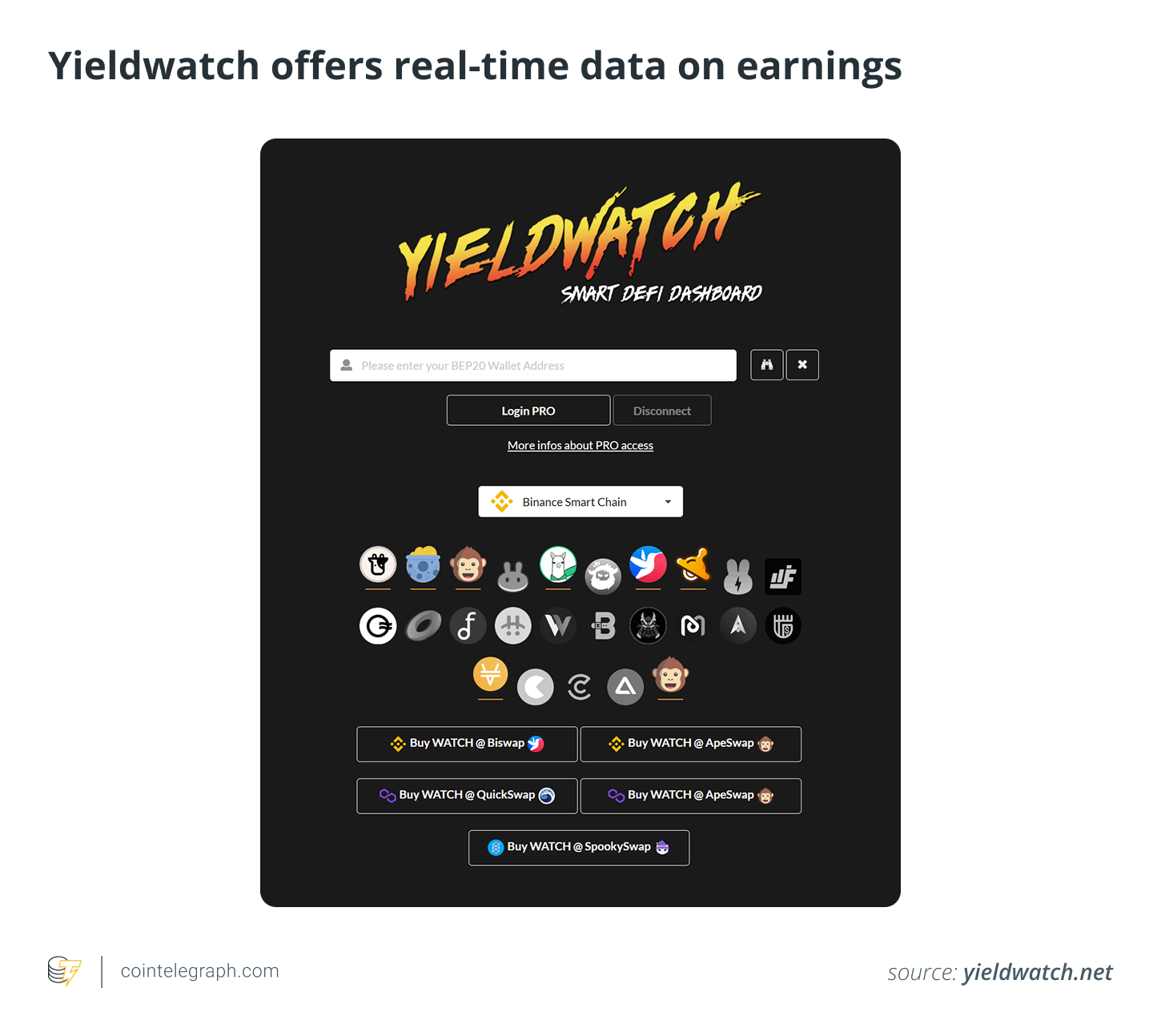

- Yieldwatch: A dashboard that displays yield farming and staking, providing real-time information on earnings.

- CoinGecko’s APY calculator: Breaks down annual proportion yield throughout totally different timeframes, serving to estimate earnings primarily based on principal and APY proportion.

Do you know? In yield farming, frequent compounding boosts returns. Handbook compounding requires reinvesting earnings, whereas automated compounding reinvests them for you. The extra usually it occurs, the upper your APY.

Understanding impermanent loss in yield farming

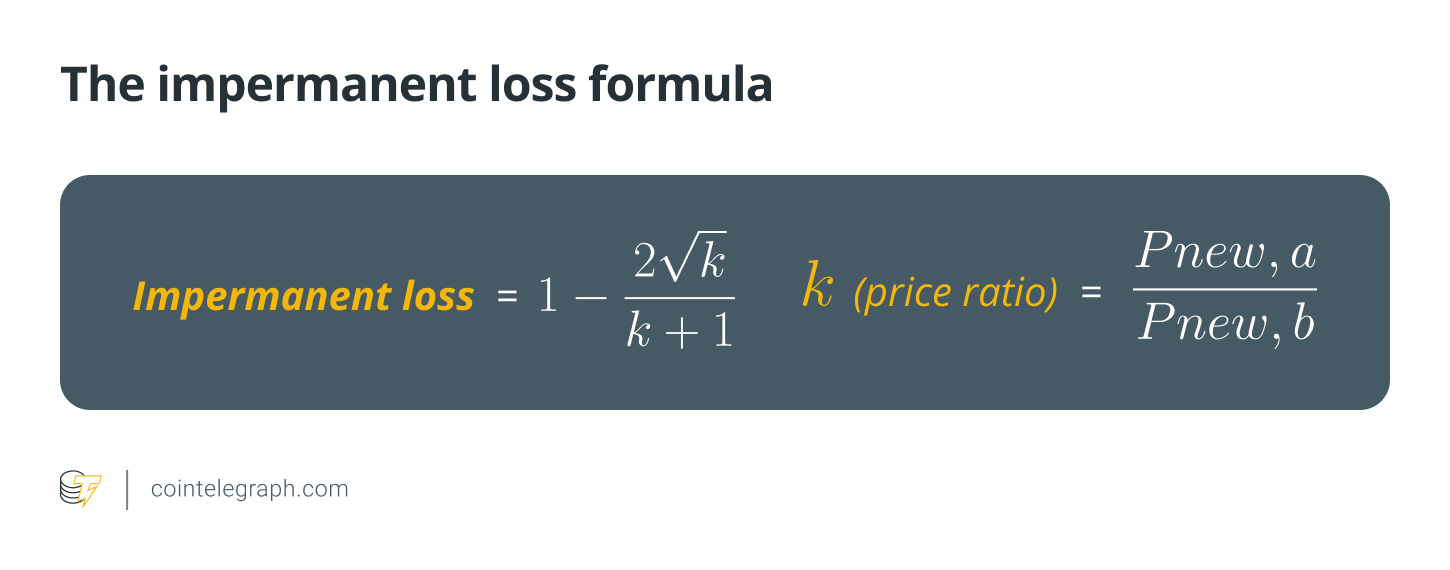

Impermanent loss happens when the worth of property deposited right into a liquidity pool adjustments in comparison with their worth if held exterior the pool.

This phenomenon arises as a result of worth fluctuations between paired property, resulting in a possible shortfall in returns for LPs. The loss is termed “impermanent” as a result of it stays unrealized till the property are withdrawn; if asset costs revert to their authentic state, the loss can diminish or disappear.

In AMM protocols, liquidity swimming pools preserve a continuing ratio between paired property. When the worth of 1 asset shifts considerably relative to the opposite, arbitrage merchants exploit these discrepancies, adjusting the pool’s composition. This rebalancing may end up in LPs holding a unique proportion of property than initially deposited, doubtlessly resulting in impermanent loss.

Contemplate an LP who deposits 1 Ether (ETH) and a pair of,000 Dai (DAI) right into a liquidity pool, with 1 ETH valued at 2,000 DAI on the time of deposit. If the worth of ETH will increase to three,000 DAI, arbitrage actions will alter the pool’s steadiness. Upon withdrawing, the LP may obtain much less ETH and extra DAI, and the entire worth may very well be lower than if the property have been merely held, illustrating impermanent loss.

For detailed methods on managing impermanent loss, seek advice from Step 4 of card 3 on this article.

The way forward for yield farming

The early days of sky-high, unsustainable returns fueled by inflationary token rewards are fading. As a substitute, DeFi is evolving towards extra sustainable fashions, integrating AI-driven methods, regulatory shifts and crosschain improvements.

1. Actual yield replaces inflationary rewards

DeFi is shifting away from token emissions and towards actual yield — rewards are generated from precise platform income like buying and selling charges and lending curiosity. In 2024, this shift was clear: 77% of DeFi yields got here from actual price income, amounting to over $6 billion.

2. AI-driven DeFi methods

AI is turning into a game-changer in yield farming. DeFi protocols now use AI to optimize strategies, assess dangers, and execute trades with minimal human enter. Good contracts powered by AI can alter lending charges in real-time or shift funds between liquidity swimming pools for optimum effectivity.

3. Laws

With DeFi’s growth, regulatory scrutiny is ramping up. Governments are pushing for frameworks to guard traders and stop illicit actions. Whereas elevated oversight may add compliance hurdles, it might additionally appeal to institutional gamers, bringing extra liquidity and legitimacy to the area.

4. Crosschain yield farming

Single-chain ecosystems have restricted options. Crosschain yield farming and interoperability solutions are breaking down boundaries, permitting customers to maneuver property seamlessly throughout blockchains. This opens up extra farming alternatives and reduces reliance on any single community’s liquidity.

What’s subsequent?

A number of rising tendencies are reshaping yield farming. Liquid staking lets customers stake property whereas nonetheless utilizing them in DeFi. Automated vaults simplify farming by dynamically shifting funds for optimized returns. Decentralized index funds supply publicity to a number of property via a single token, lowering danger whereas sustaining yield potential.

In brief, yield farming is turning into extra subtle, sustainable and interconnected. The times of straightforward cash are gone, however the alternatives for sensible, long-term methods are solely getting higher.

Yield farming vs staking: Key variations

The first distinction between yield farming and staking is that the previous necessitates customers depositing their cryptocurrency money on DeFi platforms whereas the latter mandates traders put their cash into the blockchain to assist validate transactions and blocks.

Yield farming necessitates a well-considered funding technique. It is not so simple as staking, however it may end up in considerably greater payouts of as much as 100%. Staking has a predetermined reward, which is said as an annual proportion yield. Often, it's roughly 5%; nevertheless, it could be extra vital relying on the staking token and method.

The liquidity pool determines the yield farming charges or rewards, which could alter because the token's worth adjustments. Validators who help the blockchain set up consensus and generate new blocks are rewarded with staking incentives.

Yield farming relies on DeFi protocols and smart contracts, which hackers can exploit if the programming is finished incorrectly. Nevertheless, staking tokens have a good coverage that's instantly linked to the consensus of the blockchain. Unhealthy actors who attempt to deceive the system danger shedding their cash.

Due to the unpredictable pricing of digital property, yield farmers are inclined to some dangers. When your funds are trapped in a liquidity pool, you'll experience an impermanent loss if the token ratio is unequal. In different phrases, you'll undergo an impermanent loss if the worth of your token adjustments when it's within the liquidity pool. While you stake crypto, there isn't any impermanent loss.

Customers are usually not required to lock up their funds for a set time when utilizing yield farming. Nevertheless, in staking, customers are required to stake their funds for a set interval on numerous blockchain networks. A minimal sum can also be required in some instances.

The abstract of the variations between yield farming and staking is mentioned within the desk beneath:

Is yield farming protected?

Each crypto investor ought to pay attention to the dangers, together with liquidation, management and worth danger associated to yield farming.

Liquidation danger happens when the worth of your collateral falls beneath the worth of your mortgage, leading to a liquidation penalty in your collateral. When the worth of your collateral diminishes or the price of your mortgage rises, you might face liquidation.

The issue with yield farming is that small-fund members could also be in danger as a result of large-fund founders and traders have larger management over the protocol than small-fund traders. By way of yield farming, the worth danger, equivalent to a mortgage, is a major barrier. Assume the collateral's worth falls beneath a sure stage. Earlier than the borrower has a possibility to repay the debt, the platform will liquidate him.

However, yield farming remains to be probably the most risk-free methods to earn free money. All it's a must to do now could be hold the above talked about dangers in thoughts and design a method to deal with them. It is possible for you to to higher handle your funds should you take a sensible method reasonably than a completely optimistic one, making the mission worthwhile. You probably have a pessimistic view of yield farming, alternatively, you will nearly definitely miss out on a wealthy incomes alternative.