India’s contribution to the worldwide Web3 ecosystem — primarily in software program improvement, gaming, investments and startup funding — elevated year-on-year regardless of an absence of domestically tailor-made crypto laws.

India’s share of world Web3 builders grew from 5% to 12% within the final 10 years, second solely to the USA as of 2024, based on the India Web3 Panorama Report 2024 by Hashed Emergent, shared with Cointelegraph.

Developer development in India since 2015. Supply: Hashed Emergent

Talking to Cointelegraph, Tak Lee, CEO and Managing Companion at Hashed Emergent, identified 4 key elements driving India to the highest of world crypto adoption: retail crypto transactions on centralized companies, highest buying and selling volumes, institutional adoption and retail DeFi transactions.

Gen Z dominates the Web3 developer panorama in India

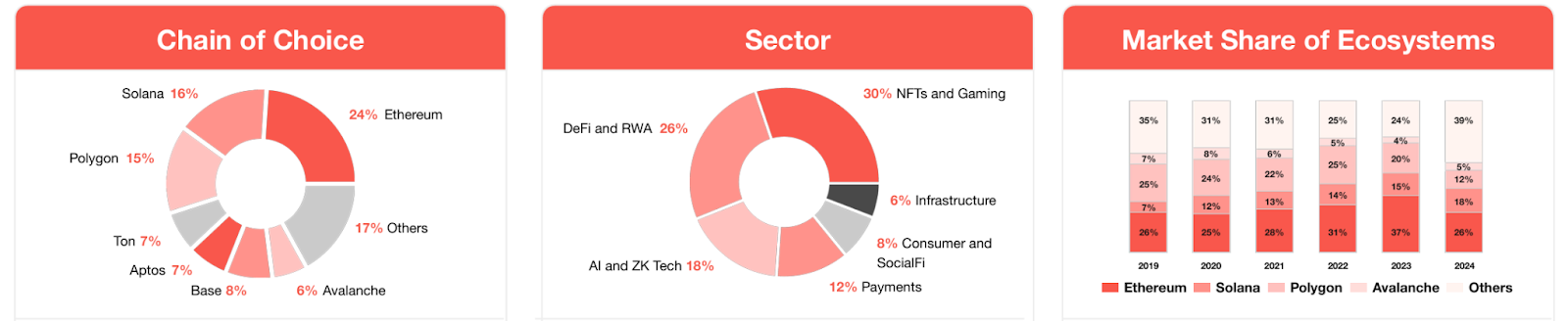

The expansion is pushed by the youthful era, as roughly 80% of all blockchain builders in India are between 18 and 27 years of age. The Indian builders in DeFi, Funds, AI and SocialFi choose Solana because the go-to blockchain.

Ton, Aptos and Base are steadily gaining momentum throughout different key sectors, pushed by the increasing presence of layer-1 and layer-2 ecosystems, the report famous.

Web3 sector and ecosystem traits in India. Supply: Hashed Emergent

Whereas funding alternatives and builder initiatives like hackathons help preliminary development, Indian builders have identified employers’ lack of willingness to pay salaries that match world business requirements.

The challenges confronted by Web3 gaming tasks are the extraordinarily excessive value of buyer acquisition (CAC) to onboard Web3 customers and the shortage of high quality gameplay past monetary incentives to retain Web2 players. “Due to this fact, a number of of those video games at the moment are specializing in having nice high quality video games earlier than integrating blockchain mechanics or tapping into Indian players’ craze for RMG,” Lee defined.

Associated: Indian town adopts Avalanche blockchain for tamper-proof land records

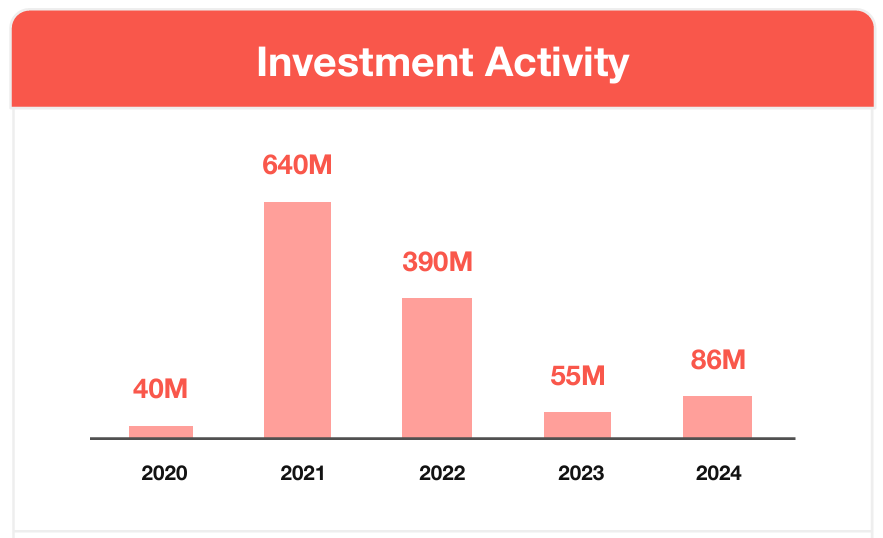

In distinction, investments into the Indian Web3 panorama noticed a 224% enhance in 2024 in comparison with the earlier 12 months — sourced from numerous avenues resembling native funds, ecosystem funds and company enterprise arms of main exchanges.

Lee instructed Cointelegraph that the shortage of development capital within the Web3 world, together with the absence of conventional enterprise/development/personal fairness funds, makes it tough for Indian corporations to boost capital, including:

“Due to this fact, entrepreneurs discover crowd gross sales as a approach to fund their future development. Some famend tasks may discover crowd gross sales as a consequence of larger valuations provided however that is extraordinarily uncommon and carried out by the extraordinarily blue chip founders who can elevate cash from retail with ample certainty and excessive volumes.”

Funding in India’s Web3 finance sector. Supply: Hashed Emergent

In comparison with the earlier years, the substantial development in Web3 investments in 2024 “indicators a gradual restoration, with buyers specializing in rising areas of decentralized finance,” the report mentioned.

India is a worldwide hub for founders and builders, at the moment residence to the second-largest developer market and third-largest founder base globally.

A few of the primary limitations stopping large-scale investments, based on Tak, need to do with the “slower than anticipated development of a few of these startups .“ Unclear laws and compliances additionally hinder Web3 investments in India.

Rising Web3 in opposition to all odds

Regardless of an energetic high-tax atmosphere on cryptocurrency, small-scale crypto investments noticed an uptick in India. Merchants typically most well-liked small, frequent trades, with 96% sustaining positions lower than $12 with a median of 11x-20x leverage. Females represented 1 in 10 futures merchants in India, highlighting the scope for higher participation.

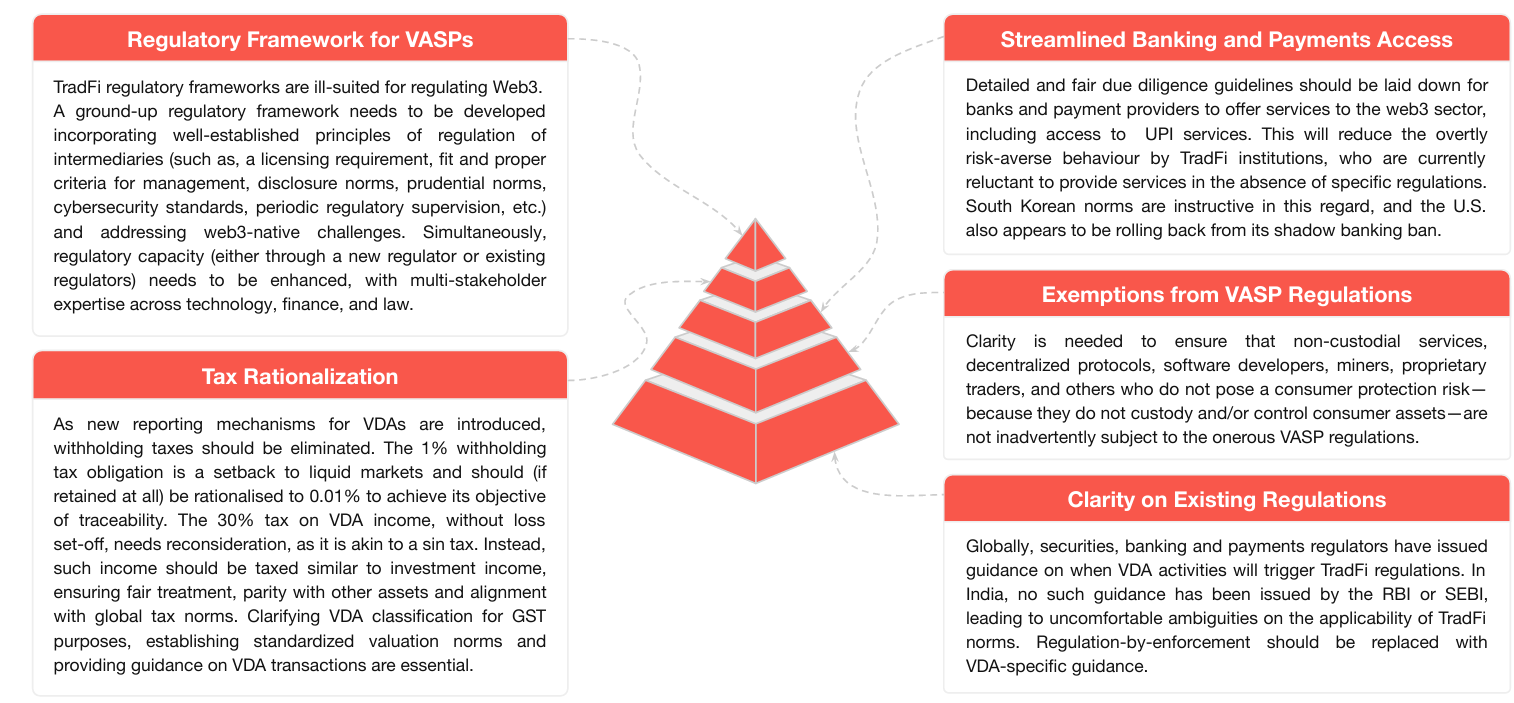

The report known as for reforms in crypto tax deductions and reporting along with the necessity for federal steerage and tax implications:

“India should overcome its destructive coverage notion that stifles innovation and as an alternative concentrate on figuring out and addressing the ache factors confronted by stakeholders with efficient regulation that may incentivize the Web3 sector to develop and thrive.”

Indian Web3 corporations name for progressive regulation for all stakeholders. Supply: Hashed Emergent

The coverage want checklist for the Indian Web3 contains the regulatory framework for digital asset service suppliers (VASP), tax rationalization, streamlined banking and cost entry for Web3 corporations, exemptions from VASP laws and readability on present laws.

Latest regulatory initiatives like URL blocking of domestically unlicensed crypto exchanges have resulted within the inflow of funds to self-custodial options (decentralized exchanges) or home exchanges, that are regulated underneath Indian legislation.

Journal: Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express