Bitcoin (BTC) noticed a traditional Wall Road sell-off on Mar. 12 as bears tempered a welcome US inflation slowdown.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

BTC worth reverses at key bull market trendline

Information from Cointelegraph Markets Pro and TradingView confirmed BTC/USD reaching three-day highs of $84,437 on Bitstamp earlier than reversing.

The January print of the US Shopper Worth Index (CPI) got here in beneath expectations at 2.8%, per data from the Bureau of Labor Statistics (BLS), hinting at slowing inflation.

“Core CPI inflation FALLS to three.1%, beneath expectations of three.2%,” buying and selling useful resource The Kobeissi Letter added in a part of a response on X.

“This marks the primary decline in each Headline and Core CPI since July 2024. Inflation is cooling down within the US.”

US CPI 12-month % change. Supply: BLS

Nevertheless, the excellent news was short-lived as the beginning of Wall Road buying and selling noticed the return of attribute promoting strain throughout crypto markets.

Bitcoin thus fell to $82,400 earlier than consolidating, on the time of writing, circling the day by day open.

In his newest market observations, fashionable dealer and analyst Rekt Capital noticed cause for cautious optimism on BTC worth efficiency.

“The newest Bitcoin Day by day Shut signifies that worth has started the method of exiting its just lately crammed CME Hole after turning it into assist,” he told X followers, referring to the distinction between session closing and opening ranges on CME Group’s Bitcoin futures — a standard short-term worth affect.

“Any dips into the highest of the CME Hole would represent a post-breakout retest try to completely verify the exit from this CME Hole. Preliminary indicators of that retest occurring already.”

CME Group Bitcoin futures 1-day chart. Supply: Rekt Capital/X

Fellow dealer Daan Crypto Trades targeted on the 200-day easy and exponential transferring averages (SMA/EMA) — classic bull market support trendlines at the moment at $83,550 and $85,650, respectively.

“Bulls bought work to do right here to get again above the Day by day 200MA/EMA. Final 12 months we had the identical factor and worth chopped round these ranges for 3+ months,” a part of his newest X evaluation noted.

BTC/USD 1-day chart with 200SMA, 200EMA. Supply: Cointelegraph/TradingView

Bitcoin ETF outflows level to “rising warning”

Persevering with on the macro theme, buying and selling agency QCP Capital advised that the day’s CPI print may weigh on the Federal Reserve’s rates of interest choice subsequent week.

Associated: Bitcoin whales hint at $80K ‘market rebound’ as Binance inflows cool

“With inflation considerations lingering and macro dangers mounting, the CPI print might be a key determinant of whether or not the disinflationary development will maintain, or volatility intensifies within the close to time period,” it wrote in its newest “Asia Color” market replace.

QCP noticed $82,000 solidifying as assist, whereas institutional investor traits warranted warning.

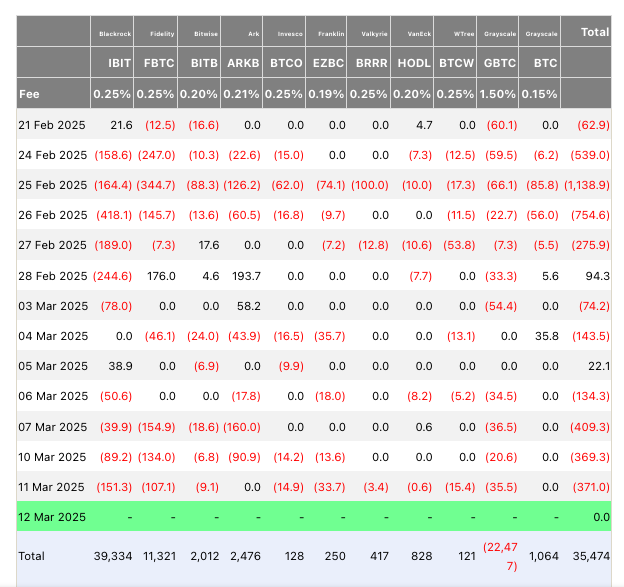

“In the meantime, Bitcoin ETFs noticed a major web outflow of $153.87 million, led by Grayscale’s Bitcoin Belief (GBTC), which just lately offloaded 641 BTC, valued at $56.45 million,” it concluded, referencing netflows from the US spot Bitcoin exchange-traded funds (ETFs).

“This introduced GBTC’s complete holdings right down to 195,746 BTC, value round $17.24 billion. This indicators rising warning amongst institutional buyers.”

US spot Bitcoin ETF netflows (screenshot). Supply: Farside Traders

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.