Bitcoin exchange-traded merchandise could have basically altered the idea of a crypto “altseason.”

For years, the crypto market adopted a familiar rhythm, a near-predictable dance of capital rotation. Bitcoin (BTC) surged, bringing mainstream consideration and liquidity, after which the floodgates opened to altcoins. Speculative capital rushed into lower-cap property, inflating their values in what merchants euphorically deemed “altseason.”

Nonetheless, as soon as taken without any consideration, this cycle exhibits indicators of a structural collapse.

Spot Bitcoin exchange-traded funds (ETFs) have shattered records, funneling $129 billion in capital inflows in 2024. This has offered unprecedented entry to Bitcoin for each retail and institutional buyers, but it has additionally created a vacuum, sucking capital away from speculative property. Institutional gamers now have a protected, regulated strategy to achieve publicity to crypto with out the Wild West dangers of the altcoin market. Many retail buyers are additionally discovering ETFs extra interesting than the perilous hunt for the following 100x token. Effectively-known Bitcoin analyst Plan B even traded in his actual BTC for a spot ETF.

The shift is occurring in actual time, and if the capital stays locked in structured merchandise, altcoins face a diminishing share of market liquidity and relevance.

Is the altseason lifeless? The rise of structured crypto publicity

Bitcoin ETFs supply an alternative choice to chasing high-risk, low-cap property, as buyers can entry leverage, liquidity and regulatory readability by way of structured merchandise. The retail crowd, as soon as a serious driver of altcoin hypothesis, now has direct entry to Bitcoin and Ether (ETH) ETFs, automobiles that get rid of self-custody issues, mitigate counterparty danger and align with conventional funding frameworks.

Establishments have even better incentives to sidestep altcoin danger. Hedge funds {and professional} buying and selling desks, which as soon as chased greater returns in low-liquidity altcoins, can deploy leverage by way of derivatives or take publicity by way of ETFs on legacy monetary rails.

Associated: BlackRock adds BTC ETF to $150B model portfolio product

With the power to hedge by way of choices and futures, the inducement to gamble on illiquid, low-volume altcoins diminishes considerably. This has been additional bolstered by the record $2.4 billion in outflows in February and arbitrage alternatives created by ETF redemptions, forcing a degree of self-discipline into crypto markets that didn't beforehand exist.

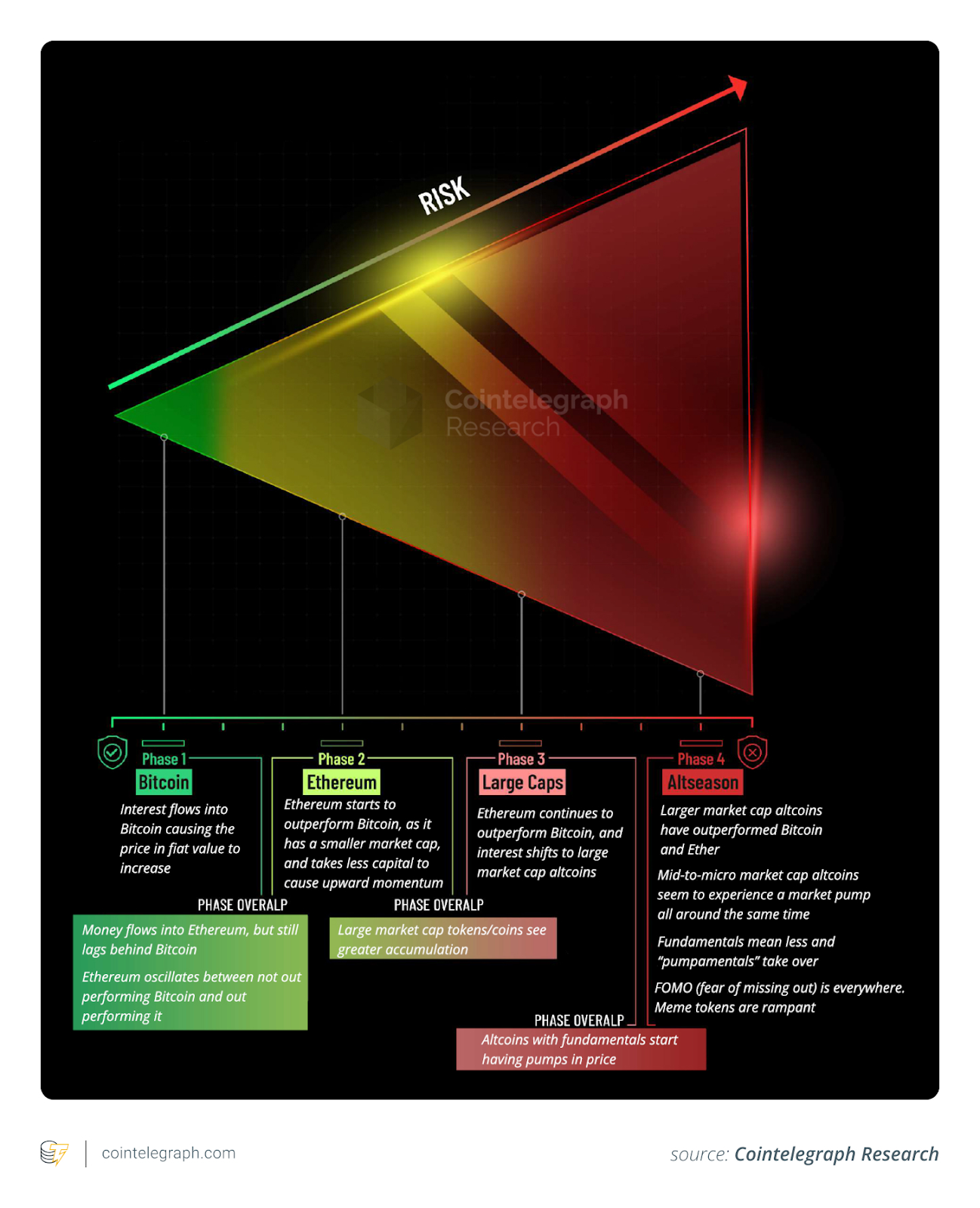

The standard “cycle” begins with Bitcoin and strikes to an altseason. Supply: Cointelegraph Research

Will enterprise capital abandon crypto startups?

Enterprise capital (VC) companies have traditionally been the lifeblood of alt seasons, injecting liquidity into nascent tasks and spinning grand narratives round rising tokens.

Nonetheless, with leverage being simply accessible and capital effectivity a key precedence, VCs are rethinking their method.

VCs attempt to make as a lot return on funding (ROI) as doable, however the typical range is between 17% and 25%. In conventional finance, the risk-free price of capital serves because the benchmark in opposition to which all investments are measured, usually represented by US Treasury yields.

Within the crypto area, Bitcoin’s historic development price capabilities as the same baseline for anticipated returns. This successfully turns into the trade’s model of the risk-free price. Over the past decade, Bitcoin’s compound annual development price (CAGR) over the previous 10 years has averaged 77%, considerably outperforming conventional property like gold (8%) and the S&P 500 (11%). Even over the previous 5 years, together with each bull and bear market circumstances, Bitcoin has maintained a 67% CAGR.

Utilizing this as a baseline, a enterprise capitalist deploying capital in Bitcoin or Bitcoin-related ventures at this development price would see a complete ROI of roughly 1,199% over 5 years, that means the funding would enhance almost 12x.

Associated: Altcoin ETFs are coming, but demand may be limited: Analysts

Whereas Bitcoin stays risky, its long-term outperformance has positioned it as the basic benchmark for evaluating risk-adjusted returns within the crypto area. With arbitrage alternatives and diminished danger, VCs could play the safer guess.

In 2024, VC deal counts dropped 46%, whilst total funding volumes rebounded in This autumn. This alerts a shift towards extra selective, high-value tasks somewhat than speculative funding.

Web3 and AI-driven crypto startups are nonetheless drawing consideration, however the days of indiscriminate funding for each token with a white paper could also be numbered. If enterprise capital pivots additional towards structured publicity by way of ETFs somewhat than a direct funding in dangerous startups, the implications could possibly be extreme for brand new altcoin tasks.

In the meantime, the few altcoin tasks which have made it onto institutional radars — similar to Aptos, which recently saw an ETF filing — are exceptions, not the rule. Even crypto index ETFs, designed to seize broader publicity, have struggled to draw significant inflows, underscoring that capital is concentrated somewhat than dispersed.

The oversupply downside and the brand new market actuality

The panorama has shifted. The sheer variety of altcoins vying for consideration has created a saturation downside. In response to Dune Analytics, over 40 million tokens are at present in the marketplace. 1.2 million new tokens had been launched on common monthly in 2024, and over 5 million have been created because the begin of 2025.

With establishments gravitating towards structured publicity and an absence of retail-driven speculative demand, liquidity is just not trickling right down to altcoins because it as soon as did.

This presents a tough fact: Most altcoins won't make it. The CEO of CryptoQuant, Ki Younger Ju, just lately warned that the majority of those property are unlikely to outlive with out a elementary shift in market construction. “The period of every part pumping is over,” Ju stated in a current X publish.

The standard playbook of ready for Bitcoin dominance to wane earlier than rotating into altcoins could now not apply in an period the place capital stays locked in ETFs and perps somewhat than free-flowing into speculative property.

The crypto market is just not what it as soon as was. The times of simple, cyclical altcoin rallies could also be changed by an ecosystem the place capital effectivity, structured monetary merchandise and regulatory readability dictate the place the cash flows. ETFs are altering how individuals put money into Bitcoin and basically altering liquidity distribution throughout your entire market.

For many who constructed their methods on the idea that an altcoin growth would comply with each Bitcoin rally, the time could have come to rethink. The principles could have modified because the market has matured.

Journal: SEC’s U-turn on crypto leaves key questions unanswered

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.